Beginner’s Guide: How to Store Cryptocurrency Securely and Protect Your Digital Wealth

Introduction: First Step to Crypto Ownership — Secure Storage

Before you buy your first Bitcoin or explore Ethereum-based apps, one thing must come first: understanding how to store cryptocurrency securely. Without a secure storage method, your digital assets are at risk from hackers, device failure, or even your own forgetfulness.

Unlike money in a bank, crypto is stored and accessed via cryptographic keys. If you lose access to those keys, there’s no customer service line to call. This is why wallet security is the foundation of crypto ownership, especially for beginners.

What Is a Crypto Wallet and Why Do You Need One?

Credit from Bankrate

A crypto wallet allows you to interact with blockchain networks. It stores your private keys—which act as digital signatures proving your ownership of funds.

When people talk about a wallet, they’re really referring to:

- A way to view balances

- A tool to send or receive cryptocurrency

- A storage method for keys or recovery phrases

There’s no physical currency inside. Your coins remain on the blockchain, and your wallet simply lets you control them.

Types of Wallets

Wallets can be broadly categorized into:

- Hot wallets: connected to the internet, easier to use, but more vulnerable

- Cold wallets: kept offline, very secure, ideal for long-term storage

Let’s look at how they compare.

Table: Hot Wallets vs. Cold Wallets

| Feature | Hot Wallets | Cold Wallets |

|---|---|---|

| Internet Connection | Always connected | Remains offline |

| Security Risk | Higher (vulnerable to online hacks) | Very low (isolated from internet threats) |

| Ease of Access | Easy to use, quick transactions | Requires physical access |

| Ideal For | Daily trading or small holdings | Long-term holding, large assets |

| Examples | MetaMask, Trust Wallet, Exodus | Ledger Nano X, Trezor, Paper Wallets |

| Cost | Usually free | Typically $50–$200 USD |

Why Security Is a Top Priority in Crypto

Cryptocurrency has no middleman. If your wallet is compromised, there’s no insurance or chargeback. You alone are responsible for securing your holdings.

According to Chainalysis, over $3.8 billion worth of crypto was stolen in 2022, mostly through hacks of hot wallets and DeFi platforms. Even experienced users have fallen for phishing attacks or lost backup phrases.

Good security starts with understanding your tools—and continues with good habits.

How to Store Cryptocurrency with Hot Wallets

Credit from Letsexchange.io

Hot wallets are popular for newcomers because they’re easy to download and set up. These wallets come in mobile, desktop, or browser extension formats. Most allow you to store multiple cryptocurrencies and interact with apps and exchanges.

Recommended for Beginners:

- MetaMask: Ideal for Ethereum and Web3 applications.

- Trust Wallet: Supports many tokens and has a clean mobile interface.

- Exodus: Desktop and mobile wallet with built-in exchange features.

Hot wallets are useful when you need quick access to funds. Just remember—they’re only as secure as the device and internet connection they rely on.

Tips for hot wallet safety:

- Use a strong, unique password

- Enable two-factor authentication (2FA)

- Avoid using public Wi-Fi when accessing your wallet

- Always verify the source before downloading wallet apps

How to Store Cryptocurrency with Cold Storage

Once you’ve accumulated a meaningful amount of crypto, consider moving funds into a cold wallet. Cold wallets store your private keys offline, which makes them much harder for hackers to reach.

Common Cold Wallets:

- Ledger Nano S Plus / X: Supports thousands of coins, USB device

- Trezor One / Model T: Trusted open-source hardware wallet

- Paper wallets: Physical printout of your private keys (high risk if lost/damaged)

These options are more suitable for users holding crypto long-term, such as those saving for future gains or using crypto as digital gold.

Keep in mind that cold wallets involve a learning curve, but the trade-off is significantly stronger protection.

How to Back Up Your Wallet

Every crypto wallet generates a seed phrase—a sequence of 12 to 24 words used to recover your wallet. This phrase is the only way to regain access if your phone or hardware device is lost.

To properly back up a wallet:

- Write your seed phrase on paper, not stored digitally

- Store copies in separate secure places (like a safe or safety deposit box)

- Consider using metal recovery plates for added durability

- Never share your seed phrase with anyone

If someone gets access to your seed phrase, they can access and transfer your crypto—instantly and irreversibly.

