Forex Trading vs Money Changer in Indonesia: What Sets Them Apart?

Forex Indonesia: Though they both revolve around foreign currencies, forex trading and money exchange serve very different purposes. In Indonesia, the distinction between forex vs money changer Indonesia has become increasingly relevant as more people gain access to global financial platforms. Forex trading is conducted digitally, often for profit, and relies on the volatility of currency values. In contrast, money changers provide physical currency conversion, primarily for travel, small business, or practical cash needs. While they may appear interchangeable at first glance, the differences in their mechanics, accessibility, and risks are substantial — and knowing those differences can help you make better decisions depending on your needs.

Forex Indonesia: How does forex trading work?

Forex trading — short for foreign exchange trading — is part of a massive global market where currencies are bought and sold based on their shifting values. Traders engage in currency trading through online platforms or brokerage accounts, buying one currency while simultaneously selling another. The market operates 24 hours a day, five days a week, allowing users in Indonesia to trade at almost any time. What makes forex trading distinct is that no physical money changes hands; everything happens electronically. Profits (and losses) are made based on fluctuations in exchange rates, which can be triggered by everything from economic data and central bank policy to geopolitical events.

In Indonesia, the popularity of forex trading has grown in recent years, thanks in part to mobile apps and easy online access. However, it’s not without risk. Many retail traders start without fully understanding the market mechanics, and due to the leverage involved, even a small mistake can lead to significant losses. That’s why the government — through BAPPEBTI, the Commodity Futures Trading Regulatory Agency — strongly regulates this industry to ensure that only licensed brokers operate legally in the country. This also ensures that traders have access to educational resources, risk disclosures, and customer support in the local language.

Forex Indonesia: How do traditional money changers operate?

Source: The Conversation

Unlike forex trading, traditional money exchange services are physical and straightforward. You walk into a money changer, hand over your rupiah, and receive the equivalent amount in foreign currency — or vice versa. There are no trading strategies, no digital platforms, and no speculation involved. These outlets are designed for practical use: travel, overseas remittances, or small-scale business operations. They’re commonly found in urban centers, tourist hotspots, shopping malls, and airports. The rates are clearly displayed, and transactions are often completed within minutes.

For many Indonesians, especially those less familiar with financial technology or online trading, money changers offer familiarity and trust. The service is face-to-face, and you can see the physical bills you’re receiving. That said, it’s important to check whether the outlet is licensed by Bank Indonesia, as unlicensed operators may offer poor rates or violate compliance rules. This physical exchange process — direct, tangible, and immediate — defines the other side of the forex vs money changer Indonesia conversation.

Forex Indonesia: What are the regulations surrounding both in Indonesia?

Source: Pam money changer

Regulation is one of the clearest dividing lines between forex trading and money exchange services. Licensed money changers in Indonesia are supervised by Bank Indonesia, which sets the standards for exchange rate disclosures, anti-money laundering protocols, and operational transparency. These businesses are required to renew their licenses regularly and follow strict documentation rules, including transaction limits and customer identity verification. In short, they’re part of the formal banking ecosystem, albeit on a smaller scale.

On the other hand, forex trading in Indonesia falls under the jurisdiction of BAPPEBTI. Only platforms and brokers registered with this agency are allowed to offer legal forex trading services to Indonesian citizens. This is crucial, especially considering the rise of online scams and offshore trading platforms targeting Southeast Asian users. Unlicensed platforms may promise high returns or offer favorable conditions but carry serious legal and financial risks. Whether you’re analyzing money exchange vs forex market comparison or simply trying to stay compliant, knowing who regulates each service is essential.

Which is better: forex trading or money exchange?

