Bitstamp Exchange Review: A Closer Look at One of Crypto’s Oldest Platforms

When you start searching for reliable trading platforms, the name Bitstamp exchange review often pops up. It’s not a newcomer—Bitstamp has been around since 2011, which in crypto terms makes it one of the oldest players still active today. The question that keeps coming back in 2025 is whether being old also means being relevant. Some traders praise its consistency and transparency, while others argue that younger exchanges with flashy features have taken the spotlight. This review tries to cut through the noise and look at what Bitstamp actually offers right now.

A Legacy in the Crypto World

Bitstamp started in Slovenia before moving operations to Luxembourg and eventually London. Over the years, it earned credibility as one of the first exchanges to secure licenses and build proper banking relationships. Unlike the chaotic platforms that disappeared overnight, Bitstamp took a slower, more measured path. That history matters because, for many traders, trust in crypto exchanges is fragile. While new platforms appear every year, not all of them last, and some vanish with client funds. Bitstamp, despite its age, has managed to remain steady.

Regulation is also part of its story. The exchange is registered in Luxembourg and has compliance systems that align with European Union standards. For investors in regions where regulation is a big concern, this legacy still counts for something.

Bitstamp Exchange Review: Fees and Trading Costs

When it comes to fees, Bitstamp is neither the cheapest nor the most expensive. Spot trading fees range from 0.30% for beginners down to 0.00% for very high-volume traders. Compared to Binance or OKX, which sometimes offer fees close to zero, Bitstamp is not the go-to platform for low-cost scalpers. On the other hand, for users who want reliability rather than just chasing the lowest cost, the pricing is fair.

Deposits through SEPA transfers are free, which is attractive to European customers, while card deposits are more expensive. Withdrawal fees depend on the method, and this is one area where some traders complain that Bitstamp feels a bit “traditional banking” in its approach. Still, considering it is often chosen by long-term holders, the costs don’t usually scare off its main customer base.

Bitstamp Exchange Review: Trading Features and Liquidity

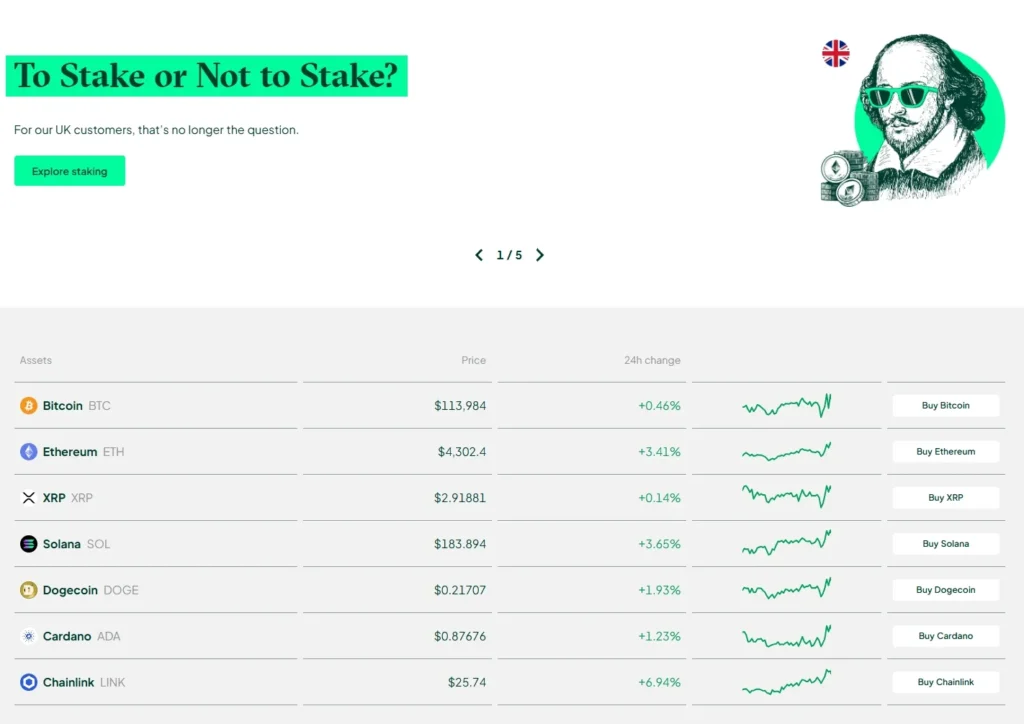

Bitstamp’s strength has never been in offering thousands of coins. At present, it lists around 85+ cryptocurrencies, which is small compared to giants like Coinbase or KuCoin. But what it does list tends to have strong liquidity. The exchange has always focused on a smaller selection of assets rather than chasing every new meme coin.

For some traders, that’s a drawback—if you want the latest experimental DeFi token, Bitstamp will likely not have it. But for conservative investors, the narrower list feels safer. Liquidity on major pairs like BTC/USD and ETH/EUR is strong, making it suitable for both retail users and institutions.

