Privacy Coins for Beginners: A Clear Guide to Crypto Privacy

Privacy coins for beginners often raise the same question: why do we need cryptocurrencies that hide transaction details when most people just use Bitcoin or Ethereum? The answer is rooted in how blockchain transparency works. While Bitcoin’s ledger is public, meaning every transaction can be traced, privacy coins take a different approach — they use advanced cryptography to conceal sender and receiver identities, as well as transaction amounts.

These coins address a growing concern in the digital age: the right to financial privacy. For some, this is about avoiding unwanted corporate tracking; for others, it’s about personal safety in regions where financial activities can be monitored and penalized.

What Are Privacy Coins?

At their core, privacy coins for beginners are a subset of cryptocurrencies designed to make transactions untraceable and unlinkable. Unlike regular crypto assets, which record wallet addresses and amounts openly on a blockchain, privacy coins obscure these details using encryption techniques.

This doesn’t mean they’re immune from regulation or law enforcement scrutiny. Instead, they occupy a middle ground — offering privacy features while still operating within the broader cryptocurrency ecosystem.

How Privacy Coins Differ from Traditional Cryptocurrencies

The difference comes down to visibility:

| Feature | Traditional Cryptocurrencies (e.g., Bitcoin) | Privacy Coins (e.g., Monero, Zcash) |

|---|---|---|

| Ledger Transparency | Fully public, anyone can view transactions | Obscured, details hidden or encrypted |

| Sender/Receiver Identity | Pseudonymous but traceable | Concealed with cryptographic methods |

| Transaction Amounts | Publicly visible | Often hidden or shielded |

| Fungibility | Can be tainted by past transactions | Every coin unit is interchangeable |

Why Privacy Matters in Cryptocurrency Transactions

When Bitcoin was launched in 2009, many assumed it was anonymous. In reality, it’s pseudonymous: if your wallet address is ever linked to your identity, your entire transaction history can be exposed. This transparency has benefits for trust and auditability but creates privacy risks.

For example, businesses might not want competitors to see supply chain payments. Journalists and activists working in politically sensitive environments might need to keep their funding sources confidential. Even everyday users may prefer privacy to avoid targeted scams or profiling.

Key Features of Privacy Coins

Enhanced Transaction Anonymity

Privacy coins use cryptographic techniques to ensure no one can link a sender to a receiver.

Cryptographic Technologies

- Ring Signatures (Monero): Mixes a sender’s signature with others to hide the actual origin.

- Stealth Addresses (Monero, Zcash): Generates one-time addresses for each transaction.

- Zero-Knowledge Proofs (Zcash): Allows verification of transactions without revealing details.

Fungibility

Because coins cannot be traced back to previous transactions, each unit is equal in value and not “tainted” by past use.

Examples of Popular Privacy Coins

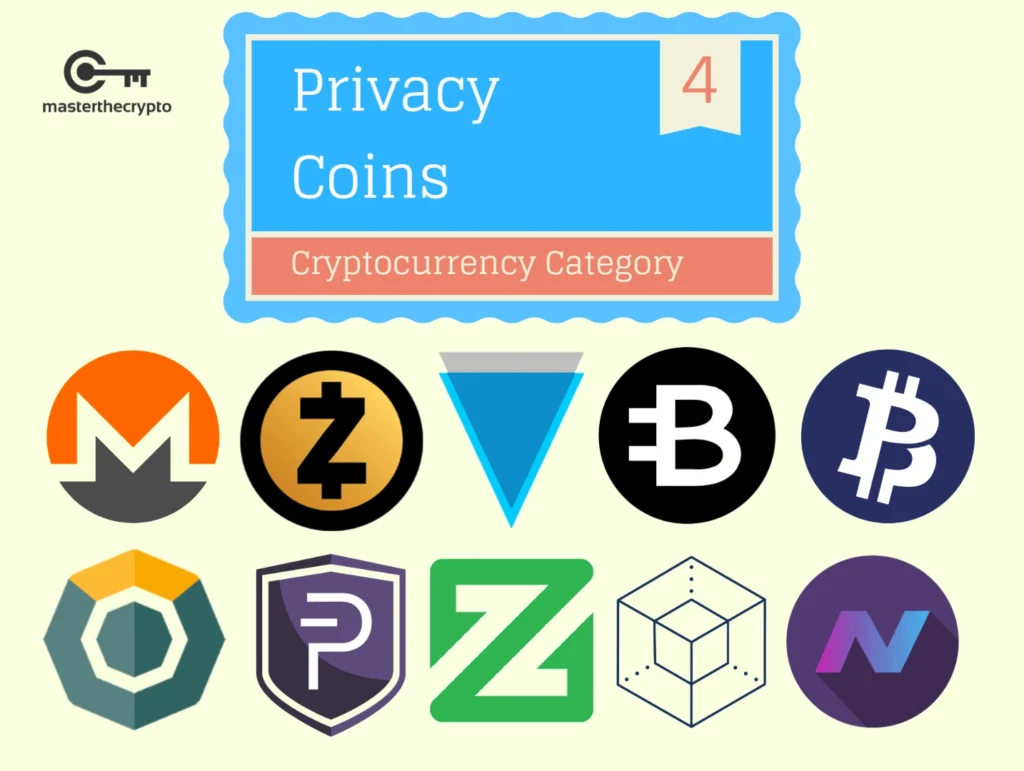

Credit from Master The Crypto

- Monero (XMR) – Launched in 2014, focuses entirely on privacy using ring signatures and stealth addresses.

