2025 Gold Forecast: Will Vietnam’s Gold Market Boom or Crash Amid Inflation?

Introduction: Gold Forecast in a Shifting Economy

Gold forecast? Vietnamese investors have traditionally turned to gold as a symbol of wealth and stability — especially during times of uncertainty. As 2025 approaches, questions are rising across the market: will gold prices soar in response to global inflation, or could the market correct sharply after years of gains?

In this article, we explore the key indicators shaping Vietnam’s gold market, weigh expert forecasts, and consider what history and economic signals suggest for gold’s trajectory in 2025.

Gold vs Inflation: A Tense Balancing Act

Credit from Taylor & Francis Online

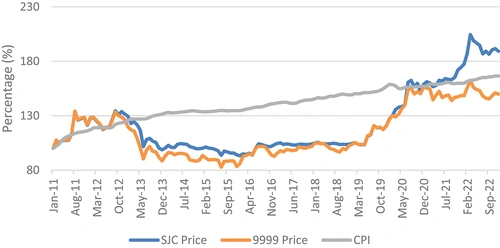

One of the most watched dynamics in gold pricing globally is the relationship between gold and inflation. Historically, when inflation rises, so does gold — acting as a hedge against depreciating currency value. Vietnam, like many economies, has faced inflationary pressure in the past two years, particularly in sectors like housing, fuel, and imported goods.

If inflation persists through early 2025, it could put upward pressure on gold demand domestically. But there’s also a counterpoint: if central banks (especially the U.S. Federal Reserve) begin aggressive rate cuts or adjustments, global investors may shift from gold to equities or bonds, softening demand.

Vietnam Gold Price Forecast 2025: Trends and Market Behavior

The Vietnam gold price in 2025 will also be shaped by local market behavior. In recent years, Vietnamese consumers have shown a strong cultural and economic attachment to physical gold — from jewelry to bars — making Vietnam one of Asia’s more resilient physical gold markets.

Retail gold prices in Vietnam tend to deviate slightly from global prices due to regulatory factors and domestic demand surges around Tet holidays and wedding seasons. In early 2024, we saw a mini-boom as concerns over economic stability pushed consumers toward safe-haven assets.

Will the pattern repeat in 2025? That depends in part on inflation, global economic sentiment, and any unexpected shocks in the region.

Gold Forecast: Will Gold Crash in 2025? Or Just Stabilize?

Credit from Buy Gold Bars from Africa

Fears of a gold crash in 2025 aren’t unfounded — especially among traders watching for signs of overheating. Gold reached record highs in several global markets in 2024, and some analysts now warn of a potential correction, particularly if inflation is brought under control faster than expected.

However, a full crash — defined by a sudden and deep decline — seems less likely in Vietnam’s context. The country’s gold consumption is tied more to long-term holding and cultural habits than speculative trading, which can cushion against extreme swings.

Still, a stabilization or slight dip from current highs may occur if other investment avenues (like real estate or equities) regain favor in a calmer global economy.

What Factors Will Affect Gold Prices in Vietnam 2025?

A few key factors could influence the 2025 gold price prediction for Vietnamese investors:

- Global Economic Policy: Moves by the U.S. Fed or European Central Bank could impact global interest rates, thereby affecting gold.

- Domestic Inflation Trends: Higher inflation tends to fuel gold demand in Vietnam.

- Import Regulations and Taxation: Government controls on gold imports can influence pricing, as Vietnam has a tightly monitored gold trade.

- Cultural Spending Cycles: Seasonal factors like Tet, weddings, and gifting cycles can create short-term price spikes.

Is Gold Still a Safe Investment in Vietnam in 2025?

Credit from The Saigon Times

From a long-term perspective, gold remains a stable asset in the Vietnamese investment landscape. It offers a tangible hedge in times of uncertainty and inflation. However, it may not deliver rapid gains the way equities or cryptocurrencies sometimes do.

Investors should consider gold as part of a broader portfolio strategy — especially in 2025, a year that may bring both volatility and correction across asset classes.

Conclusion: Forecasting the Gold Market in Vietnam — Boom or Bust?

As we weigh the gold forecast against inflation trends and investor behavior, 2025 appears more likely to bring a period of stabilization or modest growth, rather than a full-blown crash or runaway boom. For Vietnamese investors, gold still holds its place — not as a speculative ticket, but as a cultural and financial anchor in uncertain times.