USDT Real World Usage: How to Turn It Into Spendable Cash

Let’s be honest—USDT real world usage sounds super convenient… until you actually try spending it. If you’ve ever stared at your Tether balance thinking, “Okay, now what?”—you’re not the only one. Whether you’re hodling from the last bull run or just got paid in stablecoins, turning USDT into real, spendable money can feel way more complex than it should.

But hey, the good news? It’s not rocket science. You just need the right tools, a bit of caution, and maybe a cheat sheet like this.

The Basics: What You’ll Need First

Before you even think about converting USDT into physical cash—or to your bank—here’s what you’ll need on deck:

- A trusted crypto wallet (obviously)

- An exchange account (like Binance, Coinbase, Kraken, etc.)

- A linked bank account or debit card

- Some patience—seriously, fees and wait times can vary

Now, not all platforms are created equal. Some charge higher withdrawal fees, while others delay processing. Pick your poison wisely.

How to Turn USDT into Usable Cash: The Fast Track

Alright, now we’re getting into it. Here are the most common (and safest) methods:

- Crypto Exchanges (The Classic Route)

Platforms like Binance or Coinbase let users trade USDT for fiat currency (USD, EUR, etc.). Once you sell, you can withdraw to your bank account or debit card. Watch out for transaction and withdrawal fees though—they sneak up on you. - Peer-to-Peer (P2P) Marketplaces

Want more control over your rate? P2P platforms (like Binance P2P, Paxful, or LocalBitcoins) allow you to sell USDT directly to a buyer. You get to pick your price—but you also carry more risk. Always trade with verified users and use escrow features. - Crypto ATMs

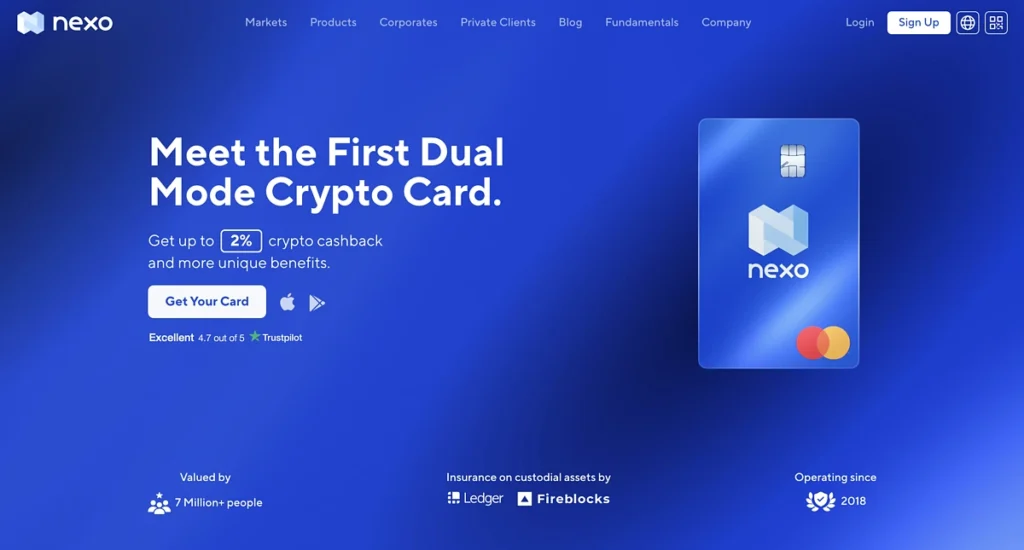

Yep, they exist! Crypto ATMs allow you to sell USDT and get cash—instantly. The catch? Higher fees and limited availability. If you’re lucky enough to live near one, it can be a fast, no-fuss option. - Payment Cards (Crypto-Linked Cards)

Platforms like Crypto.com and Binance offer prepaid Visa or Mastercard debit cards that let you spend your USDT directly—or withdraw it at ATMs. You don’t even need to convert to fiat… just swipe and go.

Is This Legal? What About Taxes?

Let’s be real—yes, turning crypto into cash is legal in most countries. But taxes? That’s another story. Some jurisdictions consider every sale or trade a taxable event. That means you might owe capital gains taxes when converting USDT.

So, yeah… maybe talk to a tax advisor before making it rain.

How to Turn USDT into Usable Cash Without Getting Burned

Sounds easy on paper, right? But a few rookie mistakes can cost you:

- Avoid unverified P2P buyers

- Triple-check wallet addresses before sending USDT

- Use 2FA and strong passwords on exchange accounts

- Know the fee structure before hitting “sell”

- Always transfer a small test amount first if you’re unsure

Some say crypto is like the Wild West, and honestly? They’re not wrong. But a little caution goes a long way.

Final Thoughts: So, How to Turn USDT into Usable Cash Without Going Crazy?

Source : Coingecko

Turning USDT into spendable money shouldn’t feel like solving a Rubik’s Cube blindfolded. Yet, for many, it does. Thankfully, with exchanges, P2P trades, and crypto-linked cards, you’ve got options—lots of them.

Sure, things aren’t always perfect. Fees can bite, regulations change, and platforms sometimes glitch. But if you follow the steps, do your homework, and keep an eye on security, you’ll be holding real-world cash in no time.

So yeah—if you’re still asking how to turn USDT into usable cash, now you’ve got your answer. Go forth and convert (smartly)!

Relevant News : Here