Decentralized Finance for Beginners: Exploring the Future of Finance Without Banks

What Is DeFi, and Why Should Beginners Care?

Decentralized finance for beginners can seem complex at first glance, but the concept is rooted in a simple idea: financial services without centralized control. Instead of using banks or brokerages, DeFi operates through blockchain technology. It allows anyone, anywhere, to lend, borrow, earn interest, or trade assets directly — no paperwork, no credit checks, no permission required.

This open financial network is powered by smart contracts, which are coded agreements that live on public blockchains like Ethereum. These contracts automatically execute transactions based on set rules, eliminating the need for intermediaries.

How Is DeFi Different from Traditional Finance?

Traditional finance is built around centralized institutions. From applying for loans to opening savings accounts, users depend on banks and governments to authorize and oversee their transactions. In contrast, DeFi replaces these institutions with transparent code that anyone can interact with directly.

Here’s a direct comparison:

| Category | Traditional Finance | Decentralized Finance (DeFi) |

|---|---|---|

| Access | Often restricted by region or credit rating | Open to anyone with internet access |

| Identity Requirements | ID verification and KYC procedures | Usually not required |

| Intermediaries | Banks, brokers, and clearing houses | Smart contracts only |

| Transaction Speed | Hours to days | Seconds to minutes |

| Transparency | Closed systems | Fully open-source |

| Fund Control | Held by third parties | Held by user |

| Security | Regulated, sometimes insured | Riskier, self-managed |

DeFi’s decentralized nature allows for faster, borderless interactions, but it also shifts the responsibility of security and risk assessment entirely to the user.

How DeFi Works: A Beginner’s Walkthrough

Imagine you want to earn interest on your savings. In traditional finance, you’d deposit into a savings account and let the bank manage the money. With DeFi, you’d use a lending protocol like Aave or Compound, where you deposit your crypto into a smart contract. That contract then makes the funds available for borrowers and distributes interest to you automatically.

To use DeFi, you need a digital wallet that can interact with decentralized applications. Once it’s set up, you can connect to protocols, deposit funds, and start using financial tools — all from your own device.

Everything runs autonomously on the blockchain. There are no approval steps, no gatekeepers, and typically, no customer service departments. Transactions are fast, transparent, and irreversible.

What You Can Do With DeFi

DeFi has introduced a wide range of financial use cases that are accessible to everyday users. You can:

- Lend or borrow digital assets without intermediaries

- Trade tokens using decentralized exchanges (DEXs)

- Stake tokens or provide liquidity to earn rewards

- Use stablecoins like DAI or USDC to hedge against volatility

- Track and manage your portfolio across multiple platforms

While these functions mirror those of the traditional system, they’re executed through open-source protocols and smart contracts rather than banks and institutions.

Wallets: Your DeFi Passport

Your wallet is your entry point into the DeFi world. Unlike traditional banking apps, DeFi wallets allow you to hold and manage your assets without giving up control. They are also used to authorize transactions, interact with platforms, and store private keys.

MetaMask, for example, is a popular browser-based wallet that supports Ethereum and compatible networks. Mobile users often turn to Trust Wallet for its ease of use. For added security, hardware wallets like Ledger store your keys offline, protecting them from online threats.

Once installed and funded, your wallet can connect to DeFi apps through browser popups or mobile interfaces. No usernames or passwords — just cryptographic signatures.

Decentralized Finance for Beginners: What Are the Risks in DeFi?

Credit from 101 Blockchains

Despite its appeal, DeFi isn’t without serious risks. Smart contracts, while powerful, can have vulnerabilities. Bugs in code have led to high-profile hacks and user losses. And since DeFi protocols are usually unregulated, there’s little legal recourse when things go wrong.

Another concern is the rise of rug pulls, where malicious developers launch a token, attract investors, then drain all funds and disappear. Additionally, if you provide liquidity to a token pair, you might face impermanent loss — a temporary loss in value caused by shifting prices between assets.

Market volatility is also a major factor. Tokens can swing wildly in value, and with no insurance backing, users must take full responsibility for their decisions.

Getting Started in DeFi (Without Losing Your Shirt)

To safely enter DeFi, it helps to start small and move slowly.

Rather than diving into advanced strategies, begin by setting up a wallet like MetaMask and transferring a small amount of crypto — such as ETH — from a centralized exchange like Binance or Coinbase. Choose one reputable platform, such as Aave, and deposit a modest amount to understand how interest accrues.

Always use official links, double-check contract addresses, and avoid clicking links from social media unless verified. Staying cautious, especially during your first few interactions, can prevent most mistakes.

Which Platforms Are Beginner-Friendly in 2025?

