Unlocking Forex Time Zones: A Practical Guide to the Best Trading Hours for Asians

Why Forex Time Zones Matter for Asian Traders

If you’re an Asian trader stepping into the world of forex, understanding when to trade can matter just as much as knowing what to trade. While the market is technically open 24 hours a day from Monday to Friday, the forex time zones affect liquidity, volatility, and opportunity in a big way. For traders in Vietnam or anywhere in Southeast Asia, aligning your trading activity with the right time windows can help you avoid unnecessary noise—or worse, missed chances.

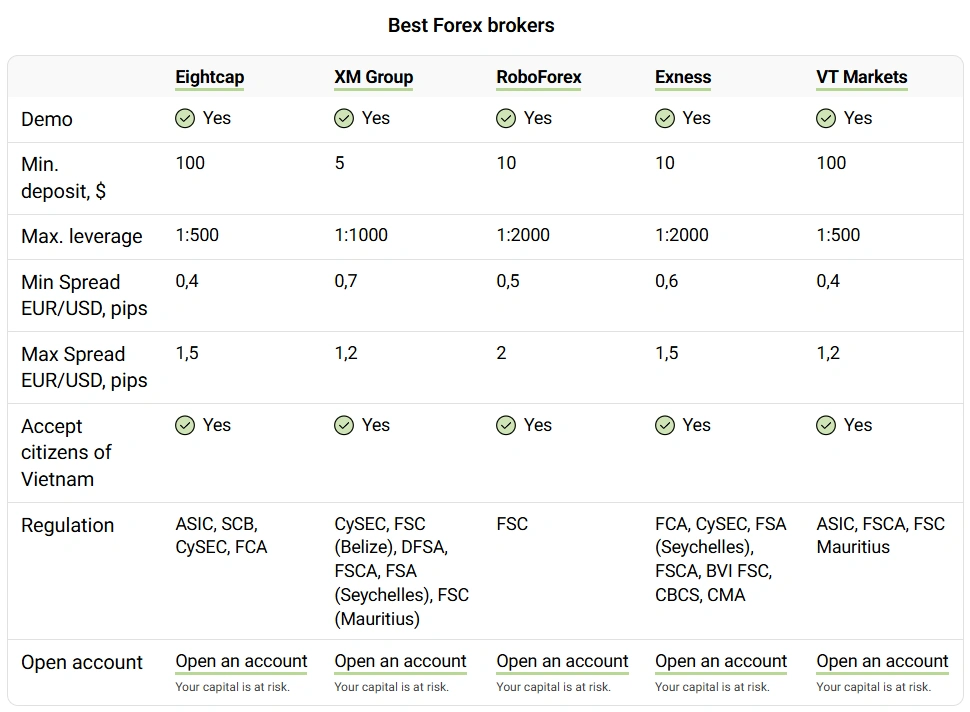

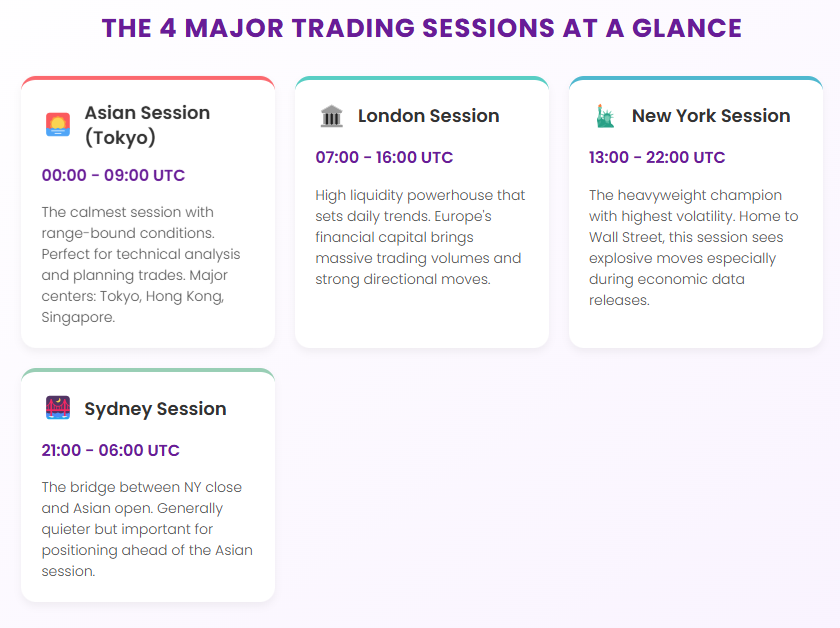

Breaking Down the Global Forex Sessions

The forex market revolves around four key trading sessions: Sydney, Tokyo, London, and New York. Each session has distinct trading volumes and influences particular currency pairs. For instance, the Tokyo session (starting around 6 a.m. Vietnam time) is when JPY pairs see higher movement. Meanwhile, action in the London session (2 p.m. local time) and New York session (starting at 8 p.m.) often shapes the day’s overall direction.

If you’re based in Vietnam, the overlap between London and New York—roughly 8 p.m. to 11 p.m.—is generally the most liquid and volatile, offering prime opportunities for short-term trades.

Vietnam Forex Trading: Best Local Hours to Watch

Credit from Blog IFC Markets

For Vietnamese traders balancing work and life, trading in the evening during Vietnam time zone forex market overlap (especially the London–New York sessions) may offer the best opportunities. This window allows access to the most active price movements, tighter spreads, and potential news-driven volatility. It’s no surprise many local retail traders treat this as their “evening trading window.”

Currency Behavior and the Importance of Session Timing

Different currency pairs behave differently depending on the session. USD/JPY might be calmer and more technical in the early hours but could become more volatile as New York opens. EUR/USD often sees increased movement when both European and American markets are active. Understanding these behavioral shifts is essential to creating a trading schedule that suits your strategy.

Daylight Saving Time and Its Subtle Impact

While Vietnam stays on GMT+7 year-round, other regions—like the U.S. and U.K.—observe daylight saving time (DST). This causes forex session overlaps to shift by an hour twice a year. Though most platforms adjust automatically, it’s a crucial detail for traders working with time-sensitive strategies, especially those trading based on news releases or scheduled economic data.

Finding Your Optimal Forex Trading Time in Vietnam

Credit from Traders Union

There’s no single best hour that fits all. Some traders favor the low-volatility hours of the Asian session to spot emerging trends. Others thrive in the fast-moving overlap of Western markets. The trick is to experiment and observe: Which hours do you feel most focused? When do your trades perform best?

Tools like MetaTrader’s backtesting module or MyFXBook analytics can help you refine your ideal time block based on your unique performance pattern.

Conclusion: Mastering Forex Time Zones for Smarter Trading

Credit from Mind Math Money

Whether you’re trading from Hanoi, Ho Chi Minh City, or elsewhere in Southeast Asia, mastering forex time zones isn’t optional—it’s foundational. Knowing when the markets move, why they move, and how that overlaps with your local schedule gives you a strategic edge. For traders in Vietnam, aligning with session overlaps—especially between London and New York—can lead to more efficient, confident decision-making.

In the world of forex, time is more than a number on a chart—it’s rhythm, structure, and opportunity.