Gemini Exchange Review 2025: Balancing Security and Accessibility

In the fast-moving world of crypto exchanges, some platforms lose relevance quickly, but Gemini has managed to stay in the conversation. Founded in New York, Gemini has always marketed itself as a highly regulated exchange, and this gemini exchange review shows why it continues to attract both retail and institutional traders. Between its strict compliance, gemini security features, and a growing set of products like Gemini Earn Program and Gemini Custody Service, the platform has carved a unique place in 2025.

Gemini Exchange Review: Registration and KYC

The onboarding flow is smooth, but not instant. Anyone opening an account must go through the gemini KYC process, including ID verification and proof of address. This takes a little longer than on some competitors, but the trade-off is peace of mind with compliance.

For new users, Gemini provides resources to explore markets before depositing funds. A gemini demo account isn’t widely advertised but is available for practice trading, letting you try out the trading instruments on Gemini with no risk.

Gemini Exchange Review: Supported Assets and Market Coverage

In terms of breadth, the supported assets on Gemini are fewer than on Binance or KuCoin, but Gemini prefers quality listings over sheer numbers. Traders can access gemini spot trading across dozens of cryptocurrencies, including Bitcoin, Ethereum, and carefully vetted altcoins.

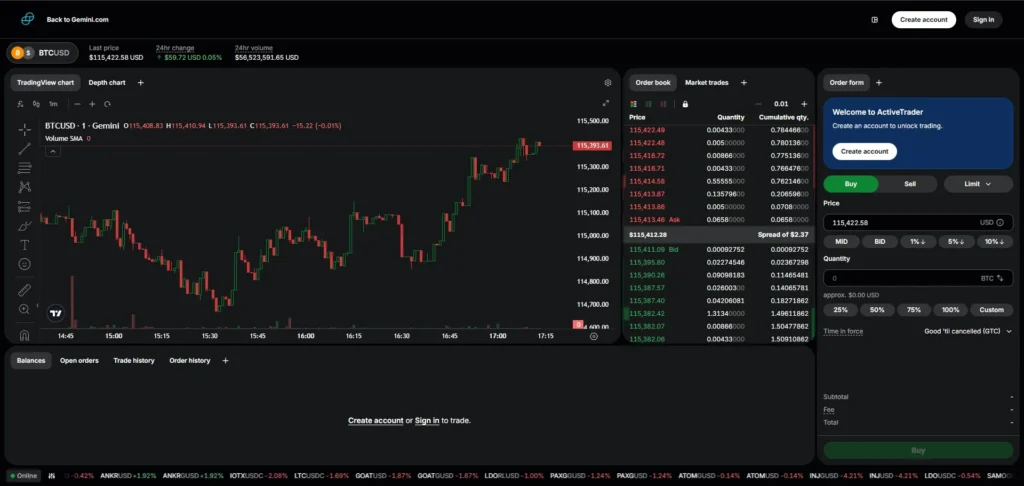

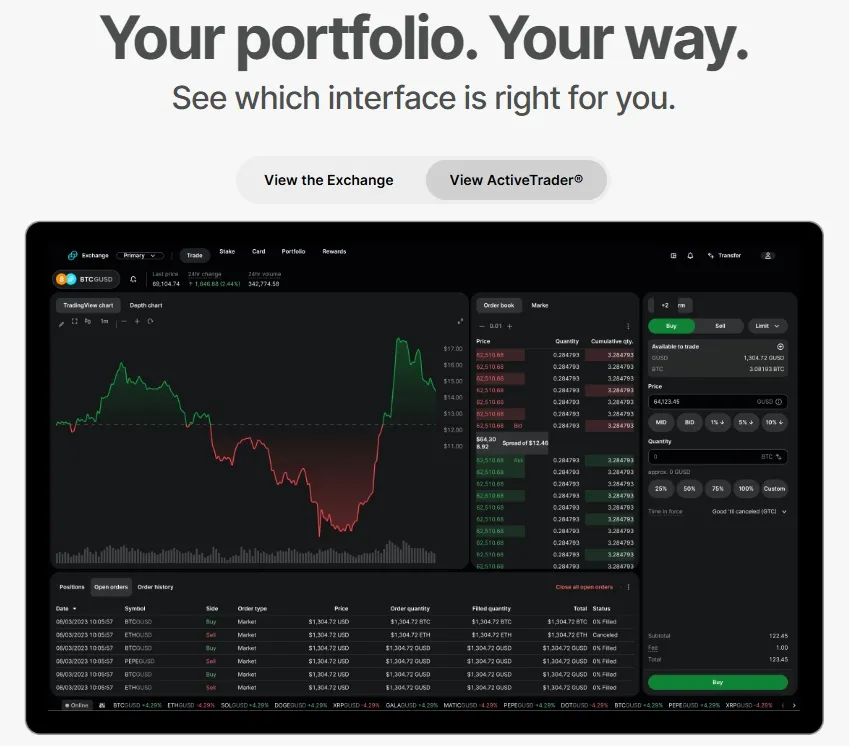

For advanced traders, the gemini active trader platform provides lower fees and advanced charting, making it suitable for professional use. While gemini futures trading is still limited compared to other exchanges, Gemini continues to explore derivatives in regulated jurisdictions.

