How Gold Tokenization Is Evolving in Indonesia’s Web3 Era

What is gold tokenization, and how is it being adopted in Indonesia?

Gold tokenization Indonesia refers to the process of converting physical gold—often held in secure vaults—into digital tokens that are recorded and managed on a blockchain. These tokens maintain a 1:1 ratio with real gold, meaning each token corresponds to a specific amount of physical metal. The concept is not merely technical; it represents a shift in how traditional assets are accessed and distributed in a digital age. In Indonesia, where gold has long been a culturally and financially significant store of value, this innovation is particularly relevant. It aligns with both modern digital behaviors and a strong cultural trust in tangible wealth. Startups and fintech platforms in Jakarta and Bandung are already launching pilot programs, offering users fractional gold ownership through blockchain interfaces. With mobile penetration on the rise and digital wallets becoming the norm, gold tokenization is poised to transform how Indonesians invest, save, and even trade gold.

How does tokenized gold work within the Web3 ecosystem?

Tokenized gold integrates into the Web3 ecosystem by becoming a digital, interoperable asset that can participate in decentralized applications (dApps), smart contracts, and financial protocols. After a piece of physical gold is audited and locked in custody, tokens representing ownership are issued on a blockchain. These tokens can then move freely between users without involving traditional intermediaries, thanks to blockchain infrastructure. The transparency of the ledger allows anyone to verify that the gold backing the tokens truly exists and remains untouched. Within Web3, this means tokenized gold can serve multiple roles: it can be used as collateral in DeFi lending, be swapped across decentralized exchanges (DEXs), or even be integrated into yield farming strategies. This utility makes tokenized gold far more dynamic than its physical counterpart. In the context of gold tokenization Indonesia, this opens up a wealth of opportunities for both conservative investors and tech-forward users looking for stable-value assets in the volatile crypto landscape.

What are the key benefits of tokenized gold for Indonesian investors?

Source: FREEMAN LAW

For Indonesian investors—particularly millennials and Gen Z users exploring digital finance—tokenized gold provides a number of tangible benefits. First, it lowers the barrier to entry. Instead of purchasing a minimum of one gram or more of physical gold, users can buy fractional tokens for as little as a few thousand rupiah. This inclusivity matters in a market where income levels vary widely. Second, the tokens are easily transferrable, meaning users can send, trade, or redeem them instantly using a mobile device. Unlike traditional gold, which involves handling, security, and logistics costs, tokenized gold eliminates many of these operational headaches. Additionally, the blockchain backing provides real-time verification and immutable records, boosting trust among a tech-savvy user base. Perhaps most importantly, these tokens can be put to work—earning passive income through staking, lending, or integration in liquidity pools within the broader tokenized gold in decentralized finance ecosystem. In essence, Indonesian investors are no longer confined to holding gold as a static store of value—they can now activate it as a productive asset.

Is tokenized gold safe and regulated in Indonesia?

The security of tokenized gold hinges on two factors: the physical storage of the gold itself and the digital integrity of the blockchain system. In Indonesia, several emerging platforms partner with certified custodians to ensure that every token issued is fully backed by gold stored in regulated vaults—sometimes located locally for compliance and reassurance. These custodians often publish regular audits or work with third-party verifiers to confirm reserves. On the digital side, smart contracts governing token issuance and movement must be rigorously tested and, ideally, independently audited. As for regulation, the Indonesian Commodity Futures Trading Regulatory Agency (BAPPEBTI) has taken early steps toward formalizing digital commodities, including blockchain gold. While not yet a fully mature legal framework, the direction is promising. BAPPEBTI has expressed interest in fostering fintech innovation while protecting consumers, meaning that tokenized gold platforms are likely to come under clearer regulatory scrutiny in the near future. For now, investors should assess platform credibility carefully, checking for audits, reserve proof, and local registration.

How is gold tokenization Indonesia different from digital gold services offered by banks or fintech apps?

The difference lies primarily in ownership, interoperability, and technology architecture. In traditional digital gold services offered by banks or fintech apps, users are essentially buying gold that is recorded in an internal ledger, usually confined to a single platform. While this model offers convenience, it also restricts flexibility—users often cannot transfer their gold outside of the app ecosystem. In contrast, gold tokenization Indonesia platforms issue blockchain-based tokens, which are not limited to one platform and can be moved, traded, or stored in decentralized wallets. Blockchain-based tokenization also allows for programmable features—such as automatic interest payments or real-time valuation updates—through smart contracts. Furthermore, users can view public records of the total supply and backing of each token, enhancing transparency and trust. In short, tokenized gold through Web3 provides greater freedom, traceability, and utility than conventional digital gold products tied to banks or centralized institutions.