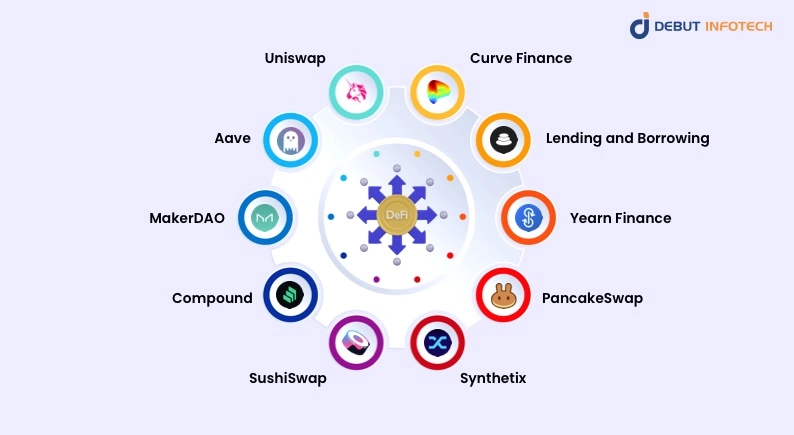

Credit from Debut Infotech

The DeFi space has grown rapidly, but a few platforms have stood out for their reliability and ease of use:

- Uniswap: Known for its user-friendly interface and reliable liquidity, Uniswap is a go-to for token swaps.

- Aave: Allows users to earn interest or borrow funds with adjustable collateral settings.

- Compound: Offers a clean dashboard for lending and borrowing with transparent rates.

- Curve Finance: Optimized for stablecoin trading, minimizing slippage and fees.

- Zerion / DeBank: Portfolio trackers that provide an overview of your DeFi activity across multiple apps.

These platforms are widely audited, community-supported, and integrated with most DeFi wallets.

Decentralized Finance for Beginners: Emerging Trends in DeFi (2025)

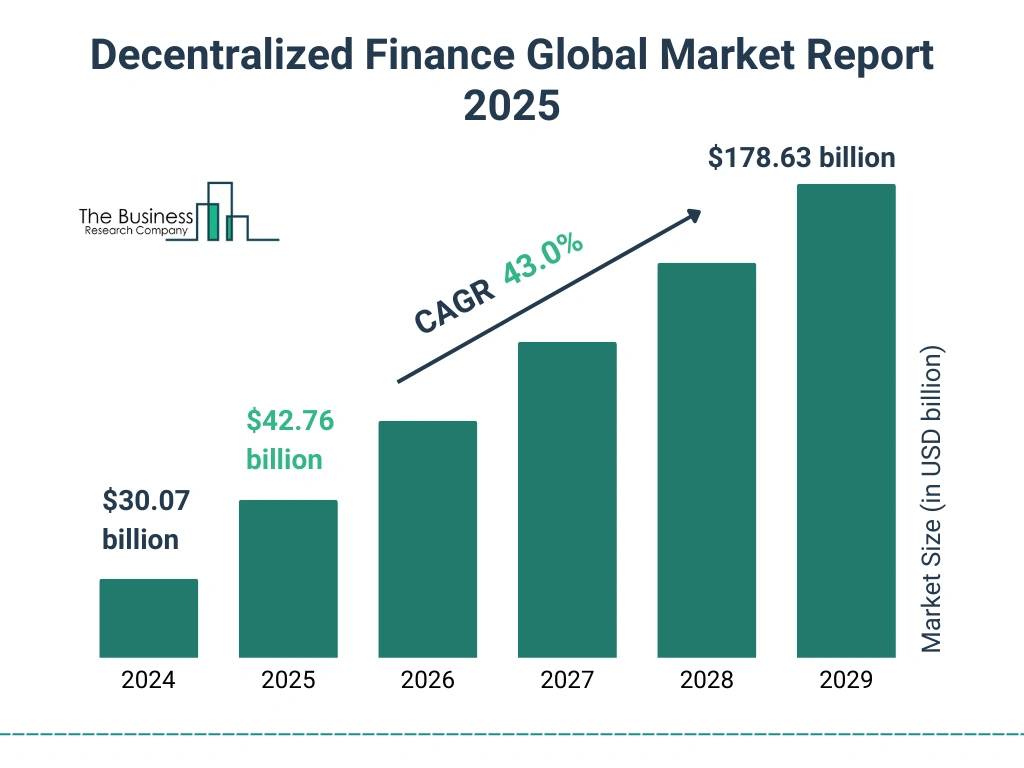

Credit from The Business Research Company

Several exciting trends are changing the landscape of decentralized finance. Layer 2 networks like Arbitrum, zkSync, and Base are offering cheaper and faster transactions, allowing more users to engage with DeFi protocols without worrying about high gas fees.

We’re also seeing increased experimentation with real-world assets (RWA) — like tokenized treasury bonds or invoice financing — brought into DeFi via token protocols. Another growing sector is decentralized identity (DID), which enables users to access services based on on-chain reputation instead of traditional credentials.

Lastly, cross-chain interoperability is improving, meaning users can now move assets between different blockchains more easily, opening up a broader range of tools and investments.

Decentralized Finance for Beginners: Conclusion

Decentralized finance for beginners doesn’t have to be overwhelming. With the right tools, a cautious mindset, and some basic understanding of how smart contracts and wallets work, anyone can begin exploring DeFi’s possibilities.

This open financial system is still evolving, with new protocols, trends, and risks emerging constantly. But for those willing to learn, DeFi offers an alternative way to engage with money — one that’s open, programmable, and controlled by users themselves. As the space matures, its potential to reshape global finance is becoming clearer with each passing year.