Staking Crypto for Beginners: Simple Ways to Earn Passive Income in 2025

Staking crypto for beginners has become one of the more stable and accessible ways to earn in the digital asset world—especially in contrast to the volatile prices, rapid trades, and speculative bets that many people still associate with cryptocurrency. But not every crypto strategy demands constant attention or nerves of steel. In 2025, staking offers a way to earn rewards simply for holding coins and contributing to the operation of a blockchain network.

If you’ve never staked before, this guide will explain what staking actually is, how to get started safely, and what to expect as a first-time participant.

Staking Crypto for Beginners: So, What Exactly Is Staking?

Credit from Decimal

At its core, staking is the act of locking up your cryptocurrency to support a blockchain network that uses a Proof-of-Stake (PoS) model. Unlike Bitcoin’s Proof-of-Work, which depends on energy-intensive mining, PoS blockchains rely on users like you to help validate transactions and maintain consensus by “staking” their coins.

You’re not giving away your coins. You still own them—but by locking them into the network (or assigning them to someone who validates on your behalf), you’re helping secure the system. In exchange, you receive periodic payouts in the form of new tokens.

It’s not unlike keeping money in a fixed deposit: you can’t use it while it’s locked, but it earns you something in return.

Staking Crypto for Beginners: Why Do People Stake? Is It Worth It?

People stake for the same reason they put money in savings accounts or treasury bonds: they want reliable returns. Staking appeals to those who plan to hold crypto long term but don’t want it to sit idle.

Some of the key reasons newcomers are choosing staking over more aggressive strategies include:

- No need to trade actively. You earn over time, not by predicting price swings.

- Energy-efficient. No mining rigs, no technical setup—staking is low-maintenance.

- Aligns with holding. If you were already planning to keep your coins, staking just adds passive value.

That said, staking isn’t a get-rich-quick scheme. Returns are usually modest—often between 3% and 10% annually, depending on the coin and the method. But when managed well, it’s one of the most beginner-friendly ways to participate in crypto ecosystems.

Staking Crypto for Beginners: Understanding the Risks

Credit from Quadcode

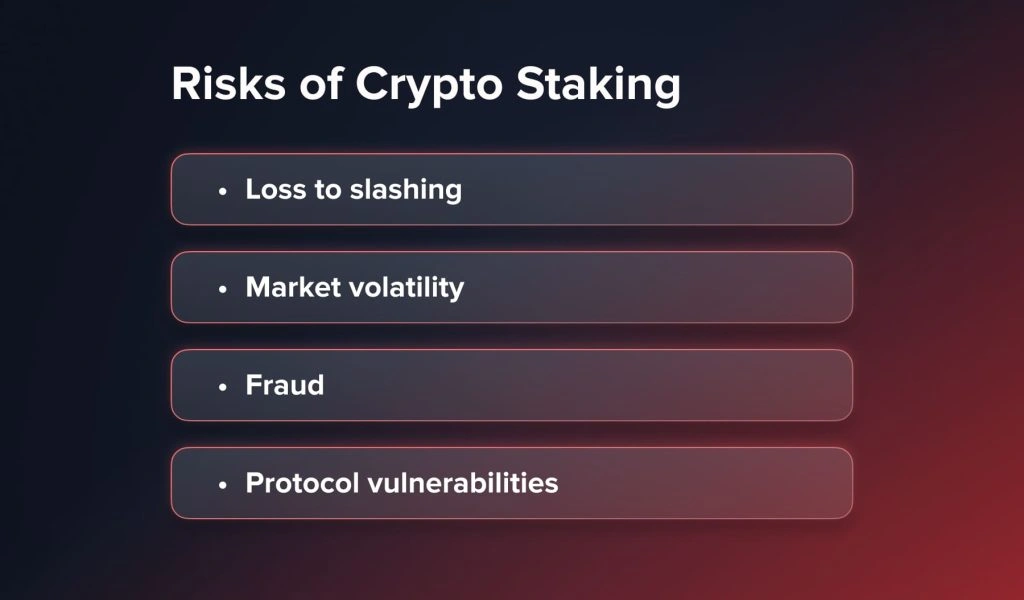

Although staking sounds like easy money, there are several things you should know before jumping in.

Market Risk

Even if you’re earning 5% rewards, a 30% drop in the token’s price could still result in a net loss. Price volatility doesn’t disappear just because you’re staking.

