Behind the Scenes: How BI Forex Intervention Helps Stabilize the Rupiah

What Does “BI Forex Intervention” Really Mean?

BI forex intervention refers to the ways Bank Indonesia (BI) steps into the foreign exchange market to influence the exchange rate of the rupiah. This action isn’t about setting a fixed rate, nor is it an attempt to dominate the market. Instead, it’s a calibrated approach to ensuring the rupiah does not swing too wildly in response to external shocks. In the context of Indonesia’s open economy—where trade, capital flows, and investor sentiment all intertwine—the role of BI in maintaining order within the forex market is quietly but critically important. The intervention allows businesses and consumers alike to operate with more financial predictability, even when the global outlook becomes uncertain.

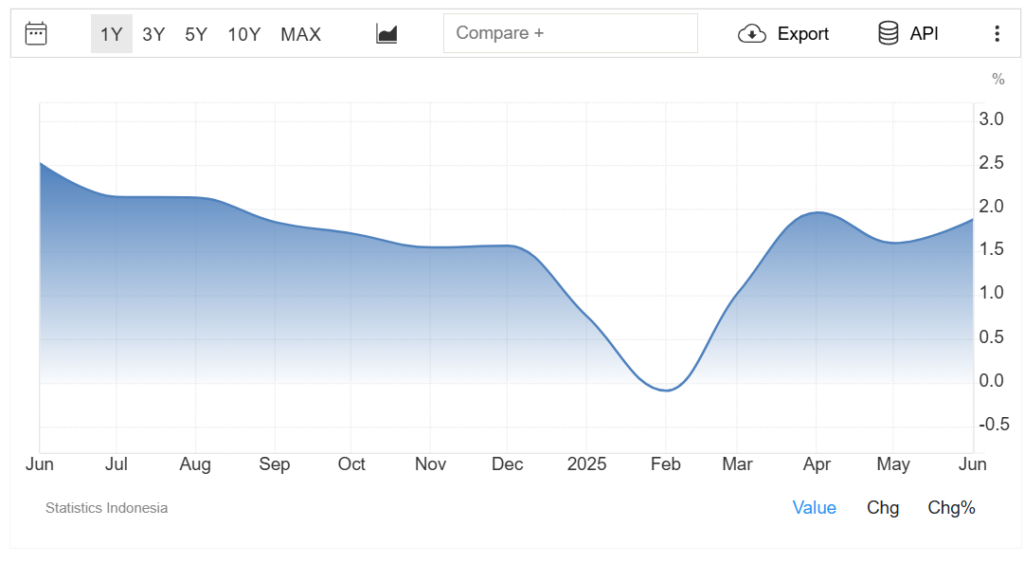

Why Does Bank Indonesia Intervene in the Forex Market?

Source: Trading Economics

Bank Indonesia’s decision to intervene usually stems from the need to defend the country’s financial and economic stability. Sudden currency depreciation, for instance, can drive up the cost of imports, hurt domestic purchasing power, and trigger inflationary pressure. On the other hand, a rupiah that strengthens too quickly could make Indonesian exports less competitive. Therefore, BI’s forex intervention is about striking a balance: ensuring the currency reflects economic fundamentals without being hijacked by speculative flows or panic selling. It’s less about controlling the exchange rate and more about cushioning volatility—especially during moments when global markets are under stress, such as during geopolitical tensions, energy crises, or major monetary policy shifts in the U.S. or China.

What Tools Does Bank Indonesia Use for Forex Intervention?

Source: TradingEconomics

Bank Indonesia employs a sophisticated mix of instruments to stabilize the forex market. Among the most visible is its participation in the spot market, where it buys or sells U.S. dollars against the rupiah. This helps absorb excess demand or supply in the market. Beyond that, BI utilizes domestic non-deliverable forwards (DNDFs), a hedging instrument that allows local businesses and financial institutions to manage currency risk without affecting the spot rate directly. BI also taps into its substantial foreign exchange reserves to signal market confidence. In certain instances, adjustments to interest rates or macroprudential policies complement these interventions. The key lies in combining these tools in a timely, measured fashion to restore market calm without distorting natural price movements.

When Does Bank Indonesia Usually Step In?

Source: BUSINESSTODAY

While BI doesn’t publish an intervention schedule, its actions typically become visible during episodes of pronounced volatility. For example, when global investors pull funds from emerging markets in search of safer assets, the rupiah may face downward pressure. If the depreciation is too fast or destabilizing, BI may sell U.S. dollars to meet demand and anchor expectations. These interventions often occur quietly, signaled not through official announcements but through subtle market liquidity shifts or changes in interbank rates. Market participants—especially exporters, importers, and banks—are usually quick to detect BI’s presence when the exchange rate stabilizes unexpectedly. In some cases, interventions happen even before panic sets in, acting as a preemptive move to guide market behavior.

What Impact Does BI Forex Intervention Have on the Rupiah?

The effects of intervention depend on both the timing and the approach used. In the short term, selling dollars into the market can ease depreciation pressure and reassure investors. It also sends a signal that the central bank is monitoring the situation and ready to act. Over the long term, though, intervention alone cannot prop up a weak currency—it must be backed by strong economic fundamentals. When done correctly, consistent BI forex intervention creates a sense of predictability in the financial ecosystem, which is especially important for businesses with foreign currency exposure, such as exporters or those reliant on imported raw materials. The psychological effect—where market players believe BI will act if needed—is often just as powerful as the actual currency transactions.

