PrimeXBT Exchange Review: High‑Leverage Trading Without the Noise

Let’s set the stage: PrimeXBT exchange review pieces often swing between fanboy praise and blanket criticism. My experience sits somewhere in the middle. PrimeXBT aims for a focused toolkit—fast execution, high leverage, and multi‑market access—without bombarding you with features you’ll never touch.

That simplicity helps. Instead of ten product hubs and four reward centers, you get a clean trading core that covers crypto, forex, indices, and commodities. If you’re here to trade rather than collect badges, the fewer distractions, the better.

PrimeXBT Exchange Review: Fees & Cost Structure

Cost control matters more than most people admit. The PrimeXBT trading fees are flat and predictable, which makes planning easier for scalpers and swing traders alike. You won’t find confusing VIP ladders or obscure rebates; what you see is usually what you pay.

For a quick snapshot, here’s the fee card most traders care about:

| Market | Trading Fee | Overnight Financing |

|---|---|---|

| Crypto | 0.05% | Varies by pair |

| Forex | 0.001% | Varies by pair |

| Indices / Commodities | 0.01% | Varies by contract |

Is it the absolute low fee crypto exchange? Not really. However, because spreads are transparent and fees don’t jump between tiers, your effective cost stays consistent. For active accounts, that predictability can be worth more than a headline discount you rarely qualify for.

Supported Assets & Trading Pairs on PrimeXBT

PrimeXBT mixes supported crypto assets with traditional markets. You can move from BTC/USD to EUR/USD or Brent in a couple of clicks, which is rare for a crypto‑first venue. The trading pairs available on PrimeXBT skew toward high‑liquidity majors rather than endless long‑tail coins.

That design choice has pros and cons. On the plus side, liquidity depth on BTC and ETH is strong and slippage is usually mild even on size. On the downside, if you’re hunting micro‑caps, this isn’t an altcoin exchange—choice narrows as you leave the top names.

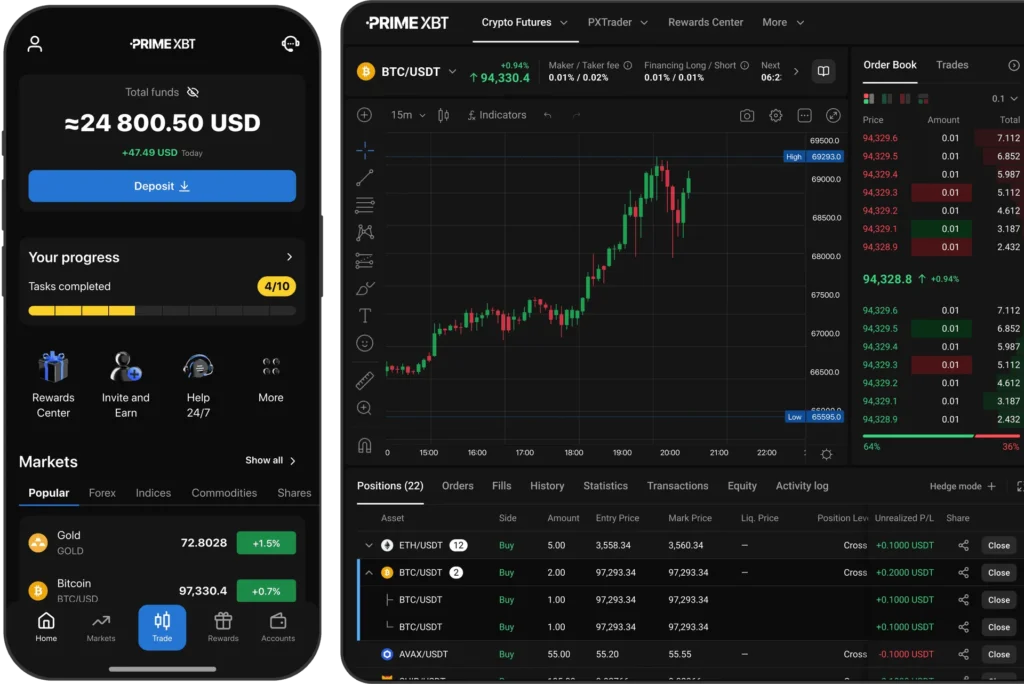

Platform Performance, UI & Trade Execution Speed

The user interface keeps things tidy: TradingView charts, a sensible order ticket, and account panels that don’t hide core data behind extra clicks. If you’ve used a pro terminal before, you’ll feel at home in minutes; if not, the layout still reads logically.

Performance held up as well. During tests on BTC/USDT and ETH/USDT, trade execution speed sat comfortably under 200ms for marketable orders. That’s quick enough for tight stops and rapid partials, and I didn’t hit odd freezes when volatility spiked.

PrimeXBT Exchange Review: Security, KYC & Regulatory Status

Security matters more when leverage is involved. PrimeXBT’s security features include 2FA (authenticator or email), withdrawal address whitelists, device alerts, and cold storage segregation. None of this is flashy; it’s the baseline you want to quietly do its job.