Fees – Clear but Not the Cheapest

One recurring theme in user reviews Gemini is that its fees are higher than some rivals, especially for smaller trades. The base gemini trading fees for regular users can be steep, though the ActiveTrader interface cuts costs significantly.

Here’s a simplified view of the 2025 fee structure:

| Service | Fee | Notes |

|---|---|---|

| Spot Trading (Standard) | ~1.49% | Applies on web and app trades |

| Active Trader Platform | 0.25% maker / 0.35% taker | Much lower fees |

| Futures | Varies by contract | Limited availability |

| Withdrawal | Free up to 10 per month | Network fees after limit |

| Earn Program | 0% fee | Interest earned from lending/staking |

Compared to gemini vs coinbase, fees are similar for casual traders, but serious investors prefer Gemini’s ActiveTrader for its lower costs.

Gemini Exchange Review: Security and Regulation

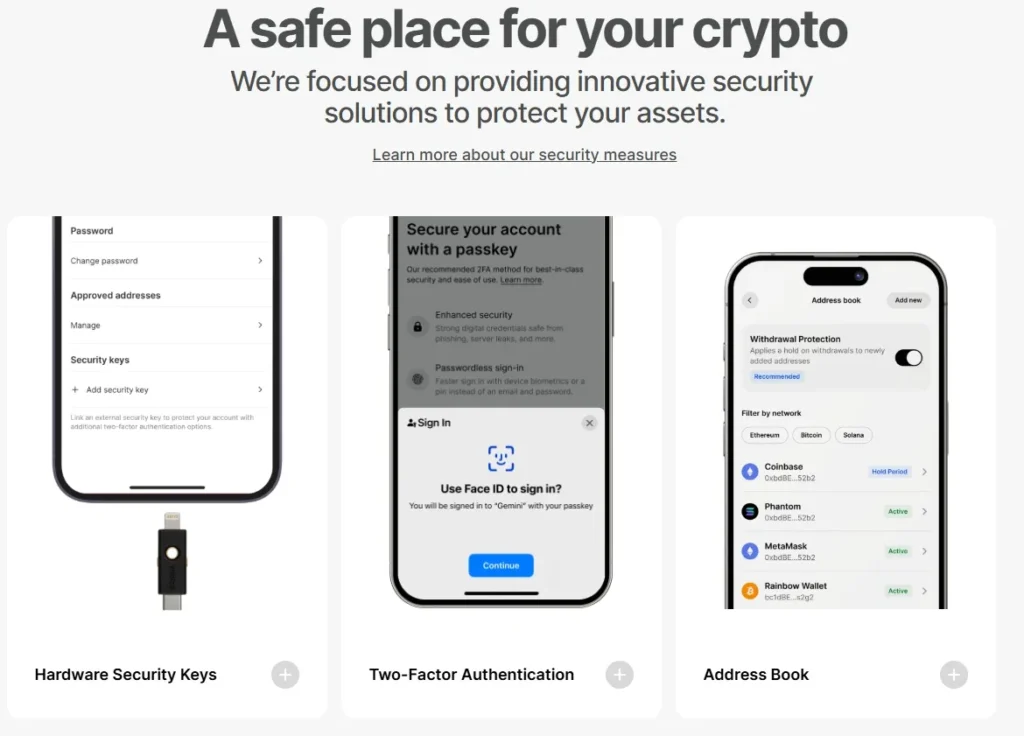

Security is where Gemini really shines. The gemini security features include two-factor authentication, hardware security keys, and SOC 2 Type II certification. The gemini custody service is a regulated and insured solution for institutions, one of the strongest in the industry.

The regulatory status Gemini is also clear: it’s a New York trust company regulated by the NYDFS. For users who prioritize compliance and trust, this makes Gemini a standout in a market where many exchanges still operate in legal gray zones.

Platform Experience – Desktop and Mobile

The desktop platform is intuitive, though less flashy than competitors. The gemini mobile app mirrors the same design, offering a seamless way to manage accounts, trade, and access investment tools on Gemini.

Performance is stable. Liquidity and execution speed are solid on major pairs like BTC/USD and ETH/USD, though niche altcoins can see lower volumes compared to Binance or Bitget.

Earning and Investment Tools

The Gemini Earn Program allows users to earn interest on idle assets through lending and staking partnerships. Rates are competitive, though capped in some regions due to regulations. Alongside this, investment tools on Gemini include price alerts, charting, and portfolio analytics designed for everyday traders as well as institutions.

Funding and Withdrawals

The deposit and withdrawal process is straightforward. Fiat deposit options Gemini include ACH transfers, wire transfers, and debit card purchases in the U.S. International users have additional bank transfer methods. Withdrawals are smooth, with up to 10 free crypto withdrawals monthly – an advantage many exchanges don’t offer.

Final Verdict – Should You Use Gemini in 2025?

This gemini exchange review shows that Gemini remains one of the safest choices for crypto investors in 2025. While it may not have the lowest gemini trading fees or the widest list of assets, its gemini security features, regulated custody service, and transparent operations make it a trustworthy platform.

For newcomers who value safety and institutions that demand compliance, Gemini continues to deliver. For those chasing niche altcoins or the absolute lowest fees, it may be worth pairing Gemini with another exchange. Either way, Gemini remains a serious player in the crypto landscape.