Day Trading vs Swing Trading: Which Trading Style Suits Indonesian Traders Best?

Day trading Indonesia refers to the active buying and selling of financial assets—such as stocks, forex pairs, or commodities—within a single day. The objective is to capitalize on short-term market movements, often holding positions for just minutes or hours. With the rise of user-friendly trading apps and access to real-time data, this approach has gained traction among younger traders in cities like Jakarta and Medan. But while technology makes it easier to enter the market, the real challenge lies in developing the discipline to make swift, informed decisions under pressure. It’s a fast-paced strategy that demands attention, quick thinking, and a solid understanding of technical indicators.

Day Trading Indonesia: How Does Swing Trading Compare?

Swing trading adopts a slower rhythm. Instead of rapid trades within a single day, swing traders in Indonesia hold positions for several days to weeks. This strategy is designed to catch larger price moves—whether trends or reversals—using tools like trendlines, candlestick patterns, and momentum indicators. For many in Indonesia juggling full-time jobs, family life, or academic responsibilities, swing trading offers a more flexible entry into the market. It requires consistent analysis, but not constant monitoring, allowing traders to plan ahead and check their positions only once or twice a day. This balance makes it appealing to those who want to stay involved without full-time commitment.

Day Trading Indonesia: Which Trading Style Takes More Time?

Source: HDFCSKY

Time is one of the biggest differences between these two methods. Day trading is demanding—it requires you to be actively present during trading hours, often reacting to minute-by-minute changes. In Indonesia, traders who work remotely or have control over their daily schedule may find this intense focus manageable. For others, however, it can be disruptive. Swing trading, on the other hand, offers more breathing space. Since trades evolve over a longer period, the time spent on screens is significantly less. Many Indonesian swing traders prefer to analyze the market during quiet evening hours or early mornings before the trading day begins.

Day Trading Indonesia: Which One Comes with More Stress?

Source: Gensler

Psychological pressure varies depending on the strategy. Day trading, by nature, is high-stress. It involves quick decision-making, managing multiple trades, and staying composed amid rapid price swings. For Indonesian beginners, especially those without a clear system in place, this can quickly lead to burnout. Swing trading tends to be less intense emotionally. Because trades are set up in advance and allowed to play out over time, there’s more room for strategy and less immediate pressure. That said, patience becomes a key skill—since holding through temporary price dips requires confidence in your analysis and self-discipline to avoid impulsive exits.

Which Offers More Profit Opportunity?

Source: Vectors

Profit potential exists in both styles, but how it’s achieved differs. Day traders may generate frequent, smaller profits that add up over time, but they also face higher transaction costs and a need for consistency. Indonesian platforms sometimes apply fees per trade or spreads, which can chip away at gains. Swing traders, by contrast, aim for larger profit margins per trade and fewer entries overall. While it may take longer to see results, it often provides a steadier return profile when strategies are applied effectively. Traders looking for sustainable growth—rather than quick wins—may find swing trading better suited to long-term capital development.

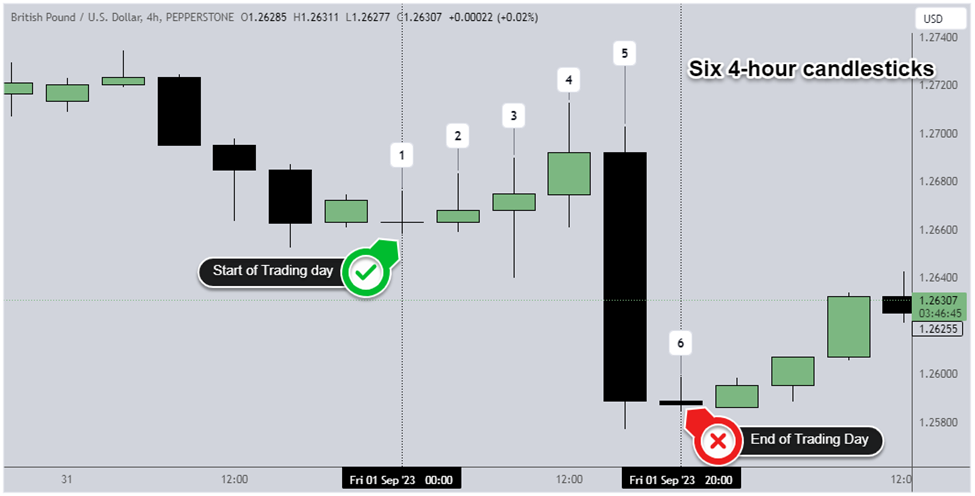

Is Either Strategy Better for Forex Trading in Indonesia?

Source: TOPBROKERS

Indonesia’s forex market is expanding, with a growing community of individual traders using global and local platforms. Day trading forex requires real-time reaction to macroeconomic data, market sentiment, and rate decisions—especially those from Bank Indonesia. While some traders thrive in this fast-moving environment, it’s easy to feel overwhelmed without experience. Swing trading forex provides an alternative. It allows traders to track major trends or currency cycles using daily or 4-hour charts, reducing the need to act immediately. Many Indonesian forex traders appreciate the balance swing trading offers, especially when combining it with local economic context and global news flow.

What Should You Consider When Picking One?

The decision between day and swing trading in Indonesia should reflect your availability, personality, and trading goals. If you have the time to dedicate full attention to the market—and enjoy quick thinking under pressure—day trading may be a good match. But if your lifestyle involves other priorities or you prefer to plan and reflect, swing trading will likely feel more sustainable. Traders across Indonesia are increasingly learning by doing: testing both styles, evaluating outcomes, and eventually focusing on the one that feels most intuitive. What matters most is finding a strategy you can stick with, refine, and scale with confidence.

Can You Use Both Approaches at Once?

Yes, it’s possible—and fairly common—for Indonesian traders to combine both styles. This hybrid strategy might involve day trading during highly active market windows or on specific instruments, while swing trades run in the background based on broader market setups. This approach requires careful organization to avoid overexposure or strategy confusion. Successful traders who mix the two often allocate different capital pools for each and track them separately. Whether in Java, Sumatra, or Kalimantan, flexibility and structured planning allow traders to tailor their activity to what works best for their schedule and market interest.

Final Thoughts: Day Trading Indonesia and Long-Term Fit

Day trading Indonesia presents unique opportunities for those seeking a fast-paced, hands-on experience. But the lifestyle demands aren’t for everyone. Swing trading offers a steadier pace, more flexibility, and often less emotional strain—especially for traders balancing multiple roles. Whichever style you choose, make sure it fits your time, energy, and personal risk tolerance. In Indonesia’s evolving trading environment, success depends not on trading faster, but on trading smarter—and sticking to a method you can maintain and improve over time.