As for the PrimeXBT KYC process, it’s light for crypto‑only use and becomes stricter once you add fiat access. The regulatory status of PrimeXBT is offshore and the platform does not serve U.S. residents. If you need fully local licensing and fiat rails, note that limitation up front.

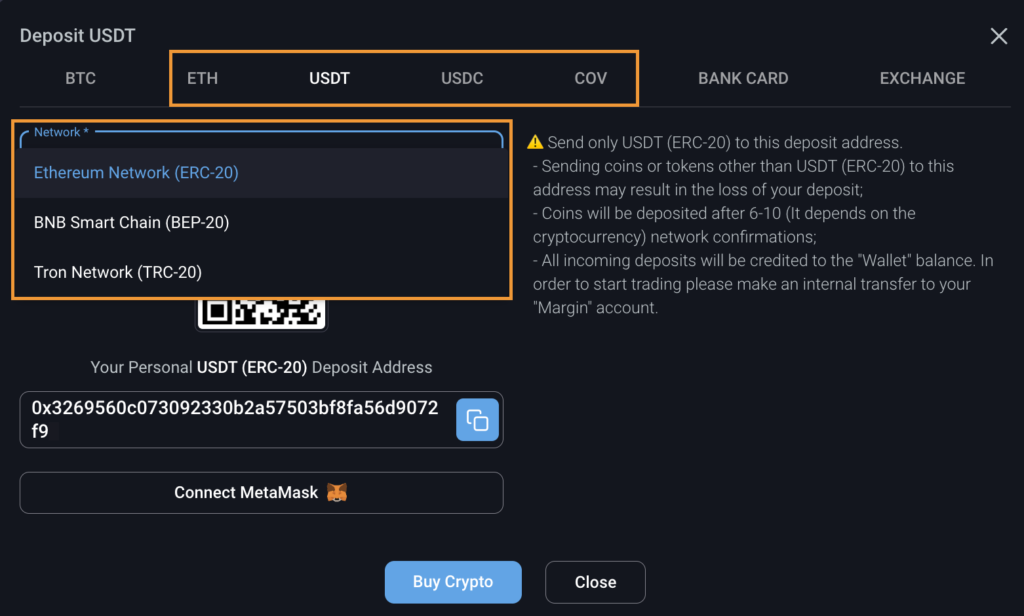

Deposits, Withdrawals & Fiat Access

Funding was straightforward in my tests. The deposit and withdrawal process for USDT and BTC worked as expected—deposits credited after network confirmations, and withdrawals batched for additional security. The queue timing varies by hour, but I didn’t see odd delays or missing TXIDs.

For fiat access, PrimeXBT relies on third‑party processors. Cards and bank transfers are available in select regions, and fees appear before you commit. It’s convenient enough for on‑ramping, though heavy fiat users may prefer an exchange with native banking.

Margin, Leverage & Crypto Futures Trading

This is the platform’s calling card. Leverage options on PrimeXBT reach up to 200x on crypto and higher on forex, but you don’t need to live at the limit. I ran positions in the 5x–25x range and the engine behaved predictably—no surprise liquidations or ghost errors.

If you’re coming from spot, the crypto futures trading layout feels familiar: isolated or cross exposure, clear liquidation lines, and one‑click size presets. Spot trading features exist but they’re intentionally lean; the emphasis is squarely on margin trading PrimeXBT rather than endless spot utilities.

Exchange Comparison: PrimeXBT vs Binance

Head‑to‑head exchange comparison helps frame expectations. Binance wins on token count, native fiat, and a massive product suite. PrimeXBT wins on focused leverage across multiple markets and a no‑nonsense workflow.

| Feature | PrimeXBT | Binance |

|---|---|---|

| Max Leverage | Up to 200x (crypto) | Up to 125x (crypto) |

| Markets | Crypto, Forex, Indices, Commodities | Primarily Crypto + Earn/NFT |

| Spot Depth | Focused majors | Very broad |

| Banking / Fiat | Third‑party providers | Native + third‑party |

| App Experience | Lean, pro‑oriented | Feature‑rich, heavier |

So, PrimeXBT vs Binance comes down to priorities: breadth and banking versus leverage and focus. If you’re trading a handful of liquid markets with size, PrimeXBT’s streamlined flow is hard to beat; if you want every token and a bigger retail ecosystem, Binance fits better.

User Reviews, Quirks & What Stood Out

Skimming user reviews PrimeXBT reveals a pattern: fans praise speed and simplicity, critics want more coins and deeper spot features. Neither camp is wrong—they just value different things. Know where you stand before you fund.

Two quirks I noticed: withdrawals batching (good for security, mildly inconvenient for timing) and a learning curve if you’ve never touched derivatives. Both are manageable with a bit of planning and a small test transfer first.

Final Verdict: Who Should Actually Use PrimeXBT?

The short answer: active traders who care about execution, clear costs, and leverage across crypto and traditional markets. If that’s you, this PrimeXBT exchange review likely reads like a checklist of boxes ticked.

If you’re a pure spot buyer, a heavy fiat on‑ramper, or someone chasing micro‑caps on an altcoin exchange, PrimeXBT isn’t built for that. And that’s fine. It doesn’t try to be everything—it tries to be fast, stable, and focused.