Bybit Exchange Review 2025: Honest Insights on Features, Safety, and Fees

This Bybit Exchange Review 2025 kicks off with a reality check: in the fast-moving crypto market, exchanges come and go, and trust isn’t built overnight. Bybit has had its share of hype, especially in the derivatives scene, but 2025 feels different. It’s no longer just the “high leverage” choice – it’s steadily becoming a serious contender among top exchanges. This review focuses on what it’s like to actually use Bybit day to day, not just what their homepage claims.

Bybit’s Rise in the Crypto Landscape

Bybit started small in 2018 with a focus on leveraged futures, quickly gaining a loyal following among high-risk traders. Over time, it expanded its offerings to include spot trading, staking, copy trading, and even passive income products.

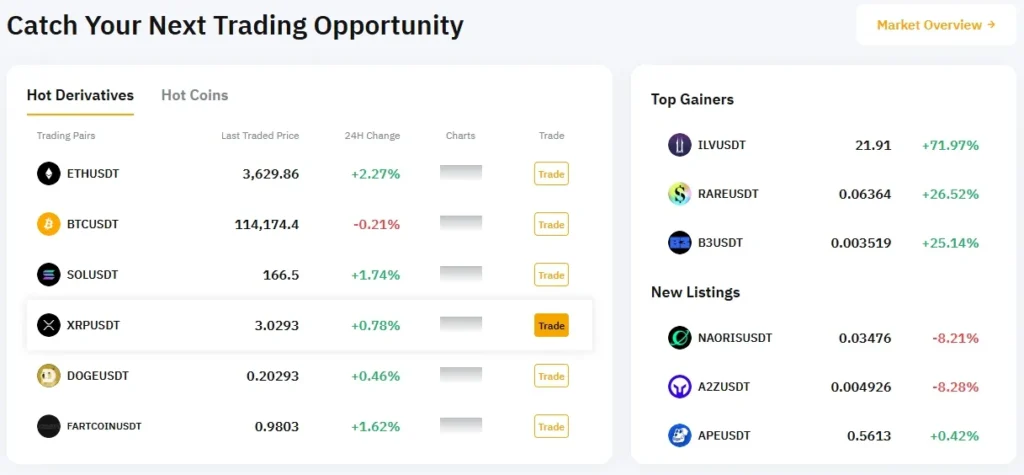

By 2025, liquidity has improved significantly, sometimes even matching Binance on major pairs. While it still faces the market’s usual volatility and risks, Bybit has moved beyond its early image as a second-tier option, becoming a more serious player in the crypto exchange space.

