Etoro Exchange Review 2025: Features, Costs, and Real Trading Insights

I first opened an Etoro account years ago, mainly out of curiosity about its famous copy trading feature. At that time, the platform felt almost too “friendly” for serious traders. Fast-forward to 2025, and my return to the platform was partly fueled by the urge to diversify beyond my usual brokers. This etoro exchange review isn’t just about what’s on their website – it’s about how the platform feels when you actually put money in and trade.

Etoro has grown into a multi-asset space, with crypto trading Etoro, forex trading Etoro, and stock trading Etoro all under one roof. It still leans heavily on accessibility, but now there’s more depth for people who actually trade daily.

Etoro Exchange Review: Account Setup and KYC

Signing up is still quick, but the etoro KYC process is no mere checkbox. I uploaded my ID and proof of address, and approval came in less than 12 hours. Friends in other regions say it can take up to 24 hours, but it’s generally smoother than many brokers I’ve tried. What I like is that you can explore the etoro demo account before fully committing funds.

The interface walks you through the first deposit, and for new traders, the user interface feels intuitive – no maze of settings, no overcomplicated charts at the start.

Etoro Exchange Review: Trading Instruments and Supported Assets

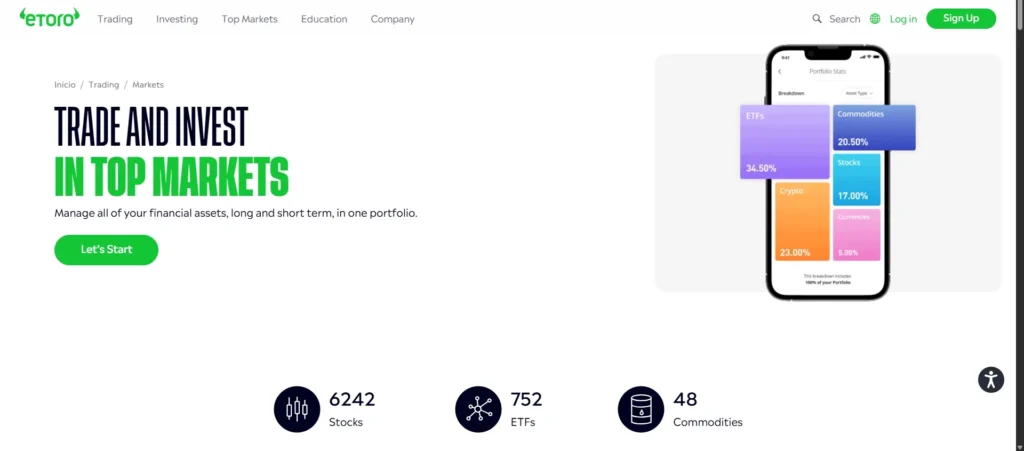

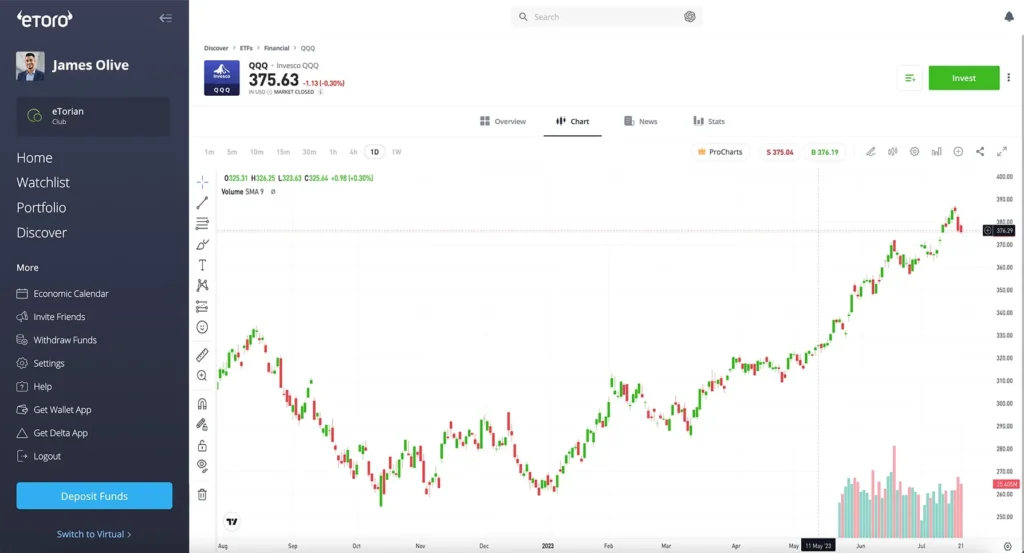

Etoro now offers over 3,000 instruments. The supported assets on Etoro range from Bitcoin and Ethereum to hundreds of global stocks and ETFs. For forex trading Etoro, you’ll find majors like EUR/USD with tight spreads and minors/exotics for those who want more volatility. On the equity side, stock trading Etoro covers US tech giants, European blue chips, and even niche Asian plays.