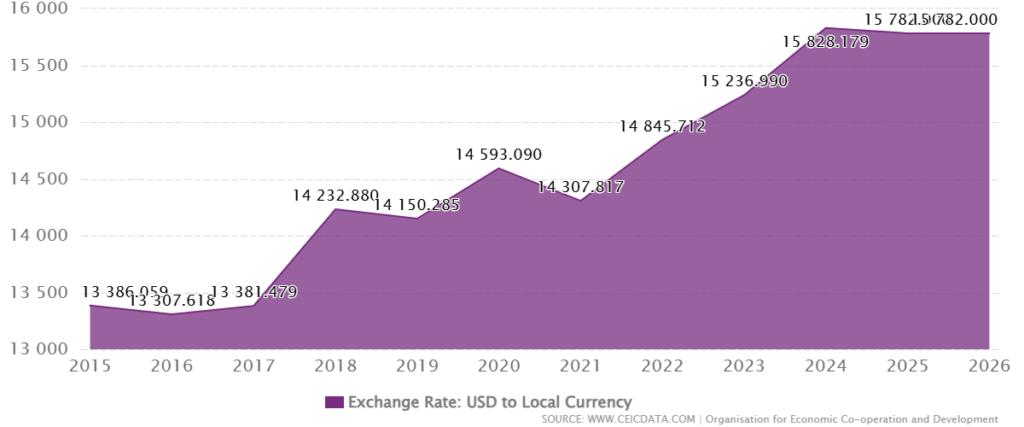

Source: ceicdata

The answer depends entirely on what you’re trying to achieve. If you need cash for a vacation in Tokyo or need to pay for imported goods in USD, a money changer offers a practical, no-fuss solution. You get the physical currency you need on the spot, usually with a small fee built into the exchange rate. However, if you’re hoping to generate income from exchange rate fluctuations or diversify your investment portfolio, then forex trading could be more appropriate — provided you understand the risks involved.

Still, the comparison isn’t black and white. While forex trading offers potential for profit, it also requires time, learning, and sometimes emotional endurance. Meanwhile, money exchange is stable, easy, and perfect for short-term needs. When weighing the options in the which is better forex trading or currency exchange debate, context is everything. Your financial goals, risk appetite, and time commitment will determine which path fits best.

Are the exchange rates the same?

No, and this is another major difference between the two. Money changers typically offer exchange rates that include a service margin — meaning they “mark up” the rate slightly to ensure a profit. Rates may also vary between outlets and can sometimes be negotiated for larger sums. It’s common to see slightly different buying and selling rates, even within the same money changer.

In forex trading, on the other hand, you typically deal with market-driven rates that update in real-time. These reflect the interbank exchange rates and are much closer to global financial benchmarks. However, forex brokers still charge a spread — the difference between the buy and sell price — or a commission per trade. In some cases, especially for large sums or frequent transactions, forex trading can offer better value. But it’s not necessarily “cheaper,” especially when you factor in the risks and platform fees.

Who typically uses each service?

Demographics vary considerably between users of forex trading platforms and those who use money changers. The latter is often frequented by everyday consumers — travelers, students going abroad, migrant workers sending money home, or small businesses dealing with foreign suppliers. It’s a one-time or occasional need, and the process is generally easy to understand.

Forex trading, however, tends to attract a more specialized group: retail investors, finance enthusiasts, and increasingly, young Indonesians looking to explore alternative income sources. It requires a basic grasp of financial concepts, market analysis, and a good sense of timing. Whether you’re curious about retail forex trading vs physical money exchange or simply want to know who’s using these services, this division is a key insight into their respective roles in the financial landscape.

Can you do both in Indonesia?

Yes — and some people do. For example, a traveler may exchange currency at a local outlet while also dabbling in online forex trading as a side hobby. There’s no rule saying you can’t use both services, as long as you engage through licensed and regulated channels. Some Indonesians even begin with money changers before gradually becoming interested in how the forex market works — transitioning from casual currency handling to active trading.

That said, it’s important to keep each activity in its proper context. If you need physical bills, you’ll still have to visit a money changer. If you’re investing, you need a broker and the patience to learn. As you explore the differences between forex trading and money exchange, this dual-use possibility highlights just how flexible — and personal — currency services have become.

Conclusion

While they both operate within the world of foreign currencies, forex trading and money changers in Indonesia serve very different functions. The forex vs money changer Indonesia debate is less about which is better and more about which is more appropriate for your particular situation. Whether you’re exchanging rupiah for yen at a Bali airport kiosk or speculating on EUR/USD from your laptop, the key is to understand the risks, legalities, and goals behind each option. With the right knowledge and mindset, both services can fit naturally into the broader picture of how Indonesians interact with global currencies today.