Crypto Scams to Avoid: How Beginners Can Stay Safe Online in 2025

1. The Most Common Cryptocurrency Scams in 2025

Crypto scams takes many forms. Phishing attacks—through fake emails or web wallets—remain among the most reported scams. Rug pulls, where developers hype a project and disappear after collecting funds, still affect investors chasing the next big token.

Fake airdrops also persist. Scammers offer free tokens as bait to trick users into exposing private keys or signing malicious transactions. Ponzi and pyramid schemes still exist, often disguised as “community-driven” investment clubs. Fake platforms have become more sophisticated, with professional-looking websites offering guaranteed returns that disappear overnight. Impersonation and social media giveaway scams continue to claim victims, especially when influencers’ likenesses are faked using AI.

The wide range of tactics—many blending psychological manipulation with technical deceit—make education the best prevention tool.

2. How to Identify Crypto Scams Before It’s Too Late

Most scams reveal their hand early, but many users fail to notice or react. A clear warning sign is the promise of outsized, guaranteed profits—especially when accompanied by urgency or exclusivity. You might encounter messages saying “only a few spots left” or “limited time offer,” which are designed to pressure people into acting without due diligence.

Lack of verifiable identities is another signal. Many scam projects have founders with no digital trail—no LinkedIn profiles, GitHub activity, or recorded conference appearances. And when a platform refuses to publish its source code or undergo a smart contract audit, that should raise serious concern.

Often, you’ll also notice inconsistent messaging, vague business models, or whitepapers full of jargon without a clear value proposition. These aren’t always definitive proof of fraud, but when several of these signals appear together, caution is strongly advised.

3. Crypto Scams for Beginners to Watch Out For

Beginners often fall for scams tailored to their lack of technical knowledge. One common example is fake wallet apps—many of which were removed from Google Play in 2024 after stealing private keys. Some were virtually indistinguishable from legitimate ones, copying logos, UI, and even app reviews.

Other newcomers get drawn into “pump-and-dump” groups on Telegram or Discord, where obscure tokens are hyped by coordinated users who sell off once prices spike. Malicious browser extensions, which mimic MetaMask or Trust Wallet interfaces, are another danger. Some of these extensions silently monitor clipboard activity or keystrokes to hijack wallet access.

QR code scams are also on the rise. Victims are led to scan QR codes at meetups, on flyers, or in chatrooms, which redirect them to phishing sites or automatically initiate dangerous transactions.

4. The Evolving Threat of Social Media Crypto Scams

Credit from consumer.ftc.gov

Crypto scams thrive on social platforms. Twitter (X), Discord, and Telegram are home to thousands of scam accounts posing as influencers, customer support agents, or project moderators. These scams aren’t always easy to spot—many use convincing graphics, plagiarized posts, and even AI-generated deepfake videos of real crypto figures.

One particularly effective tactic involves fake livestreams claiming to host AMAs (ask-me-anything) with celebrities or CEOs. In these, users are encouraged to send cryptocurrency with the promise of receiving more in return. These videos often run 24/7 and mimic actual conference footage.

Comment sections also play a role. Scammers use bot accounts to post false testimonials or pretend to validate the scam. If a video or post has dozens of replies all claiming, “This worked for me,” it’s likely coordinated.

5. DeFi Scams to Avoid in 2025

Decentralized Finance (DeFi)—while promising—isn’t immune to manipulation. Many DeFi projects are unaudited or managed by pseudonymous teams with full control of smart contracts. This makes them fertile ground for scams like rug pulls, flash loan exploits, and backdoor withdrawals.

One of the more notorious examples involved a “zombie” DeFi project—abandoned by developers but still accessible. Unsuspecting users continued depositing funds, not realizing the smart contract was vulnerable to manipulation.

If a DeFi platform doesn’t publish its code or undergo a professional audit by firms like CertiK or Trail of Bits, it’s best to stay away.

6. Rug Pulls in Crypto Explained

In a rug pull, developers create hype through flashy websites, Discord channels, and influencer endorsements. Once they attract enough investment, they shut down operations and vanish. These scams are hard to detect early on, especially when marketing and branding appear legitimate.

One 2023 case involved Fintoch, a project claiming a partnership with Morgan Stanley. It attracted tens of thousands of investors before disappearing with over $30 million. Despite numerous red flags, including unverifiable team credentials and unrealistic profit claims, many users only realized the danger after the funds were gone.

7. How to Avoid Crypto Scams Without Being Paranoid

Avoiding crypto scams doesn’t require paranoia—just methodical thinking. Start by securing your assets in cold wallets, such as hardware devices like Ledger or Trezor, which store your keys offline. Avoid clicking on unknown links or interacting with pop-up messages in your browser. Bookmark your frequently used dApps and exchanges.