Bybit Exchange Review – The Trading Experience Where It Counts

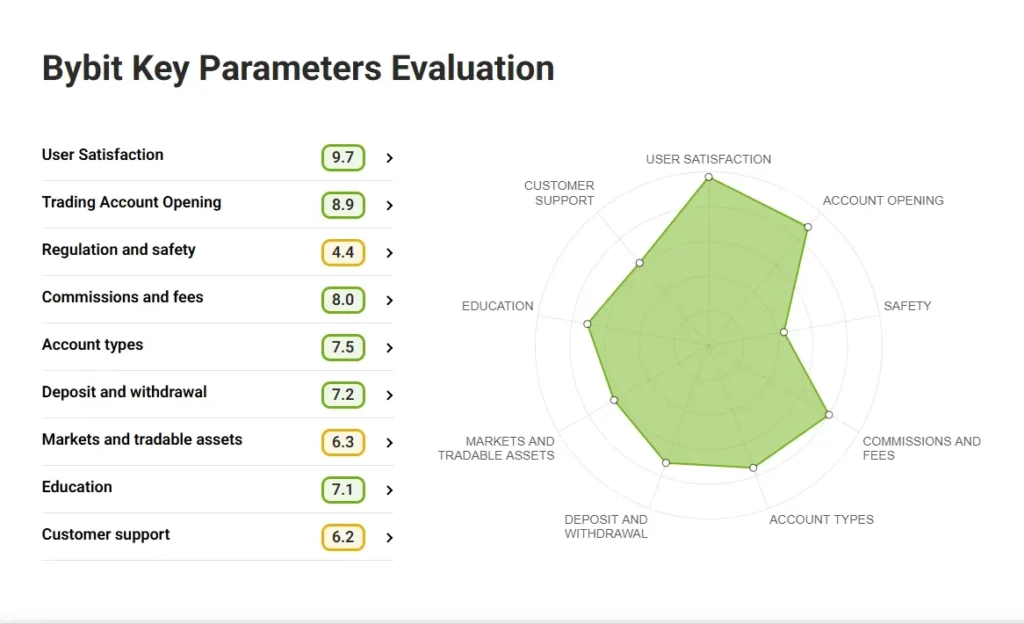

Credit From: tradersunion

Order execution is fast, and slippage is rare on high-volume pairs like BTC/USDT. This makes a big difference for traders who rely on precise entries and exits, especially during volatile markets.

The platform’s layout is flexible, letting you arrange charts and order books the way you like, which is a relief compared to some clunky competitors. Beginners may find the interface busy at first, but after a few trades, it feels intuitive. The mobile app has improved too, making on-the-go trading less stressful and closer to the desktop experience.

Bybit Exchange Review – Security: Better but Not Perfect

Bybit keeps most customer funds in cold storage, disconnected from the internet. It’s not perfect, but it makes hacking harder. When you try to withdraw, extra verification steps add friction yet make it much tougher for anyone else to touch your money. Traders like having that safety net, especially after painful lessons from the FTX meltdown reminded everyone how fragile trust can be.

Regulation is still a grey area. Bybit is pursuing licenses in markets like Singapore, which is a step forward, but in other countries, rules are vague or incomplete. That uncertainty keeps some traders cautious about leaving large balances on the platform.

Even with improvements, no exchange is bulletproof. Policies can change, governments can tighten rules, and unexpected breaches are always a possibility. Most experienced traders only keep what they need for active trades on Bybit and move the rest to personal wallets.

Fees – Competitive, Especially for Futures

Bybit’s fee structure is one of its strong points. Futures traders benefit from low maker fees, and spot trading costs are on par with major exchanges. High-volume traders can get further discounts. Here’s a quick look:

| Exchange | Spot Fees (Maker/Taker) | Futures Fees (Maker/Taker) | Max Leverage |

|---|---|---|---|

| Bybit | 0.1% / 0.1% | 0.01% / 0.06% | 100x |

| Binance | 0.1% / 0.1% | 0.02% / 0.07% | 125x |

| OKX | 0.08% / 0.1% | 0.02% / 0.05% | 125x |

The leverage is available if you want it, but it comes with real dangers. Many new traders burn through their accounts by chasing 100x positions without proper risk control.

Bybit makes leverage very accessible – maybe a bit too accessible – which is why using it carefully is crucial. Even experienced traders often suggest keeping leverage lower to avoid wiping out funds in volatile swings.

What Works Well and What Doesn’t

Copy trading is handy for beginners, but it comes with its own risks. Choosing lead traders carefully is crucial because their strategy directly affects your results, and blindly following can lead to losses. It’s a feature that lowers the barrier for newcomers but still requires due diligence.

Liquidity remains solid for top pairs like BTC and ETH, but can thin out on smaller tokens, affecting order execution speed. Customer support has improved notably, with quicker live chat responses and more detailed guides, making it easier for new users to find their way around the platform.

Where Bybit still lags is regulation clarity and occasional downtime during extreme volatility. It’s not frequent, but when the market is wild, you might feel the platform slow a bit.

Bybit Exchange Review – Final Thoughts: Is Bybit Worth It in 2025?

Bybit isn’t flawless, but it’s turning into a go-to platform for traders who want more than just a basic spot exchange. The fees are fair, execution feels snappy, and tools like copy trading and multi-chain support can actually make a difference when you’re in the market. There’s still some uncertainty around regulation and smaller coins don’t always have enough depth, yet you get the sense that Bybit is a platform learning from real traders’ feedback and slowly maturing with the market.

If you’re an active trader, especially in futures, Bybit deserves a look. Just treat leverage with respect, keep funds safe, and remember that no exchange is 100% risk-free – but in 2025, Bybit is closer than ever to being a trusted name in crypto trading.