Understanding Tokenomics: How Crypto Tokens Gain and Keep Value

The term tokenomics—short for token economics—is more than just a buzzword in crypto. For beginners, understanding tokenomics means grasping the basic forces that influence how a cryptocurrency works, grows, and holds value.

From how many tokens exist to how they’re distributed and used, tokenomics defines the rules that govern a crypto project’s economy. These design choices affect not only price trends but also user behavior, developer motivation, and long-term sustainability.

In this guide, we break down the critical components of tokenomics and explain how you can evaluate them as a crypto investor or enthusiast.

Tokenomics for Beginners: What Tokenomics Actually Covers

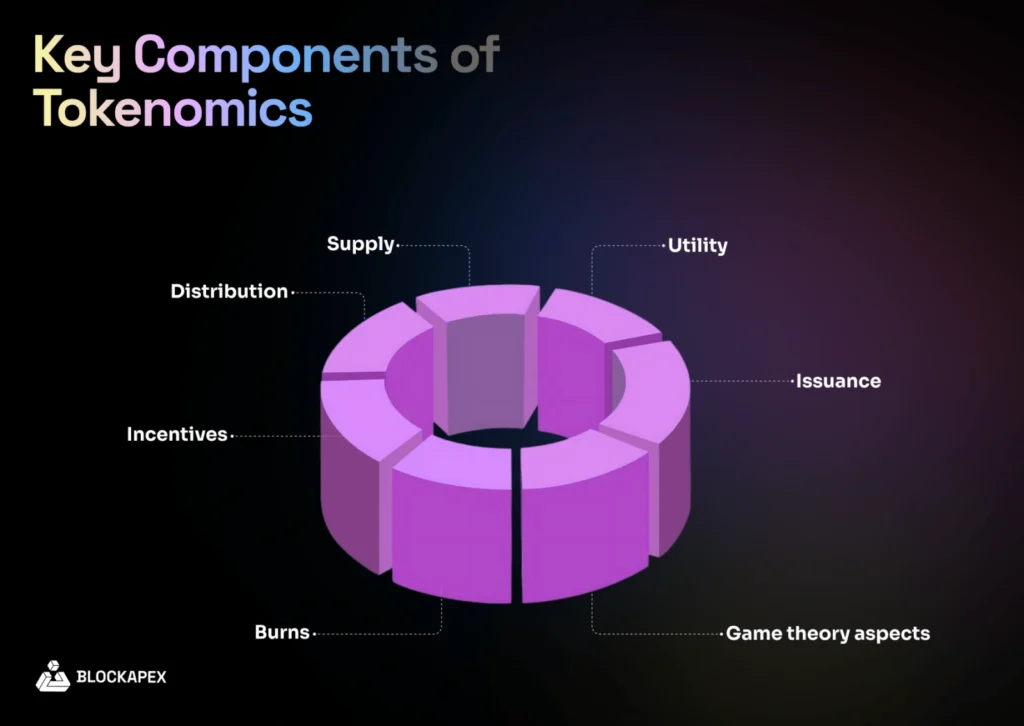

Credit from BlockApex

At its core, tokenomics answers a few key questions:

- How are tokens created and released into the market?

- What can people do with the token (utility)?

- What keeps people interested in holding or using the token?

- Is the supply fixed, growing, or shrinking?

- Who controls the token’s future?

All of these elements form the foundation of how a token behaves in the market—and whether it can succeed over time.

Total Supply vs Circulating Supply: The Numbers Behind Scarcity

In economics, scarcity drives value. Crypto follows the same principle.

| Supply Type | Description | Example |

|---|---|---|

| Total Supply | The maximum number of tokens that will ever exist. | Bitcoin: 21 million (hard cap) |

| Circulating Supply | Tokens already released and available in the market. | Cardano: ~35.4 billion ADA (2025) |

A fixed total supply can create long-term scarcity, especially if demand increases. Bitcoin’s hard cap is one of the reasons it’s often referred to as “digital gold.” Meanwhile, tokens with unlimited or highly inflationary supply must prove strong utility and network activity to justify ongoing issuance.

Token Distribution and Vesting: Who Gets What, and When

The early days of a crypto project often involve careful decisions about how tokens are distributed. Typical stakeholders include:

- Founders and core developers

- Early investors

- Community and public sale participants

- Reserve funds and ecosystem incentives

Vesting schedules ensure that tokens allocated to insiders unlock gradually over time. This reduces the risk of large-scale dumping that could crash the price. For example, Avalanche (AVAX) has a detailed vesting structure where foundation tokens are released slowly through 2030.

A transparent and fair distribution process promotes decentralization and user trust—key ingredients for adoption.

Utility: Why Would Anyone Use This Token?

