Gas Fees in Crypto: What They Are and How to Minimize Them

When people first dive into cryptocurrency, one phrase quickly stands out: gas fees. For newcomers, this term can be confusing, even frustrating—especially when the fees seem to spike without warning. If you’ve ever wondered why it costs $50 just to swap a token on Ethereum or send a simple transaction, you’re not alone. This article provides crypto gas fees explained clearly and practically—covering how they work, why they vary, and how you can avoid overpaying.

What Are Gas Fees in Crypto?

At its core, a gas fee is a transaction fee required to perform operations on certain blockchains—most notably, Ethereum. These operations range from sending tokens and executing smart contracts to minting NFTs or engaging with decentralized applications (dApps).

Gas fees serve a crucial purpose. They:

- Compensate network participants (miners or validators) for their computing power

- Prevent spam and congestion on the blockchain by assigning a cost to each transaction

- Prioritize transactions during periods of high demand

On Ethereum, these fees are paid in ETH, specifically in gwei (1 gwei = 0.000000001 ETH).

Understanding Crypto Gas Fees: A Technical Breakdown

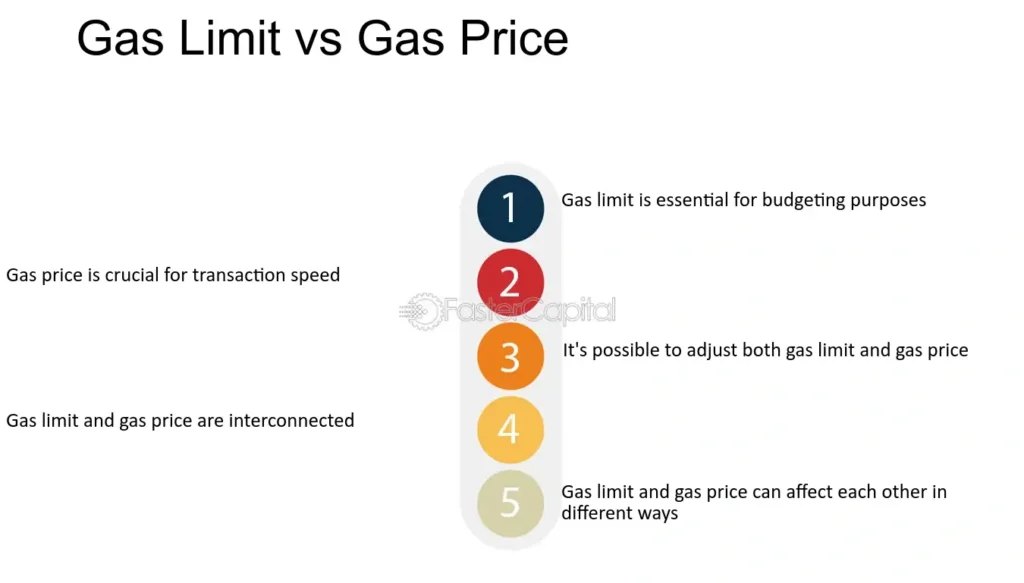

Credit from FasterCapital

To truly understand gas fees, let’s look at the components that determine how much you’ll pay.

1. Gas Units

Think of gas units as the “fuel” required for a transaction. Simple transfers might use 21,000 gas units, while interacting with a smart contract can use hundreds of thousands.

2. Gas Limit

This is the maximum number of gas units you’re willing to pay for. If the transaction needs more gas than your limit, it fails—but you still pay for the attempted computation.

3. Gas Price (Before and After EIP-1559)

Prior to Ethereum’s EIP-1559 upgrade in August 2021, users set their own gas prices—higher offers meant faster inclusion in the next block. After the upgrade, a new base fee is algorithmically set by the network, and users can add a priority fee (a tip) to speed things up.

Here’s how gas fees are calculated now:

Total Gas Fee = Gas Used × (Base Fee + Priority Fee)

This dynamic pricing model helps make fees more predictable, though not necessarily cheaper.

Why Are Gas Fees So High Sometimes?

Credit from Jumpstart Magazine

Crypto gas fees explained simply: it’s supply and demand.

Network Congestion

When more users compete to have their transactions processed, gas prices go up. Events like major NFT launches, token airdrops, or bull market spikes often trigger congestion.

Transaction Complexity

Transferring ETH to a friend uses minimal gas. But interacting with a DeFi protocol like Uniswap or a DAO contract involves more computation—and hence more gas.

Ethereum’s Popularity

As the most widely used smart contract platform, Ethereum often gets overwhelmed. This popularity contributes to the consistently high fees.

Gas Fees on Ethereum vs Other Blockchains

Ethereum isn’t the only blockchain that charges fees. However, its fees are often significantly higher than newer competitors that use different consensus mechanisms or offer scaling solutions.

| Blockchain | Consensus Mechanism | Avg. Gas Fee (USD) | Notable Feature |

|---|---|---|---|

| Ethereum | Proof of Stake (PoS) | $1–$50+ | Strong ecosystem but high fees |

| Binance Smart Chain | Delegated Proof of Stake | ~$0.05 | Faster & cheaper, but more centralized |

| Solana | Proof of History + PoS | <$0.01 | Extremely low fees, high throughput |

| Polygon (Layer 2) | Ethereum Layer 2 (PoS) | ~$0.01 | Low fees and EVM compatible |

| Arbitrum (Layer 2) | Rollup (Optimistic) | ~$0.05 | Reduces Ethereum fees significantly |

Note: Fees fluctuate daily depending on usage.