How Transparent Is Bank Indonesia About Its Intervention Strategies?

Bank Indonesia walks a careful line when it comes to transparency. While the central bank is clear about its overall mandate—maintaining monetary and financial system stability—it typically avoids disclosing exact intervention levels or timing. This strategic ambiguity allows BI to maintain flexibility and avoid front-running behavior from market speculators. However, transparency isn’t ignored altogether. BI regularly releases statements, quarterly monetary policy reviews, and financial stability reports, which offer insights into its thinking and priorities. For market analysts and institutional investors, these communications are essential for reading between the lines and understanding when and how BI might step in again. In essence, BI keeps the market informed without giving away its playbook.

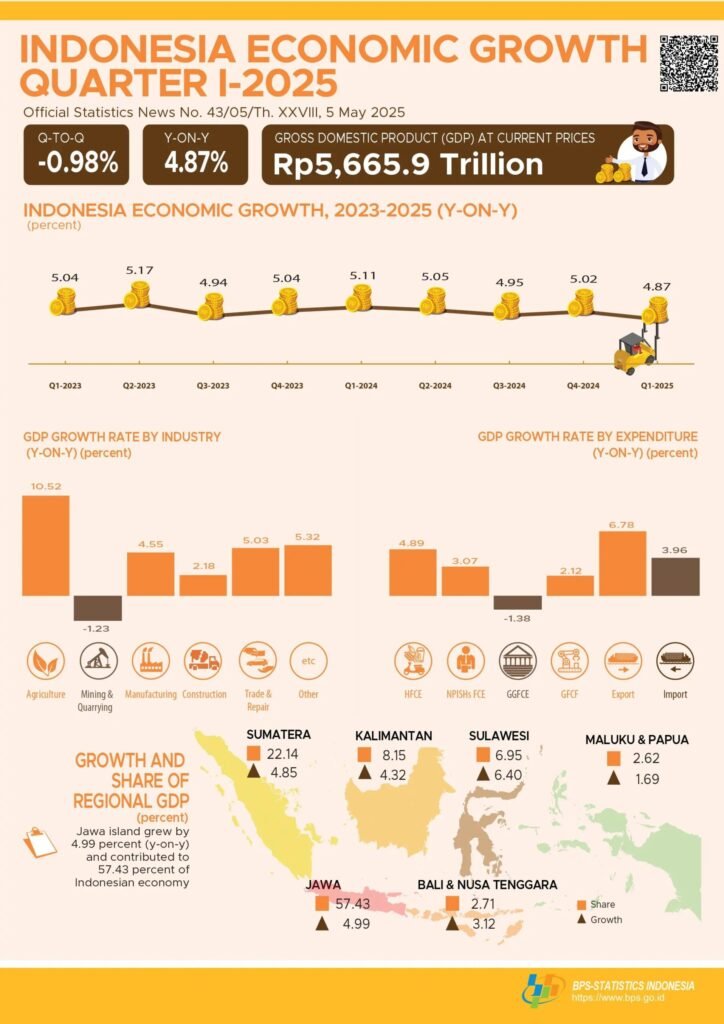

How Effective Are These Interventions in the Long Run?

Source: BPS_STATISTIC INDONESIA

BI forex intervention is effective—but only as part of a larger toolkit. In the short run, it smooths out excessive movements and buys time for other macroeconomic policies to take effect. But over time, exchange rates are shaped by deeper forces: inflation, trade balance, economic growth, and investor sentiment. That’s why BI’s interventions are always backed by broader efforts to strengthen Indonesia’s economic fundamentals. For instance, when paired with credible inflation targeting or prudent fiscal policy, the impact of currency interventions becomes far more sustainable. In other words, BI uses intervention not as a cure-all, but as a stabilizing hand that works best when the rest of the economy is moving in the right direction.

Does BI Forex Intervention Affect Ordinary Indonesians?

It might seem distant, but the effects do trickle down. A volatile exchange rate can quickly translate into higher prices for fuel, food, and imported goods—items that impact everyday life. When BI steps in to prevent a sharp depreciation, it’s not just protecting financial markets—it’s helping shield households from inflation shocks. Businesses that import machinery or raw materials also benefit from more predictable pricing, which in turn supports job security and investment planning. On a broader scale, stability in the forex market helps maintain Indonesia’s reputation as a dependable place for investment, ensuring capital flows that support infrastructure, technology, and economic development. So while forex intervention may feel abstract, its consequences are anything but.

Conclusion: Why BI Forex Intervention Still Matters

As financial systems grow more interconnected and volatile, the importance of BI forex intervention has only deepened. It’s not just a technical function of the central bank—it’s a vital part of Indonesia’s financial resilience strategy. Through calculated and often discreet actions, Bank Indonesia helps smooth rough patches in the market and keep the economy grounded. While the tools and timing may evolve, the goal remains the same: to ensure the rupiah stays reasonably stable, so that both businesses and citizens can plan for tomorrow with greater confidence.