Lock-up Periods

Depending on the network, your funds might be inaccessible for a set time. Ethereum, for instance, has unbonding periods ranging from hours to several days. Some platforms also enforce longer lockups if you choose fixed-term staking.

Validator or Delegation Risk

When you assign your stake to someone else (a validator), you’re trusting them to behave correctly. If they act against network rules, you could lose a portion of your assets—a penalty called slashing. It’s rare, but it exists.

Platform Risk

Using centralized exchanges or newer DeFi tools? Make sure you trust them. Hacks and rug pulls still happen in 2025, so go with names that have history, audits, and transparency.

The Simple Way to Staking Crypto for Beginners

Credit from tastycrypto

Let’s walk through the typical path for a first-time staker. You’ll notice it’s easier than setting up a wallet in 2017.

1. Choose a Coin That Supports Staking

Not all cryptocurrencies can be staked. Only those built on a PoS or similar model qualify. Some well-established, relatively beginner-friendly options include:

- Ethereum (ETH) – Now fully PoS after its transition.

- Cardano (ADA) – Known for strong decentralization and academic research.

- Solana (SOL) – Fast transactions, large validator pool.

- Polkadot (DOT) – Nominated staking with higher rewards but longer lock-up.

2. Buy or Transfer Your Crypto

You’ll need to obtain the token of choice via a major exchange. Most platforms like Binance, Coinbase, or Kraken allow fiat purchases and quick transfers.

Make sure to check whether that exchange supports staking directly—or if you’ll need to move the funds elsewhere.

3. Select How You Want to Stake

There are several ways to participate. Pick the one that matches your comfort level:

- Centralized Exchange Staking: Just leave your coins on platforms like Coinbase or Binance and opt-in. Easiest method, but you don’t control the keys.

- Delegated Staking via Wallets: Use wallets like Ledger Live, Trust Wallet, or Keplr to assign your coins to validators. You hold the private keys, adding a layer of security.

- Liquid Staking: Services like Lido or Rocket Pool allow you to stake and receive a “receipt token” (e.g., stETH), which you can trade or use in DeFi while still earning rewards.

4. Confirm and Monitor

Once your coins are staked, there’s not much you need to do—except keep an eye on your rewards, validator performance, or any platform updates.

Quick Comparison: Top Staking Coins for 2025

Here’s a table showing what some of the most popular staking coins offer as of August 2025.

| Coin | Network Type | Estimated APY | Lock-up Requirement | Liquid Option Available |

|---|---|---|---|---|

| Ethereum | Proof-of-Stake | 3.5%–5% | Yes (up to 7 days) | Yes (stETH, rETH) |

| Solana | Delegated PoS | 6%–7% | No | Limited support |

| Cardano | Ouroboros PoS | 4%–5.5% | No | No |

| Polkadot | Nominated PoS | 8%–10% | Yes (28 days) | No |

Note: APY ranges depend on network performance and validator choice. Always check the latest data before staking.

Tips for Staking with Peace of Mind

There’s no need to rush. If you’re new to crypto, take time to understand these basic safety steps:

- Stick to recognized platforms (e.g., Binance, Kraken, Lido).

- Avoid staking all your coins in one network or with one validator.

- Use hardware wallets like Ledger for better control and protection.

- Understand unbonding timelines so you’re not caught off-guard if you need to withdraw.

- Don’t chase the highest APY—look for consistency, validator uptime, and trustworthiness.

Staking isn’t about “fast money.” It’s about steady, low-friction growth with manageable risk.

Final Thoughts: Who Should Consider Staking?

Credit from Everstake

If you’re someone who already owns crypto and plans to hold it for months—or years—staking is one of the simplest ways to make your assets productive. There’s no need to become a coder, no need to install nodes, and no need to trade daily. You don’t even need to move assets off an exchange if you don’t want to.

That said, staking isn’t ideal if you need quick access to funds or if you’re uncomfortable with crypto volatility. It’s not a replacement for savings accounts or traditional income—it’s a way to extend your digital portfolio’s value while supporting blockchain infrastructure.

In a market full of complexity, crypto staking for beginners represents one of the clearest paths toward passive, predictable returns. And in 2025, with more tools and trusted providers available than ever before, there’s never been a better time to begin.