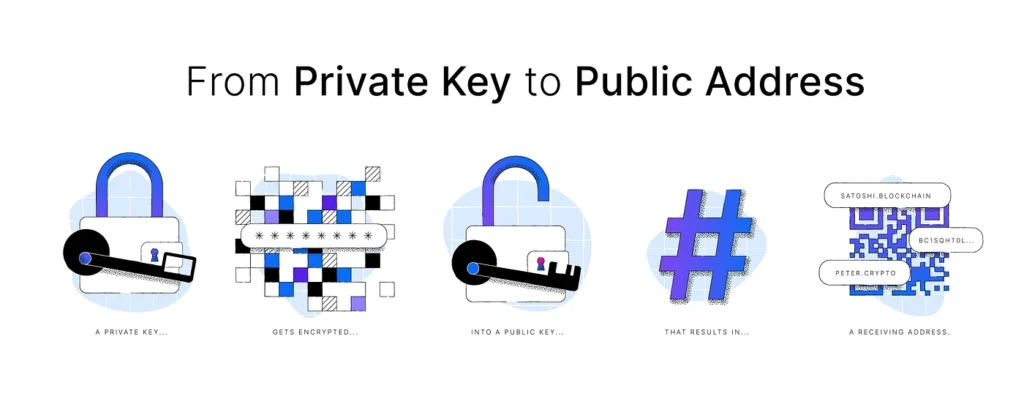

Private Keys, Public Addresses, and Your Role

Credit from Medium

Each wallet gives you both a public address (which you can share to receive funds) and a private key (which must be kept secret).

Your private key is your identity in the blockchain world. It’s mathematically impossible to “guess” a private key, but if you share or lose it, you’re out of luck.

For beginners, the key takeaway is this: owning your private key means owning your crypto. If a centralized exchange holds your key, you don’t have full control.

How to Store Cryptocurrency: Best Practices for Wallet Security

Here are some practical recommendations to secure your wallet and funds:

- Don’t store keys or seed phrases on cloud storage (Google Drive, Dropbox, etc.)

- Avoid screenshots of your wallet setup

- Keep wallet apps updated, as updates often include security fixes

- Beware of phishing emails and fake websites

- Use cold storage for large balances

When accessing your wallet or performing transactions, double-check every address. Scammers sometimes inject fake clipboard data into your system.

Long-Term Storage and Multi-Signature Wallets

If you plan to hold crypto for years, explore more advanced strategies. Multi-signature wallets (or multisig wallets) require more than one approval to move funds. This adds protection against both theft and personal mistakes.

For example, you can set up a multisig wallet that requires two of three private keys to approve any transaction. You might hold one key, your lawyer holds another, and a trusted third-party firm holds the third.

Multisig wallets are also useful for teams, DAOs (Decentralized Autonomous Organizations), or estate planning.

How to Store Cryptocurrency: Crypto Storage Isn’t One-Size-Fits-All

There’s no single perfect way to store crypto. The best method depends on your goals, risk tolerance, and technical comfort level.

- Hot wallets are great for beginners who need flexibility.

- Cold wallets are better for protecting large amounts over time.

- Multi-signature setups or institutional custodians like Fireblocks or BitGo offer extra protection for large holders or organizations.

Whichever path you choose, stay informed and cautious. The biggest crypto hacks in history often began with small security oversights.

Conclusion: Store Cryptocurrency Securely, Store Confidence

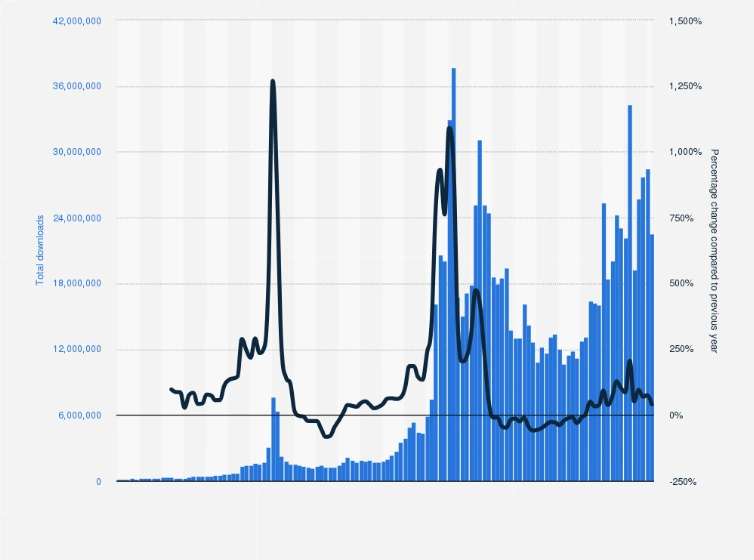

Credit from Statista

Crypto opens new financial possibilities—but with freedom comes responsibility. Understanding how to store cryptocurrency securely is one of the most important skills for any crypto user, especially beginners.

Whether you’re starting small with a mobile wallet or preparing for long-term investment with hardware storage, the right setup gives you peace of mind. Security isn’t just about avoiding hacks—it’s about building trust in your own digital future.