Can Gold Really Hedge the Rupiah? What Indonesians Should Know

1. Why Do Indonesians Turn to Gold When the Rupiah Falls?

Let’s face it — currency volatility can make even the most relaxed investors anxious. The idea of a gold hedge for the rupiah isn’t new, but it tends to gain traction when headlines start mentioning “rupiah tumbles” or “currency under pressure.” Why gold? Simple — it’s a globally accepted asset, priced in USD, and historically it holds up when local currencies falter.

So when the rupiah weakens, the gold price in IDR usually jumps. That’s why some folks treat gold like a financial umbrella when the economic clouds gather.

2. Is it Always a Reliable Against Rupiah Weakness?

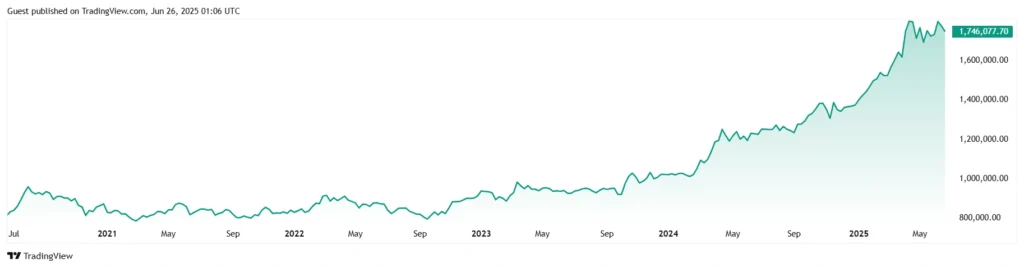

Source: TradingView

Not always — and that’s worth pointing out. While gold usually rises in IDR terms when the rupiah falls, it’s not a guarantee. Several factors come into play: global gold demand, USD movements, interest rates, geopolitical messes… you name it.

Plus, there can be lags. Sometimes the rupiah drops and gold just kinda… sits there. So yes, gold can be a hedge, but it’s not magic. Think of it as a defensive play, not a winning lottery ticket.

3. How Does Gold React to a Weakening Rupiah?

Source: Investing.com

Here’s a rough breakdown: when the rupiah falls against the dollar, gold — priced in dollars — becomes more expensive for Indonesians. That price increase shows up in local gold prices. For instance, if gold is at USD 2,300 per ounce and the USD/IDR rate jumps from 15,500 to 16,200, your local gold price likely follows the upward trend.

Of course, other things affect gold prices too, but the IDR exchange rate is a biggie. That’s why gold hedge rupiah strategies are often popular during times of high USD strength.

4. What’s the Best Way to Buy Gold in Indonesia ?

You’ve got options — and that’s a good thing.

- Physical gold: The classic — coins, bars, or jewelry. Easily bought through trusted outlets like Pegadaian or Antam.

- Digital gold platforms: Apps like Tokopedia Emas or Pluang let you buy fractions of gold without holding the metal.

- Gold ETFs or mutual funds: For those who prefer market exposure without physical storage.

Pro tip? If you’re using gold to protect against the rupiah, try to keep the fees low and liquidity high.

5. When Should You Consider Buying Gold to Hedge the Rupiah?

There’s no perfect answer, but some signs might nudge you toward gold:

- Political uncertainty or election years

- Central bank interventions or weakening reserves

- Global dollar rallies

- Persistent inflation in Indonesia

Basically, if the economic vibe feels off or the rupiah starts looking wobbly — it might be time to think about gold. Better to act before the currency moves, not after.

6. What Are the Risks of Using Gold as a Currency Hedge?

Absolutely — and it’s important to be real about that.

Gold doesn’t generate income, unlike stocks or deposits. Prices can swing wildly too, especially if global markets panic. There’s also the issue of buying at a peak — just because gold was high during the last currency crisis doesn’t mean it’ll always behave the same.

And let’s not forget — storage, theft, and fake products are still issues if you’re holding the physical stuff. So like any hedge, gold should be part of a bigger game plan — not the whole game.

7. Final Verdict: Is Gold Still a Smart Hedge Against Rupiah Weakness in 2025?

Honestly? It still makes sense — but with a grain of salt. Gold isn’t a flawless protector, but it’s accessible, familiar, and widely trusted. For many Indonesians, especially those with long-term savings in rupiah, adding a bit of gold can offer peace of mind.

That said, don’t bet the house. A balanced portfolio — maybe a bit of gold, some USD exposure, and local investments — is usually the smarter route. If you’re wondering whether a gold hedge for rupiah makes sense for you… well, maybe it’s time to ask, what’s your financial weather forecast looking like?