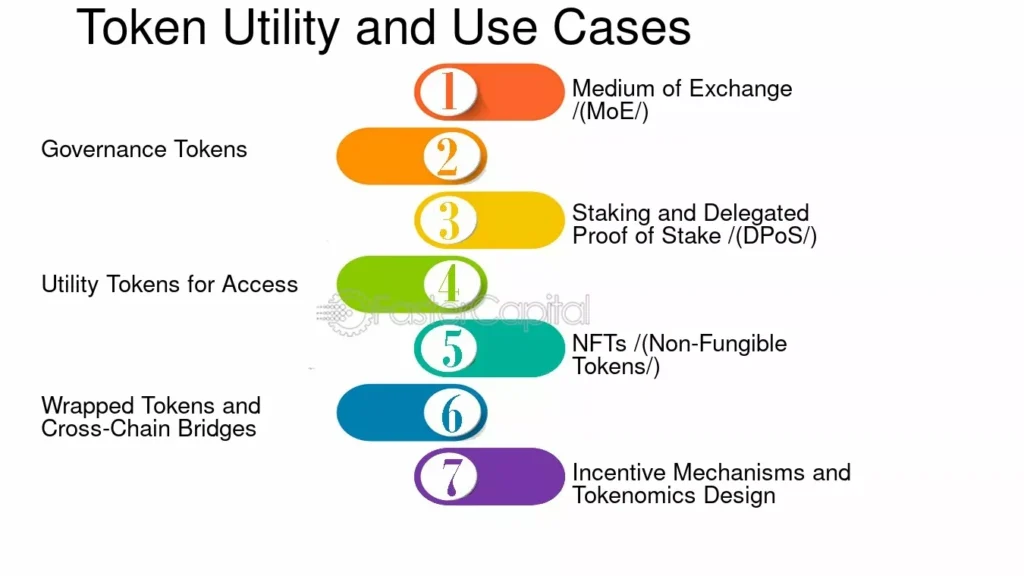

Credit from FasterCapital

A token must have a purpose in its ecosystem. Utility is often the most overlooked part of tokenomics, but it’s arguably the most important.

Common forms of utility include:

- Governance rights: Voting on protocol changes or proposals (e.g., UNI, COMP)

- Payment for services: Fees, storage, or access to digital goods (e.g., FIL on Filecoin)

- Staking and securing the network: Locking tokens to validate transactions (e.g., ADA, SOL)

- Access to features: Premium features or memberships (e.g., BAT for Brave browser)

A token without real use risks becoming a speculative tool only. Investors should look for use cases that drive demand within the platform—not just hype.

Incentive Structures: Keeping Users and Developers Engaged

Blockchain networks are decentralized, so they rely heavily on community participation. Tokenomics often includes incentives to encourage user activity, investment, and growth. These mechanisms include:

- Staking rewards for helping validate blocks

- Yield farming and liquidity rewards on decentralized exchanges

- Airdrops to attract new users or reward early adopters

Incentives must be aligned with the project’s goals. Overly generous programs can create inflation and short-term dumping, while weak incentives may fail to attract contributors.

Token Burning: Reducing Supply to Boost Value

Credit from Trust Wallet

Some projects introduce deflationary pressure by permanently removing tokens from circulation. This process, known as burning, often comes from transaction fees, revenue sharing, or protocol decisions.

Ethereum began burning a portion of its gas fees after the EIP-1559 upgrade in 2021. As of mid-2025, over 4 million ETH have been burned—introducing a counterbalance to inflation and potentially supporting ETH’s price.

Other examples include:

- Binance Coin (BNB): Burns based on exchange profits

- Shiba Inu (SHIB): Community-led burn campaigns

Burning is not inherently positive unless tied to real value creation and demand growth.

Security and Governance: Who Controls the Protocol?

Consensus mechanisms—such as Proof of Work (PoW) or Proof of Stake (PoS)—influence how tokens are distributed and how the network is secured.

In PoS-based chains, token holders often gain governance rights. This creates a feedback loop where engaged users help shape the future of the protocol. However, concentrated ownership can turn governance into a plutocracy.

Transparency in governance—such as open forums, community proposals, and on-chain voting—is now considered a best practice.

Examples: Tokenomics Models in Real Crypto Projects

Let’s briefly compare a few projects with differing tokenomics:

| Project | Supply Type | Utility Use | Incentive System | Notable Features |

|---|---|---|---|---|

| Bitcoin | Fixed (21M) | Store of value | Mining rewards (PoW) | Scarcity-based, decentralized |

| Ethereum | Dynamic | Smart contracts | Staking rewards (PoS) | Fee burning reduces inflation |

| Chainlink | Fixed (1B) | Oracle payments | Node operator incentives | Off-chain data for smart contracts |

| Uniswap | Capped (1B UNI) | Governance | No direct rewards | Community-run, decentralized exchange |

Each of these projects applies different principles of tokenomics based on its goals, user base, and architecture.

Tokenomics for Beginners: Red Flags in Tokenomics Design

Not all projects get it right. Watch out for:

- Unlimited supply without deflation: Leads to long-term price dilution.

- Heavy team allocation without vesting: Raises risks of early dumping.

- Low utility tokens: No reason to hold or use the token beyond speculation.

- Overly complex systems: If tokenomics is too confusing to explain, it often hides risks.

Transparency, auditability, and clear economic rationale are non-negotiables when evaluating a project.

Tokenomics for Beginners: How Tokenomics Affects Price Behavior

Price movements in crypto are influenced by speculation, but tokenomics acts as the underlying engine. For example:

- A token with strong utility and capped supply may resist inflation even during market corrections.

- If rewards are too high and unlocks too frequent, a flood of tokens can suppress price.

- Projects with real user engagement and growing on-chain activity tend to see positive price pressure over time.

This is why professional analysts don’t just look at charts—they study supply schedules, wallet distribution, and incentive mechanics.

Conclusion: Why Tokenomics for Beginners Should Not Be Ignored

Tokenomics for beginners isn’t about memorizing definitions—it’s about developing a lens to evaluate crypto tokens critically. Whether you’re trading, staking, or building, the token’s economic design will shape your experience.

A well-structured tokenomics model offers more than value—it builds trust, drives adoption, and sustains ecosystems. Understanding how supply, distribution, utility, and incentives interact gives you a strategic edge in crypto investing.

As blockchain matures, tokenomics is no longer just a whitepaper section—it’s a litmus test for long-term viability.