SharpLink Gaming and Ethereum: What’s Really Behind That $40M ETH Purchase?

Well, this one came out of left field. In a market filled with whispers and whales, one headline managed to shake things up: SharpLink Gaming bought 11,259 ETH, worth around $40 million. And just like that, the pairing of SharpLink Gaming and Ethereum became more than just an odd curiosity—it’s now the subject of serious crypto chatter.

For a company deeply rooted in the sports betting and iGaming world, this move raises more questions than answers. Is this part of a bigger blockchain strategy? Or are we simply looking at a traditional firm hedging its bets in volatile times?

Let’s dive in, because there’s definitely more to this story than just numbers.

Not Just Another Corporate Buy-In

The crypto world’s used to hearing about big players snapping up tokens. But this one? It hit a little differently. According to Coinpedia, the ETH purchase came from wallets directly tied to SharpLink—meaning this wasn’t a passive investment or a third-party trust move. It was intentional, direct, and yes, pretty massive.

Now here’s where it gets weird: this stash of ETH actually surpasses the current holdings of the Ethereum Foundation itself. That’s not just a flex—that’s a message.

Whether it’s a financial bet, a long-term strategy, or a foundational shift in how SharpLink sees its future, one thing’s certain: Ethereum just became part of their equation in a very real way.

Why Ethereum—and Why Now?

Let’s be honest, timing matters. Ethereum hasn’t exactly been on fire lately. Prices have fluctuated, the market has been uncertain, and narratives are shifting by the day. So, why is SharpLink getting involved now?

There’s no formal roadmap connecting this ETH acquisition to a specific product or platform integration—yet. But the theories are flying.

Maybe this is about future-proofing. Ethereum is still the top dog when it comes to smart contracts, decentralized finance (DeFi), and token ecosystems. SharpLink, with its roots in fantasy sports, betting, and digital engagement, could be eyeing deeper integrations in these spaces. Loyalty tokens? On-chain betting platforms? NFTs tied to real-world sports events? It’s not that far-fetched anymore.

Or maybe, like many firms before it, SharpLink is simply diversifying its treasury—ditching some fiat for digital assets in anticipation of economic turbulence. We’ve seen it with MicroStrategy and Bitcoin. Maybe this is Ethereum’s moment.

Either way, this wasn’t a buy made lightly.

Credit from : Lite Finance

SharpLink Gaming and Ethereum: Not the Only Big Movers

Here’s where the plot thickens.

Just as the SharpLink news was catching fire, another name entered the spotlight—The Ether Machine. This mysterious entity, still unverified, reportedly purchased over $60 million worth of ETH, according to CoinCentral.

Put them together, and that’s a cool $100 million in Ethereum acquired by just two parties in a very short span.

Coinpedia confirmed that both SharpLink and this “Ether Machine” now hold more ETH than the Ethereum Foundation itself. That’s no small detail. It suggests something more systemic—more forward-thinking—might be underway.

Could there be coordination? A shared belief that Ethereum is undervalued? Or is this all part of a wider movement of traditional firms moving quietly into Web3 territory?

We don’t have all the answers—but the pattern’s hard to ignore.

Credit from : Decrypt

What This Means for the Broader Ethereum Ecosystem

If you’ve followed Ethereum’s journey, you know it’s no longer “just” a blockchain platform. It’s the infrastructure layer for everything from DeFi protocols to metaverse land grabs.

Now, with major buyers stepping in, ETH is being re-evaluated as an institutional-grade asset. And not just for passive holding. It’s being looked at for what it powers—the apps, the platforms, the possibilities.

SharpLink’s move might help legitimize Ethereum in the eyes of more traditional firms. When companies with no prior crypto connection suddenly load up their wallets, it adds credibility. It also signals that ETH isn’t just for developers and degens anymore—it’s part of a wider strategic conversation.

Let’s not forget: ETH is also being talked about more frequently as a commodity asset, even on regulatory levels. So while the price hasn’t exploded in 2025 (yet), the narrative around Ethereum continues to mature.