- Zcash (ZEC) – Introduced in 2016, offers both transparent and shielded transactions via zero-knowledge proofs.

- Dash (DASH) – Originally a fork of Bitcoin, includes an optional “PrivateSend” feature.

Why Privacy Coins Matter for New Investors

Protecting User Identity and Transaction History

Privacy coins help prevent exposure of personal financial data in a way that regular blockchains cannot.

Common Use Cases

- Personal Financial Privacy – Everyday transactions without public visibility.

- Business Confidentiality – Protecting sensitive supply chain payments.

- Political Activism – Funding without risk of retaliation.

- Protection in Surveillance-Heavy Regions – Avoiding unwanted tracking.

Benefits for Everyday Crypto Users

Even if you’re not a political activist or a corporate executive, having privacy options can safeguard you from scams and protect your purchasing habits from being profiled.

How Privacy Coins Work — A Simple Explanation

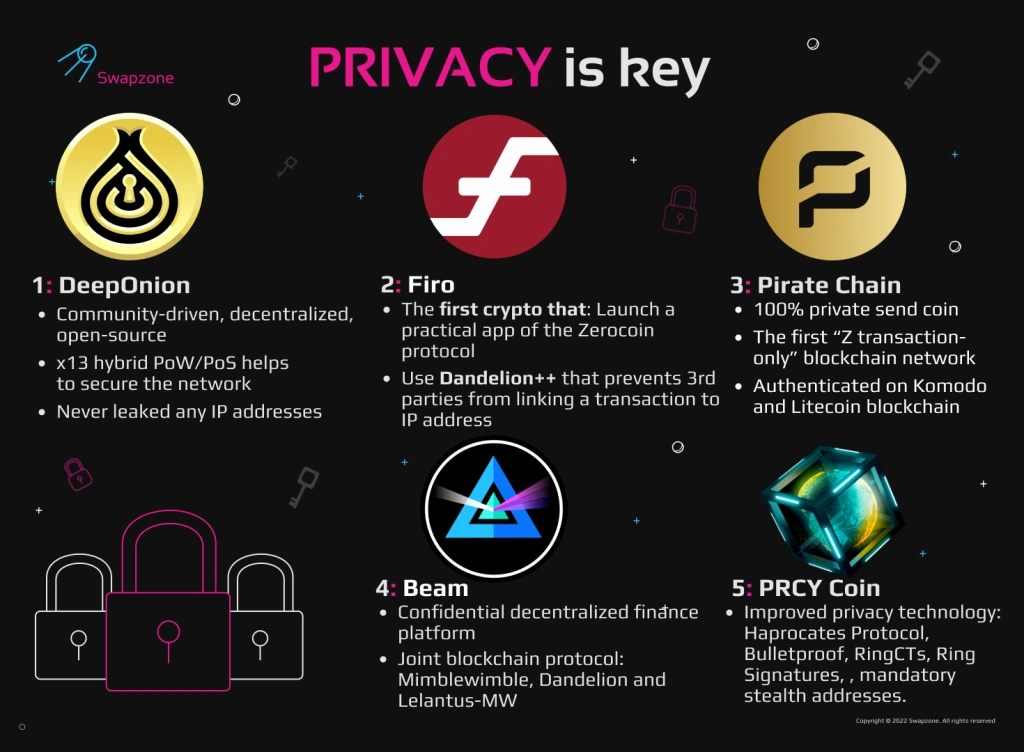

Credit from Swapzone

Think of Bitcoin’s blockchain as a public street where everyone can watch every delivery, see who sent it, who received it, and what was inside. Privacy coins turn that street into a series of locked, unmarked vans where only sender and receiver know the contents.

In practical terms:

- Monero hides the sender by mixing it with others (ring signatures).

- Zcash lets you choose between public and shielded transactions.

- Dash uses coin mixing to obscure transaction origins.

These tools make it extremely difficult for outsiders to trace payments, even with advanced blockchain analysis.

Risks and Challenges for Privacy Coin Investors

- Regulatory Environment – Several countries, including Japan and South Korea, have restricted or banned privacy coin trading on exchanges due to anti-money laundering (AML) concerns.

- Potential for Misuse – Their privacy features have been linked to illicit activity, which can attract negative media and legal attention.

- Complexity for Beginners – Setting up secure wallets and using privacy features can be harder than with Bitcoin.

- Exchange Accessibility – Some major exchanges have delisted privacy coins, affecting liquidity.

Getting Started with Privacy Coins

Buying Privacy Coins

While some major exchanges (like Binance and Kraken) still list Monero and Zcash, availability can vary by country. Always check local regulations before purchasing.

Wallet Options

- Monero GUI/CLI Wallets – Official options for secure storage.

- ZecWallet – For Zcash, supports shielded transactions.

- Ledger/Trezor – Hardware wallets that support certain privacy coins.

Best Practices for Maintaining Privacy

- Use the privacy features offered (e.g., Zcash shielded mode).

- Avoid reusing wallet addresses.

- Consider using a VPN when transacting.

Conclusion

For those exploring privacy coins for beginners, the key takeaway is that these cryptocurrencies serve a unique role in protecting financial confidentiality. They are not a replacement for Bitcoin or Ethereum but rather a complementary option for users who value privacy.

As with any investment, understanding both the benefits and the risks is essential. Whether for personal discretion, business strategy, or political necessity, privacy coins offer tools that traditional cryptocurrencies simply can’t match.