Do your own research before investing. Check whether the project has an active development team, GitHub activity, a clear whitepaper, and community transparency. If a project promises guaranteed returns with no risk, it likely isn’t legitimate.

Influencer endorsements should be treated as marketing—not due diligence. Many scammers fake these endorsements or pay creators without proper disclosure. Always verify the source and cross-check across independent platforms.

Enable two-factor authentication (2FA) on every platform that supports it, especially wallets and exchanges. Use authenticator apps, not SMS-based methods, which can be hijacked through SIM-swapping.

8. How Scammers Target Crypto Beginners

Newcomers often don’t realize that scammers can use basic public information to mount attacks. If you’ve posted about your recent crypto purchase or joined beginner forums, you may be targeted with friendly messages offering “investment tips” or “airdrops.”

Scammers also exploit search engine ads, buying top spots for fake wallet downloads or copycat exchanges. YouTube is another favorite venue—AI-generated voices, fake livestreams, and giveaway scams appear legitimate at a glance.

What makes these scams particularly dangerous is their timing—they often target users right after they join an exchange or set up a wallet, when they’re least familiar with what’s normal or suspicious.

9. What to Do If You Fall Victim to a Crypto Scam

Credit from TRM Labs

If you’ve been scammed, act quickly. Immediately halt any transactions and lock down your accounts. Contact your exchange or wallet provider to report the issue. You can also file reports with your country’s cybercrime unit—such as IC3.gov in the U.S. or CyberSecurity Malaysia.

Platforms like Chainabuse allow you to report scam addresses publicly, helping others avoid similar traps. Informing others—through Reddit, Telegram, or support forums—also prevents further damage by exposing patterns.

Recovery may be difficult, but reporting helps investigators trace larger scams, and in rare cases, funds have been recovered.

Conclusion: Knowing the Crypto Scams to Avoid Is Your First Line of Defense

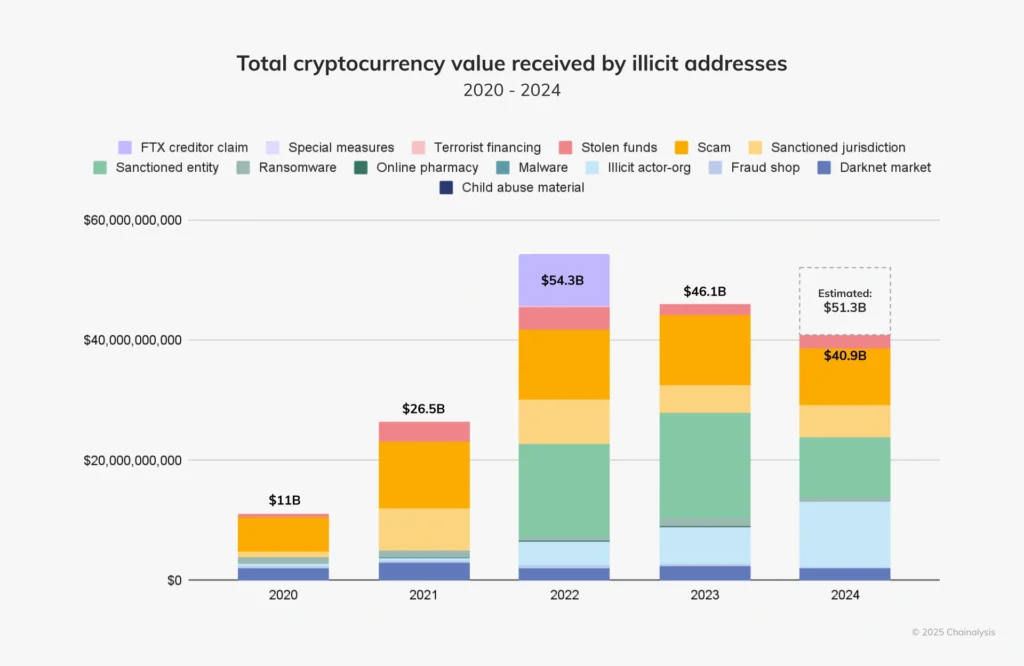

Credit from Chainalysis

Being aware of the crypto scams to avoid is the most effective shield you have in today’s fast-moving digital asset space. Scams aren’t going away, but neither is your ability to outthink them. With thoughtful research, healthy skepticism, and the right tools, beginners can build their crypto journey on a foundation of safety and confidence.