This variety means you can shift from day trading crypto to holding long-term stock positions without leaving the platform. And for ETF investors, it’s straightforward – no hidden menus, just search and add.

Etoro Exchange Review: Trading Fees in Real Terms

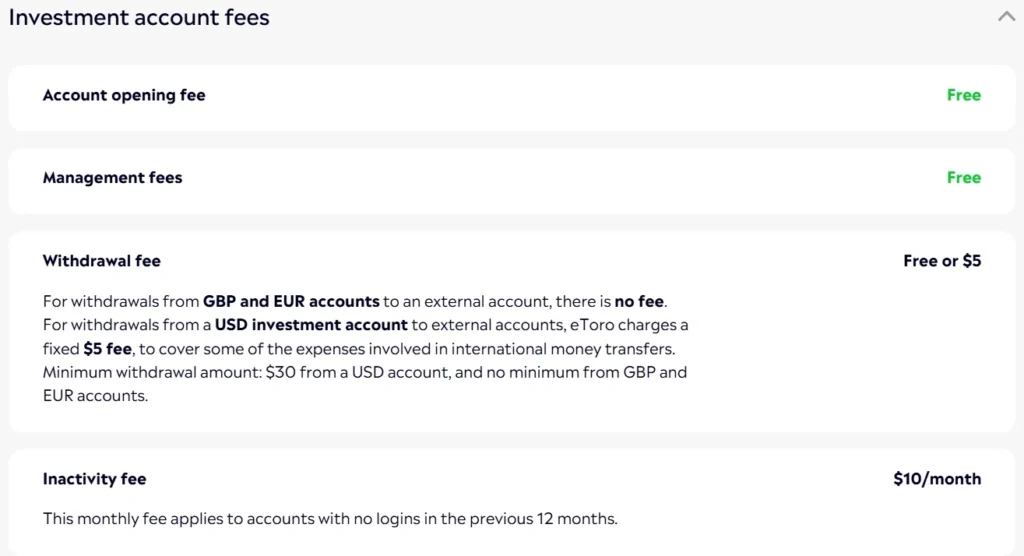

Fees are always where brokers win or lose clients. Etoro markets itself as a low fee trading platform, and compared to some rivals like etoro vs plus500, it’s competitive. Stock trades are commission-free, but of course, spreads still apply. For crypto, the etoro trading fees are built into the spread, and it’s clearly displayed before you confirm the trade.

Here’s a 2025 snapshot of the cost structure:

| Asset Type | Trading Fee / Spread | Comment |

|---|---|---|

| Stocks & ETFs | 0% commission | Spread-based pricing |

| Forex | From 1 pip | Tighter on major pairs |

| Cryptocurrency | ~0.75% spread | Varies with volatility |

| Commodities | From 2 pips | Gold, oil most popular |

| Withdrawal | $5 flat fee | Min withdrawal $30 |

For anyone trading high volume, these costs add up, but they’re still transparent. There’s no sudden “processing fee” surprise like I’ve had elsewhere.

Security and Regulation – Can You Trust Etoro?

Trust in a broker comes down to two things: how they handle your money and how they’re watched. The etoro security features include two-factor authentication, data encryption, and segregated accounts so client funds aren’t mixed with company funds.

The regulatory status Etoro is solid. It’s licensed by the FCA in the UK, CySEC in Cyprus, and ASIC in Australia. For traders, that means stricter operational standards, regular audits, and legal recourse if things go wrong.

How It Feels to Trade – Interface and Execution

I’ve used platforms where placing a trade feels like sending a letter – slow and outdated. With Etoro, execution speed is quick enough for day trading. The liquidity and execution speed are decent on both forex and major cryptos.

The mobile trading app mirrors the web platform’s clean layout, making it easy to set alerts or manage positions on the go. The investment tools on Etoro like sentiment analysis and integrated news are genuinely helpful if you know how to use them. They’re not magic predictors, but they help frame market moves.