How to Reduce Crypto Gas Fees

Reducing gas fees doesn’t require technical expertise—just good timing, the right tools, and smart habits.

1. Time Your Transactions Wisely

Blockchain activity varies throughout the day. Weekends and late-night UTC hours often see lower fees. You can use tools like Etherscan’s Gas Tracker to find the cheapest time to pay gas fees.

2. Use Layer 2 Solutions

Ethereum Layer 2 platforms like Arbitrum, Optimism, and zkSync batch multiple transactions into one, dramatically lowering fees. They work like express lanes, offering faster and cheaper alternatives to Ethereum’s mainnet.

3. Choose Cheaper Blockchains

If your activity doesn’t require Ethereum specifically, consider alternatives like Polygon or BSC for basic transfers or yield farming.

4. Set Smart Gas Parameters

Wallets like MetaMask let users customize gas limits and priority fees. While default settings usually work, advanced users can fine-tune these to avoid overpaying.

5. Use Gas Fee Discounts or Rebates

Some DeFi platforms (e.g., Balancer, 1inch) offer gas refunds or cover gas for certain user tiers or trading volumes.

Best Tools to Track and Estimate Gas Fees

Several platforms offer real-time gas fee tracking, helping users decide the best time to transact:

- Etherscan Gas Tracker (https://etherscan.io/gastracker) – Ethereum’s most trusted tracker

- GasNow – Visual, user-friendly gas prediction dashboard

- MetaMask – Built-in estimations during transaction setup

- Blocknative – Advanced mempool explorer and gas prediction

Each of these tools also provides historical gas price data, which can help you better understand network trends.

Common Misunderstandings About Gas Fees

Let’s clear up a few misconceptions:

- “Gas fees are fixed.”

Not true. They change minute-by-minute based on activity. - “Higher gas means faster speed.”

Only partly true. If you overpay during low congestion, the transaction won’t necessarily confirm faster. - “Gas fees are profit for Ethereum.”

No. Since EIP-1559, the base fee is burned, reducing ETH supply and not going to miners.

Conclusion: Why Understanding Gas Fees Matters

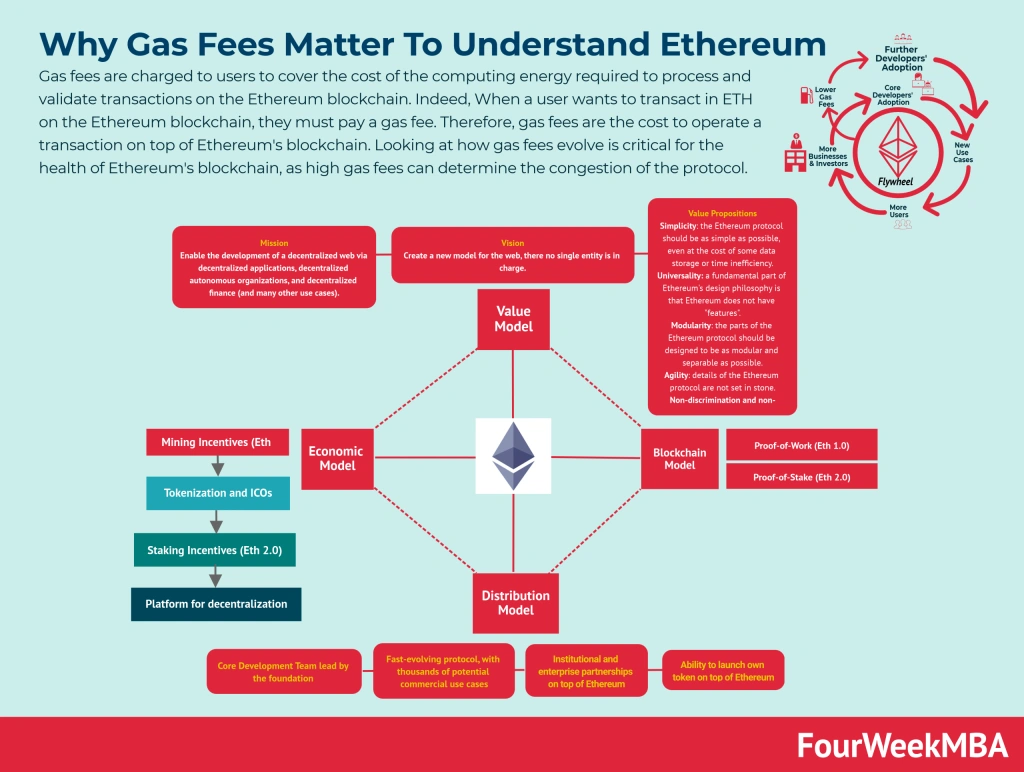

Credit from FourWeekMBA

Understanding crypto gas fees isn’t just for tech experts. It’s a crucial part of navigating the Web3 world, especially for anyone using Ethereum or DeFi apps regularly. The more informed you are, the better your chances of saving money, reducing wait times, and avoiding failed transactions.

With gas fees likely to remain part of crypto for the foreseeable future—at least on leading networks—learning how they work is essential. Whether you’re choosing the cheapest time to pay gas fees, exploring Layer 2 solutions, or simply calculating gas fees in crypto for a transaction, these insights empower you to use crypto smarter and more efficiently.