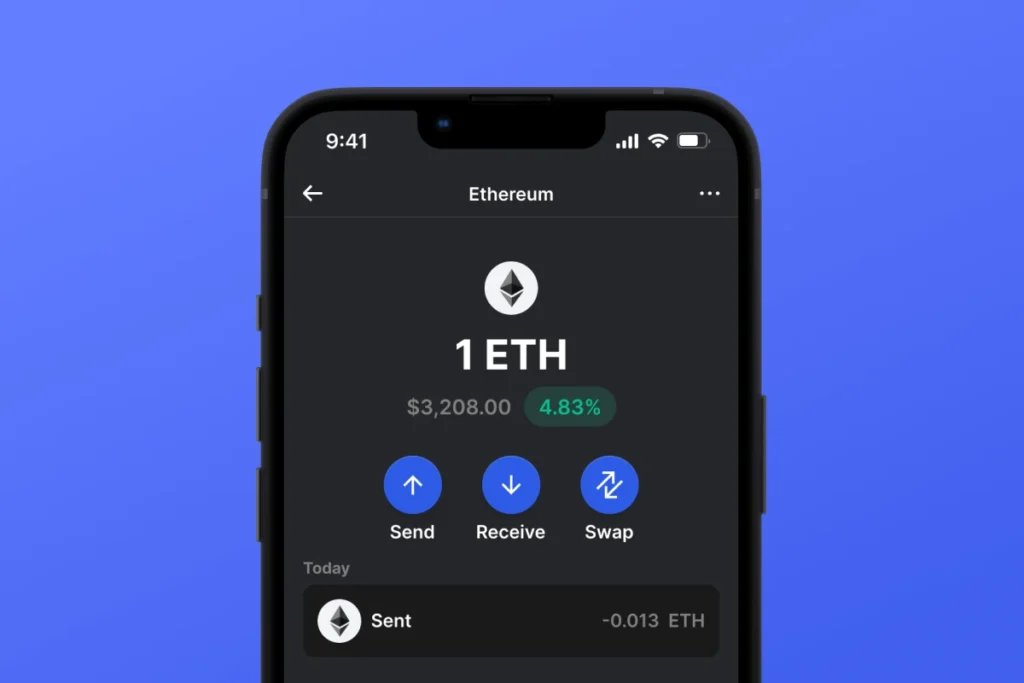

Credit from : Gem Wallet

Is This the Start of a Broader Trend?

We’ve seen this before. One company makes a bold move—others follow.

Remember how Tesla’s BTC buy kicked off a string of copycat investments? Or how NFT adoption snowballed after just a few high-profile sales? The same could happen here.

If SharpLink Gaming’s Ethereum move pays off—or even if it simply boosts their profile—expect more mid-tier firms to take notice. Especially those on the fringes of digital entertainment, gaming, or online betting, where blockchain-based features are becoming more viable.

Of course, this could go sideways too. Crypto’s nothing if not volatile, and ETH isn’t immune to market shocks. But as a long-term play, it’s hard to argue against the logic. Especially when Ethereum continues to upgrade, scale, and hold its spot at the core of Web3.

Credit from : Cryptopolitan

Final Take: What’s Next for SharpLink Gaming and Ethereum?

So, what’s really going on here?

That’s the fun part—we don’t fully know. SharpLink hasn’t released a detailed explanation, and the Ether Machine remains mysterious. But that doesn’t mean this isn’t worth watching.

The link between SharpLink Gaming and Ethereum may have started with one giant purchase, but it could evolve into much more—platform integrations, blockchain-backed games, or something we haven’t even imagined yet.

What’s clear is that Ethereum’s not just a playground for crypto-native startups anymore. It’s drawing attention from companies that, at first glance, have no real reason to be here. And yet… here they are. Holding millions in ETH. Playing the long game.

And maybe, just maybe—that’s where the future’s headed.