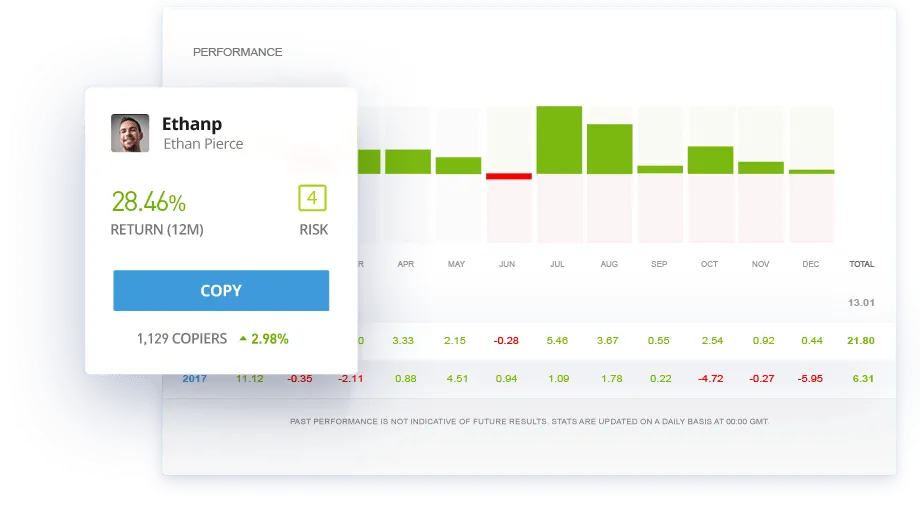

The Signature Edge – Copy Trading

Etoro’s etoro copy trading is still its crown jewel. In 2025, you can filter traders by performance, risk score, and asset focus. I tested copying a forex-focused trader and a long-term equity investor. The results were mixed – the forex trader delivered fast gains but also higher drawdowns, while the equity investor was slow but steady.

For newcomers, copy trading offers a hands-on way to learn without starting from scratch. For experienced traders, it’s a diversification tool.

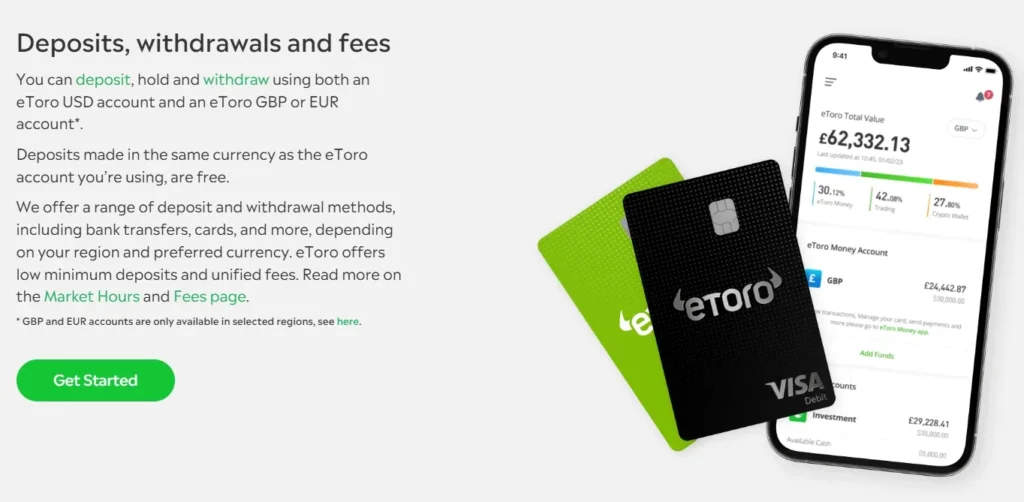

Moving Money – Deposit and Withdrawal Process

Depositing is straightforward, with multiple fiat deposit options: cards, bank transfers, and e-wallets. My deposit via card showed up instantly, while a bank transfer took two business days. The deposit and withdrawal process is smooth, but withdrawals always have that $5 flat fee. Processing speed is decent – my last withdrawal hit my bank in under 48 hours.

Final Verdict – Is Etoro Worth Your Time in 2025?

After spending months trading on the platform, my view is clear: Etoro is a strong all-rounder. This etoro exchange review shows it’s not the cheapest for every market, but the mix of asset variety, solid regulation, and unique copy trading tools make it stand out. If you want a broker where you can hold stocks, trade forex, dabble in crypto, and even mirror pros – without juggling multiple accounts – Etoro fits that bill.

Like any platform, it’s best to test with a demo or small capital first. But for me, it has earned a spot in my trading rotation for 2025.