Understanding Stablecoins: A Beginner’s Guide to Crypto Stability

The Role of Stablecoins in a Volatile Crypto World

Stablecoins for beginners represent a gateway to predictability in the crypto world, where cryptocurrencies are known for rapid price swings. A coin worth $30,000 today could rise or fall by thousands in days—or hours. That volatility, while attractive to traders, presents a problem for everyday use. For those looking for steadiness in an unpredictable ecosystem, stablecoins offer a practical solution.

Stablecoins are simply digital tokens designed to maintain a steady value, often pegged to a fiat currency like the U.S. dollar. They aim to combine the innovation of blockchain with the price stability needed for reliable transactions. For anyone entering the crypto space, understanding how stablecoins work is one of the first steps toward informed participation.

What Are Stablecoins and How Do They Work?

At their core, stablecoins are meant to serve as a dependable store of value within the crypto market. Most stablecoins maintain their value by being backed by a reserve—either in fiat, crypto, or other assets—or through algorithmic controls that manage supply and demand.

Imagine holding a digital coin whose value is consistently one U.S. dollar. You can send it across borders within minutes, use it in decentralized finance (DeFi) platforms, or keep it in your wallet during turbulent market cycles without worrying about dramatic losses in value.

The mechanism behind that $1 value depends on the type of stablecoin you’re using.

Stablecoins for Beginners: Types of Stablecoins Explained

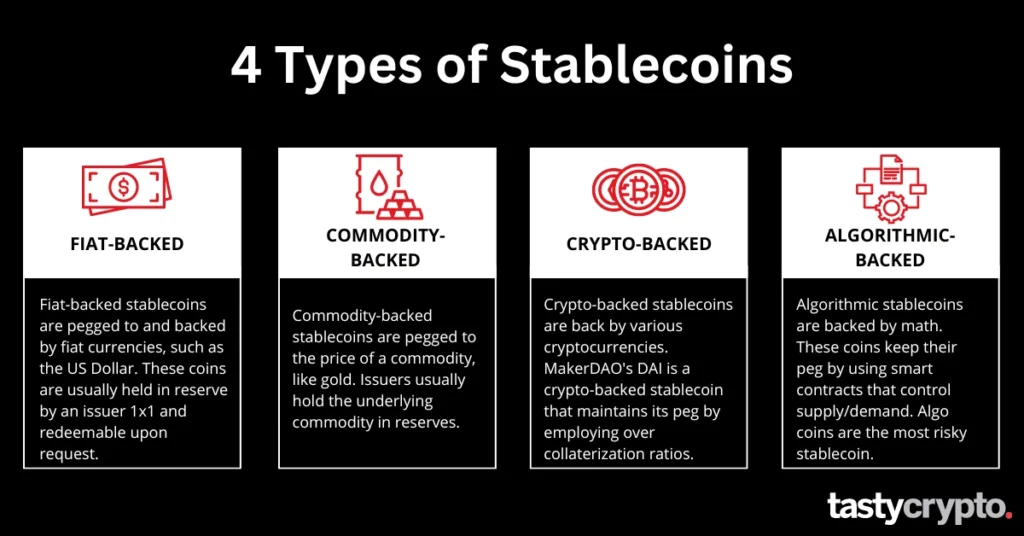

Credit from tastycrypto

Understanding the different categories of stablecoins can help beginners make smarter choices.

1. Fiat-Backed Stablecoins

These are the most common. They are backed by actual fiat reserves—usually held by a regulated custodian. For every token issued, there should be an equivalent unit of fiat currency held in reserve.

Examples include:

- USDT (Tether)

- USDC (USD Coin)

These coins are widely accepted across exchanges and are often used as a trading base against more volatile cryptocurrencies.

2. Crypto-Backed Stablecoins

Instead of fiat, these are collateralized by other cryptocurrencies, typically overcollateralized to manage price fluctuations. If you deposit $150 worth of crypto, you might receive $100 worth of a stablecoin.

DAI is a popular example, pegged to the dollar but backed by a mix of crypto assets on the Ethereum blockchain.

3. Algorithmic Stablecoins

These rely on complex algorithms and smart contracts to automatically expand or contract the coin’s supply to maintain a target price. There is no reserve in the traditional sense.

Algorithmic models can be efficient, but they’re also risky. The collapse of TerraUSD (UST) in 2022 remains a cautionary tale for many in the space.

4. Commodity-Backed Stablecoins

These are pegged to the value of a physical commodity like gold or oil. The backing provides a hedge not only against crypto volatility but also fiat inflation.

PAX Gold (PAXG), for instance, represents ownership in physical gold stored in secure vaults.

Why Stablecoins Are Useful for Beginners

For newcomers to crypto, stablecoins offer a low-risk entry point. Their price stability makes them easier to understand and less intimidating than volatile coins.