Staking was also introduced, but it hasn’t become the central feature. Unlike exchanges that market staking rewards heavily, Bitstamp seems to treat it as an add-on rather than the core of its offering.

Bitstamp Exchange Review: Security and Regulation

Security has always been a key talking point in any Bitstamp exchange review. Back in 2015, the exchange suffered a hack that led to a loss of about 19,000 BTC. Many expected that would be the end of Bitstamp, but the company reimbursed users fully and tightened its systems. Since then, no major breaches have been reported, and a large percentage of funds are stored in cold wallets.

The platform follows strict Know Your Customer (KYC) and Anti-Money Laundering (AML) rules. For some users, this is a plus—knowing that the exchange is serious about compliance makes them more comfortable storing larger sums. For others, especially privacy-focused traders, this is a downside. They feel the verification process is slow and invasive compared to competitors that allow lighter onboarding.

User Experience and Mobile App

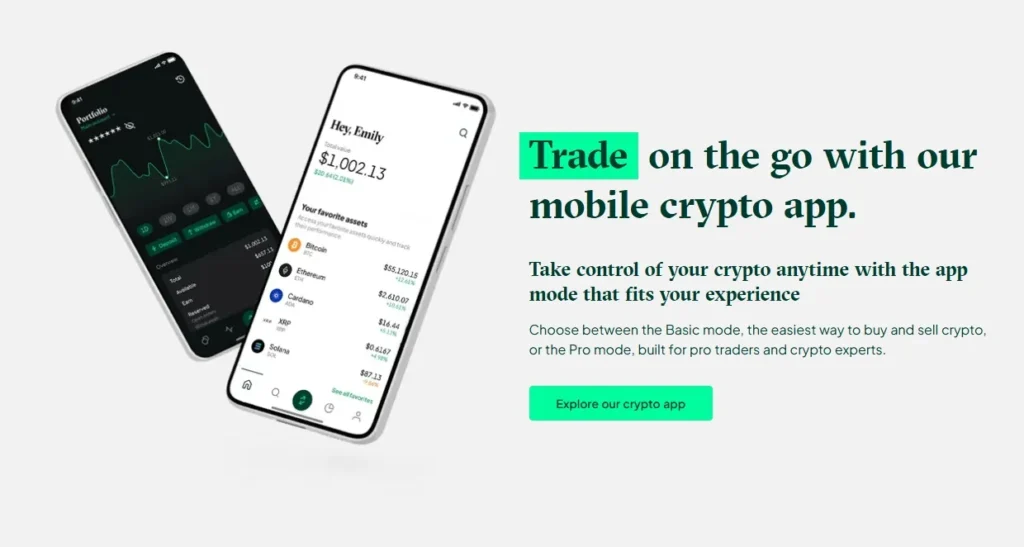

Open Bitstamp today and you won’t find flashy visuals or futuristic graphics. Instead, the platform sticks to a clean, minimalist look—simple to navigate, though some traders feel the design looks a little dated. The web interface favors function over flair, and that clarity attracts users who prefer trading without distractions.

On mobile, Bitstamp has stepped up its game in recent years. The app lets traders place orders quickly, follow live prices, and set alerts with ease. It doesn’t rival Binance Pro or Bybit when it comes to advanced tools, but for spot trading, it handles the essentials smoothly. Many app store reviewers highlight its stability, while others complain about occasional delays in updates.

Comparing Bitstamp to Competitors

It’s impossible to finish a Bitstamp exchange review without mentioning its rivals. Binance, Coinbase, and Kraken dominate headlines with aggressive product launches, from NFT marketplaces to perpetual futures. Bitstamp, in contrast, feels like the traditionalist. It has avoided the arms race of listing every possible asset or adding complex derivatives.

For users who want simplicity and safety, this is attractive. For those who want constant innovation, it may feel boring. In truth, the exchange has carved a niche for itself as the “steady hand” in a market often dominated by hype.

Here’s a quick snapshot of how Bitstamp compares with a few major players:

| Exchange | Founded | Crypto Listed | Trading Fees | Main Strength |

|---|---|---|---|---|

| Bitstamp | 2011 | 85+ | 0.30% to 0.00% | Regulation & Reliability |

| Binance | 2017 | 350+ | 0.10% or lower | Wide Asset Selection |

| Kraken | 2011 | 200+ | 0.26% to 0.00% | Strong Security & Features |

| Coinbase | 2012 | 250+ | 0.50%+ | Beginner-Friendly |

Final Verdict: Is Bitstamp Still Worth Using?

When you look at Bitstamp’s features, fees, and track record, one thing stands out—it still matters, but it doesn’t suit everyone. New traders chasing meme coins will quickly notice the limited selection. And for professional arbitrageurs hunting for the lowest fees, other exchanges may serve them better.

But if you value regulation, trust, and a platform that has stood the test of time, Bitstamp still delivers in 2025. Its focus on core pairs, strong compliance, and reliability make it a preferred choice for cautious investors. In a market where new platforms rise and fall every year, there’s something reassuring about an exchange that just keeps showing up.