Can Indonesians earn passive income from tokenized gold?

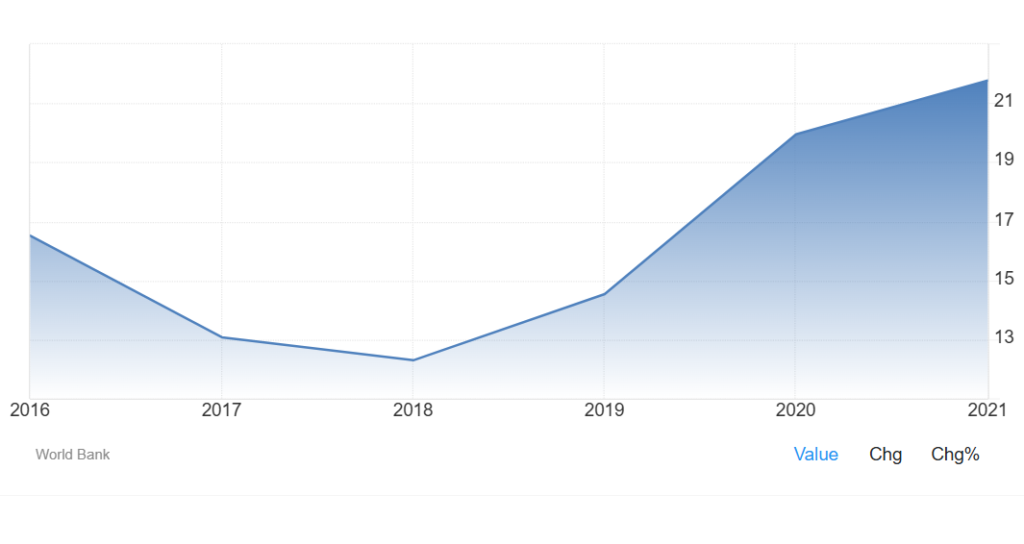

Source: Trading Economics

Yes, and this is one of the most attractive features of tokenized gold within the Web3 landscape. Unlike traditional gold, which typically just sits in storage or a safety deposit box, gold tokens can be deployed across various decentralized finance platforms. For instance, holders can lend their gold tokens to liquidity pools, earn fees from swaps, or stake them to earn protocol-native rewards. These mechanisms provide a way for holders to generate yield without having to sell their tokens. Of course, this comes with its own set of risks, including market volatility, smart contract exploits, liquidity shortages, or protocol failure. However, as DeFi infrastructure improves and platforms mature, investing in tokenized precious metals via Web3 is becoming a viable source of passive income. In the Indonesian context, this allows users not only to preserve their wealth in a trusted asset like gold but also to grow it through digital tools—blending tradition and innovation in a uniquely local way.

What’s the future of gold and blockchain in Indonesia?

The future of gold tokenization Indonesia is closely linked to broader national trends in digital transformation and financial inclusion. As the country ramps up its investment in fintech infrastructure and mobile-first banking, tokenized assets will likely become more common—especially those with strong cultural roots, like gold. We may see the development of localized smart contract platforms, government-approved gold token issuers, and even integration with e-commerce or microloan platforms. Education will also play a key role; awareness campaigns and university partnerships are beginning to explain how Web3 innovation can serve everyday financial needs. Looking further ahead, tokenized gold could become part of Indonesia’s sovereign digital asset portfolio, or feature in cross-border trade agreements within ASEAN. With the right safeguards in place, this convergence of blockchain and bullion may evolve into a major pillar of both personal and institutional wealth strategies in Indonesia.

Conclusion: A New Digital Chapter for Gold in Indonesia

As blockchain technology continues to evolve, gold tokenization Indonesia stands out as one of the most grounded and culturally relevant applications of Web3. It blends the tangible assurance of gold with the operational freedom of digital assets. More than just a fintech experiment, it’s a reflection of how Indonesia is adapting tradition to the pace of modern financial innovation. While regulatory frameworks are still catching up, the interest and experimentation on the ground signal a clear trajectory: one where Indonesians can hold centuries-old value in their hands, powered by decentralized, programmable tools. In this digital chapter of the nation’s gold story, investors are not just preserving value—they’re reshaping how it’s used, moved, and multiplied.