Rupiah Forecast 2025: What IDR/USD Trends Reveal About Indonesia’s Currency Future

What Is the Current Outlook for the IDR/USD Forecast in 2025?

The IDR/USD forecast 2025 is attracting growing interest as Indonesia’s economy walks a tightrope between domestic growth and global uncertainties. Currency watchers, investors, and analysts are closely observing the Rupiah’s path against the US Dollar, especially with ongoing geopolitical shifts and macroeconomic recalibrations. While past performance offers clues, the next twelve months will likely hinge on external pressure points and local policy response.

Will the Indonesian Rupiah Strengthen or Weaken in 2025?

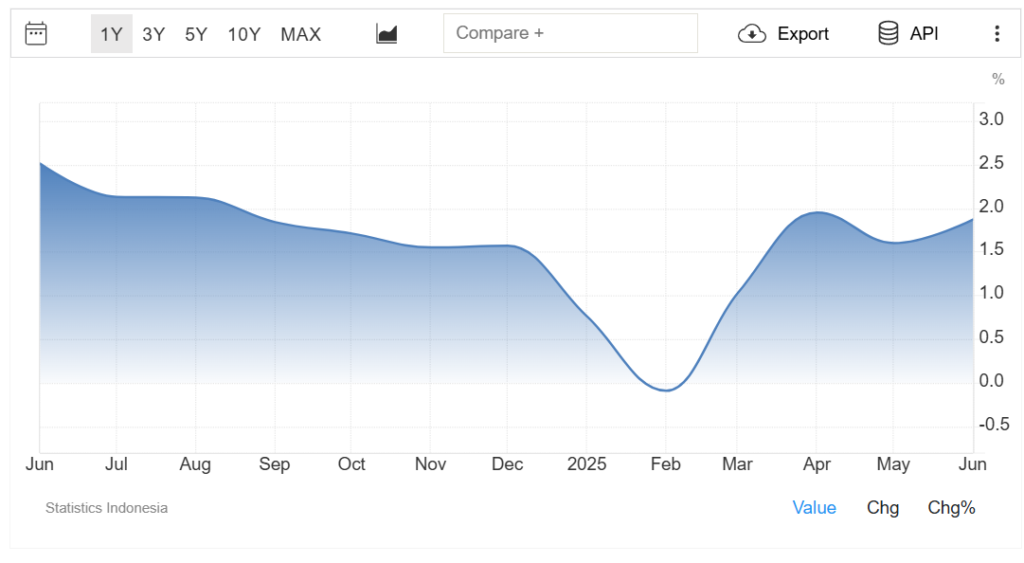

Source: TradingEconomics

Whether the Rupiah will strengthen in 2025 depends on several fluid dynamics. A potential softening of the US Dollar due to slower U.S. growth or Federal Reserve rate cuts could lend some upside to the IDR. On the domestic front, if Bank Indonesia maintains steady inflation control and economic momentum, confidence in the Rupiah may improve. That said, risks such as commodity price fluctuations and capital outflows remain wildcards.

What Are the Main Risks Facing the IDR in 2025?

The Rupiah forecast 2025 risks and opportunities hinge on both global and local factors. Externally, sustained U.S. rate hikes, geopolitical tensions, or a global slowdown could weigh heavily on emerging market currencies like the IDR. Internally, concerns around trade balance volatility, energy subsidies, or fiscal reforms could also stir market jitters. Investors will need to monitor not just numbers, but the political mood and international sentiment.

How Does Indonesia’s Economy Influence Currency Prediction?