Here are a few reasons beginners are drawn to stablecoins:

- Risk Reduction: Stablecoins act as a safe zone during high market volatility.

- Faster Transfers: Compared to traditional banking, sending funds across borders using stablecoins is quicker and cheaper.

- DeFi Access: Many decentralized applications use stablecoins as a base currency for lending, borrowing, and earning yield.

- Everyday Transactions: In some economies with unstable fiat currencies, stablecoins are already being used for daily purchases.

How to Get Started with Stablecoins

Most stablecoins can be purchased directly from major cryptocurrency exchanges. You’ll need a digital wallet—either custodial (like an exchange wallet) or non-custodial (where you control your private keys).

Here’s a step-by-step breakdown:

- Choose a reputable exchange (e.g., Coinbase, Binance)

- Verify your identity if required

- Deposit fiat or crypto and purchase your stablecoin of choice

- Store your coins in a secure wallet

- Use or transfer as needed for trading, savings, or DeFi

For beginners, starting with fiat-backed coins like USDC or USDT is generally the simplest route.

Stablecoins for Beginners: What to Watch Out For

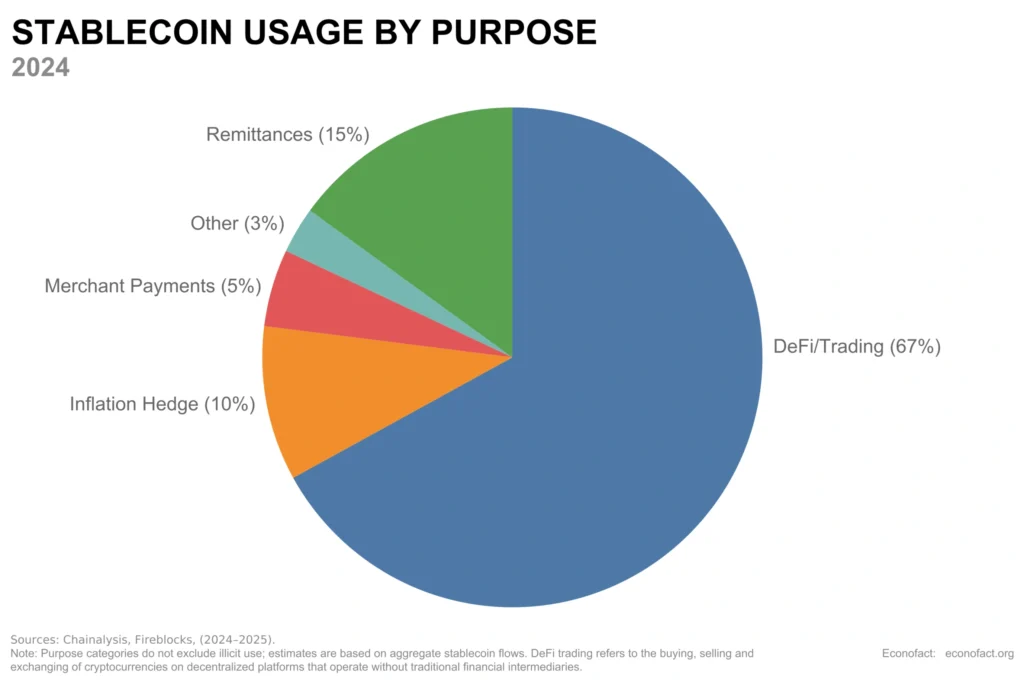

Credit from Chainalysis

While stablecoins offer benefits, they aren’t without risks:

- Reserve Transparency: Not all stablecoin issuers disclose the full details of their backing assets. This can cause concern about solvency during market stress.

- Regulatory Uncertainty: Authorities in various countries are still defining how stablecoins fit into financial regulation. Rules can change quickly.

- Centralization Risks: Many stablecoins are issued by companies that control the minting and redemption process. If these companies face legal or operational problems, users may be affected.

- Algorithmic Failures: As seen with past collapses, algorithmic models are especially vulnerable during extreme market shifts.

Stablecoins and the Broader Crypto Economy

Credit from Econofact

Beyond personal use, stablecoins serve as a bridge between traditional finance and digital assets. Traders use them to move in and out of positions quickly. Businesses in emerging markets use them for international payments. Developers rely on them to build applications that need predictable pricing.

Central banks are even studying stablecoins as a foundation for creating digital currencies of their own—commonly referred to as central bank digital currencies (CBDCs).

Conclusion: A Practical Tool for Crypto Beginners

For anyone taking their first steps into cryptocurrency, stablecoins for beginners represent a practical, approachable way to get involved. Their value stability reduces financial stress, and their broad usability makes them a versatile tool in the growing digital economy.

As the crypto ecosystem continues to evolve, stablecoins will likely remain at the center of that transformation—offering both a foundation of trust and a gateway to innovation.