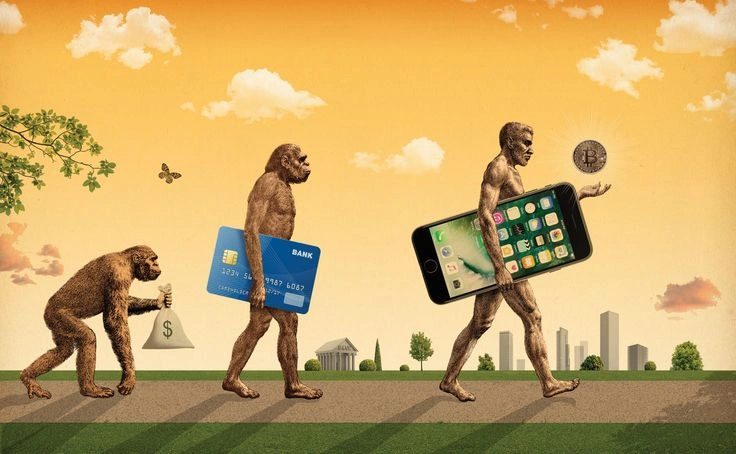

Crypto and Bank Card Integration: Are We Really Ready for This Future?

Let’s face it—crypto and bank card integration sounds like something from the future… but it’s already knocking on our digital doors. As cryptocurrency goes more mainstream, banks and fintech companies are scrambling to keep up. One way they’re trying? Blending crypto assets with everyday bank cards. Tap to pay with Bitcoin? Sounds wild—but it’s happening.

Still, we have to ask: is this the innovation we’ve been waiting for—or a confusing leap that could cause more trouble than it’s worth?

What Does Crypto and Bank Card Integration Really Mean?

In the simplest terms, it’s the merging of digital currencies like Bitcoin or Ethereum with traditional financial tools like debit or credit cards. Think of it as using your crypto wallet like a regular bank card—no more converting coins to fiat manually. Just swipe, and the platform does the math behind the scenes.

Big players like Visa and Mastercard have already dipped their toes in the crypto pool. They’ve partnered with crypto platforms like Binance, Crypto.com, and Coinbase to launch cards that let users spend digital currencies directly. Handy, right?

But hold on… is it too easy?

Why Some Say It’s the Future of Everyday Finance

Proponents of crypto and bank card integration argue that this is the bridge the crypto world needed. For years, one of the biggest criticisms of cryptocurrency was that it wasn’t usable in everyday transactions. You could hodl it, sure—but buying coffee? Not so much.

Now, with these hybrid cards, you can go from blockchain to bakery in seconds.

Plus, crypto-savvy consumers are excited about perks like crypto cashback, reduced transaction fees (in some cases), and more financial autonomy. It’s also a win for companies trying to ride the innovation wave. A fintech firm offering this kind of integration looks… well, future-ready.

But There Are A Few Red Flags, Too

Let’s not ignore the elephant in the room: volatility. Crypto markets are famously shaky. One day your coin’s worth $100, the next it’s dropped to $60. Using that to buy groceries could be a budgeting nightmare.

And then there’s regulation—or rather, the lack of it. Governments around the world are still playing catch-up with crypto laws. What’s legal in one country might be banned in another. That unpredictability makes global scaling a serious challenge.

Security is another major concern. If crypto is stolen or hacked from a linked card or wallet, what recourse do users have? Traditional banks have fraud protection… but blockchain isn’t always so forgiving.

Crypto and Bank Card Integration: A Step Toward Mainstream—or a Misstep?

There’s no denying that crypto and bank card integration is shaking things up. It’s innovative, maybe even revolutionary. But like with any major shift, it comes with growing pains.

For some, this evolution is empowering—a way to finally bring crypto into the real world, not just trading apps and speculative investments. For others, it’s a risky blend of two very different financial systems.

Maybe the solution lies in balance. Hybrid systems that allow for both crypto and fiat use, with strong security protocols and clear consumer protections, could be the way forward. Or maybe, we’re just not quite there yet…

Final Thoughts: Is Crypto and Bank Card Integration the Future?

Honestly? Maybe. The concept of crypto and bank card integration is undeniably exciting—like catching a glimpse of where finance might be heading. But whether it becomes the norm or just another tech trend will depend on a lot of things: regulation, security, consumer trust, and the ever-erratic crypto market.

Until then, let’s keep our minds open—and maybe our wallets a little diversified, just in case.

Relevant News: HERE