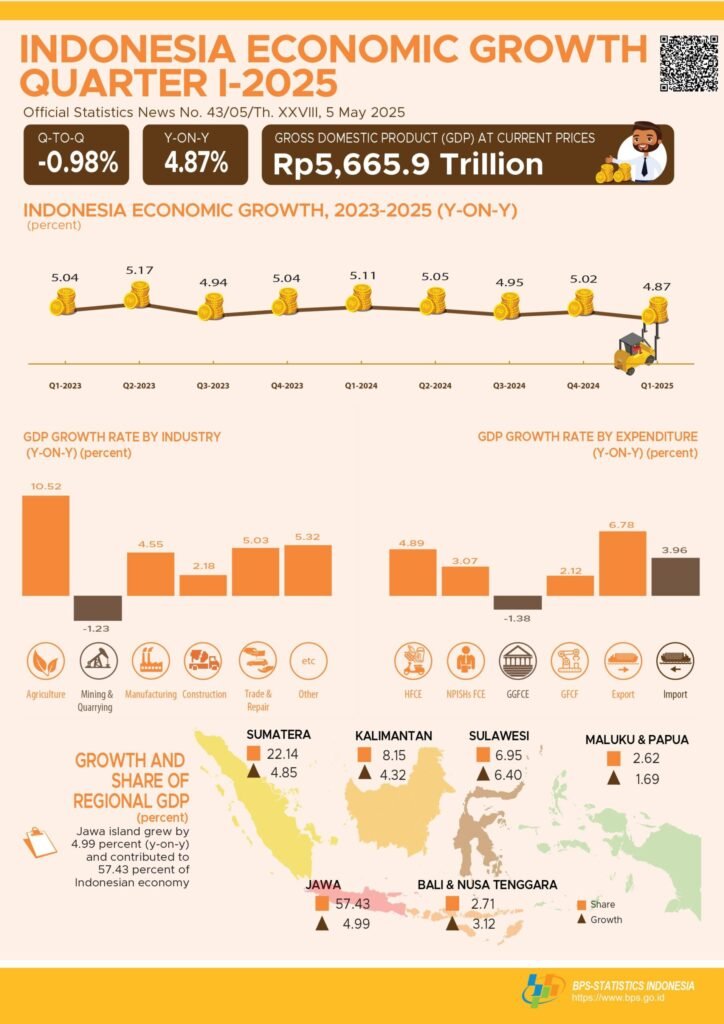

Source: BPS- Statistic Indonesia

The Indonesia economy plays a central role in any currency prediction model for the Rupiah. Key drivers include GDP growth, trade surplus, inflation, and fiscal policy. In 2025, infrastructure investment and consumer spending may offer tailwinds, but external demand from China or Western markets will remain critical. If the economy holds steady, so might the Rupiah — but it won’t be immune to external contagion.

What Does Bank Indonesia’s Policy Signal About the Currency?

Source: Bloomberg

The Bank Indonesia currency forecast 2025 indirectly reflects its policy stance. In 2024, the central bank kept a close watch on inflation and maintained cautious monetary tightening. For 2025, the tone may shift based on inflation outlooks and Fed actions. Bank Indonesia’s ability to manage liquidity, interest rates, and capital flows will be key to shielding the IDR from sharp depreciation.

What Global Trends Could Impact the IDR/USD Exchange Rate?

Source: Coincodex

Several global themes could impact the IDR to USD forecast 2025. If the Federal Reserve adopts a more dovish tone and cuts rates, the US Dollar may soften, supporting emerging market currencies like the Rupiah. Conversely, if oil prices surge or geopolitical risk escalates, the USD may strengthen, pressuring the IDR. A return to risk-off sentiment globally could prompt capital flight from Indonesia’s equity and bond markets.

What Is the Role of Market Sentiment in the Rupiah Forecast?

Market confidence is a less visible but powerful driver of the Indonesian Rupiah exchange rate prediction 2025. Even if fundamentals align in Indonesia’s favor, a single external shock could trigger volatility. Investors are increasingly factoring in sentiment-driven movements — whether from political headlines, trade disputes, or speculative flows. As such, the Rupiah forecast in 2025 will also reflect psychological cues, not just technical data.

IDR/USD forecast 2025: What’s the Best Strategy for Rupiah Investment in 2025?

For those exploring the best strategy for Rupiah investment 2025, a cautious, diversified approach may be prudent. Hedging through multi-currency portfolios, keeping tabs on macro signals, and staying aligned with Bank Indonesia policy announcements can help manage exposure. The year ahead may not be a sprint — but for strategic investors, it could still offer windows of opportunity.

Final Thoughts: What Lies Ahead for the IDR/USD Forecast 2025?

In closing, the IDR/USD forecast 2025 remains a balance of calculated hope and macro vigilance. As Indonesia enters a period of political transition and global markets adjust to new realities, the Rupiah’s journey will be anything but one-directional. Risks and opportunities are tightly interwoven — and for observers of Southeast Asia’s currency story, 2025 will be a year to watch closely.