Top 10 AI x DeFi Protocols in 2025: How Artificial Intelligence is Reshaping the Future of Decentralized Finance

Top 10 AI x DeFi : Artificial Intelligence and decentralized finance are colliding to form one of the most intriguing narratives of 2025: AI x DeFi, often called DeFAI. This blend is creating new ways for users to automate financial strategies, reduce inefficiencies, and personalize interactions with crypto markets. The appeal is simple yet powerful — automation that learns, adapts, and executes financial tasks with transparency.

The market outlook is optimistic. Investors are showing growing interest, developers are experimenting with agent-driven systems, and communities are rallying around this next-generation vision of finance. At the same time, challenges remain: complexity, volatility, and the trust gap around autonomous AI systems. Against this backdrop, it’s worth examining the top 10 AI x DeFi protocols in 2025, the projects laying the groundwork for an intelligent, decentralized financial ecosystem.

Why AI x DeFi Matters in 2025 – Top 10 AI x DeFi

The intersection of AI and DeFi is not just about futuristic headlines — it’s about solving long-standing problems. Automated strategies are already managing yield farming, staking, and arbitrage. AI brings the ability to adapt these strategies to market conditions in real time, reducing human error and inefficiency.

Personalization is another driver. Instead of one-size-fits-all DeFi platforms, AI can tailor services based on user risk appetite, financial goals, or trading habits. Natural language interfaces lower the barrier to entry, making it easier for newcomers to interact with complex tools.

Perhaps most importantly, AI in DeFi promises verifiable automation. With technologies like zero-knowledge proofs and trusted execution environments, there’s growing confidence that autonomous agents can operate securely and transparently. Yet, challenges such as AI reliability, smart contract risks, and regulatory ambiguity remain.

ChainGPT (CGPT) — The AI Infrastructure Stack for Web3

ChainGPT has emerged as one of the most ambitious infrastructure projects in AI x DeFi. It functions as a complete AI ecosystem, offering smart contract generation, NFT tools, and an AI chatbot for Web3. What makes it particularly compelling is the AI Virtual Machine (AIVM), designed to run AI agents directly on-chain — a foundation for scalable automation.

The CGPT token is central, powering access to AI services, staking, and even participation in its launchpad ecosystem. Backed by a growing community and developer base, ChainGPT is positioning itself as a critical backbone for AI-driven blockchain applications.

Supra (SUPRA) — AutoFi Layer-1 Blockchain

Source: Supra

Supra is pursuing a bold idea: automation built into the blockchain itself. Known as an “AutoFi” Layer-1, Supra integrates native oracles, cross-chain messaging, and MEV protection. The upcoming Supra 2.0 upgrade introduces auto-arbitrage and auto-liquidations as enshrined features, making automation a core part of its DNA rather than an add-on.

With strong backing from Coinbase Ventures and Animoca Brands, Supra is carving out a niche as a next-generation DeFi-first chain. Its token powers governance, staking, and participation in its automation economy.

Newton Protocol (NEWT) — Trust-Minimized Agent Layer

Source: NFTevening

Newton Protocol is designed to solve a central challenge: trust in AI agents. By combining Trusted Execution Environments (TEEs) with zero-knowledge proofs (ZKPs), Newton enables verifiable automation. Its adoption curve has been steep, with over 280,000 agents and one million sign-ups in a short span.

The NEWT token is used for compute services, staking, and governance, giving holders direct influence over how the agent economy evolves. Newton’s emphasis on security and verification makes it a strong candidate for mainstream adoption in agent-driven finance.

Solidus Ai Tech (AITECH) — AI Compute Meets DeFi

Source: CoinTelegraph

At its core, Solidus Ai Tech is bridging decentralized finance with computing power. It runs a high-performance data center and a GPU marketplace, letting users access compute resources while integrating financial incentives through DeFi. Its Agent Forge is a no-code builder that lowers barriers for creating AI agents.

The AITECH Pad, a launchpad for AI and Web3 projects, adds another dimension. Tokenomics are deflationary, with a burn mechanism in place to balance demand. For those looking at the hardware and compute side of AI x DeFi, Solidus is an important player.

Hey Anon (ANON) — Conversational AI for DeFi

Source: CoinLore

Hey Anon takes a different angle: making DeFi conversational. Through natural language commands, users can ask it to “Bridge my USDC to Arbitrum” or “Show me the best yield rates.” It aggregates market insights from multiple blockchains and even social channels.

The project has caught attention with its strategic partnership with DWF Labs and its focus on multi-step automation, from execution to risk management. Its agents act as personal assistants in navigating the often complex DeFi landscape.

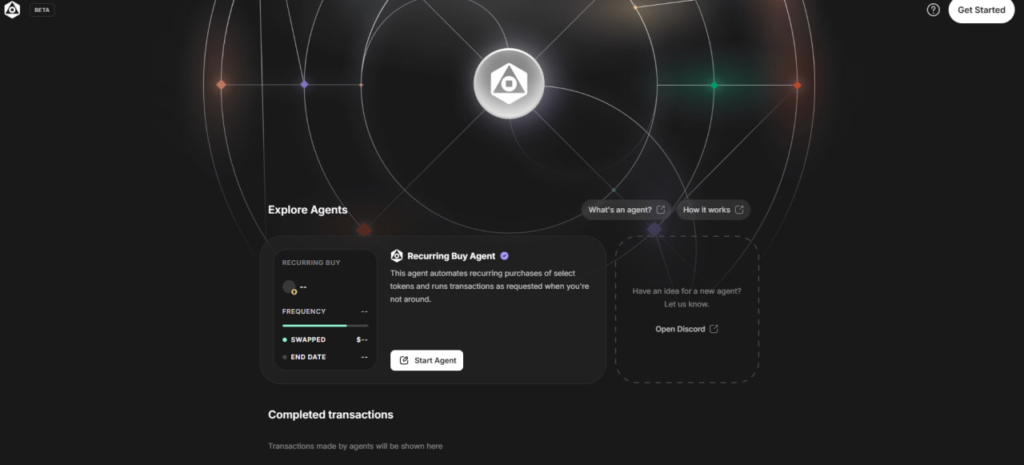

GRIFFAIN (GRIFFAIN) — Natural Language DeFi on Solana

Source: Griffain

Built on Solana, GRIFFAIN combines high-speed blockchain infrastructure with AI-powered agents. Its “Agent Engine” powers DeFi, NFT, memecoin, and copy-trading strategies. GRIFFAIN also introduces the @ Store, a marketplace for DeFi agents that users can deploy directly.

Its growth has been fast, bolstered by a Binance futures listing. The GRIFFAIN token supports transactions, agent deployment, and incentives within its ecosystem, making it a notable Solana-native entrant in the AI x DeFi space.

Hive AI (BUZZ) — Intent-Based Multi-Agent System

Hive AI positions itself as an intent-based DeFi orchestrator. Users simply express what they want to achieve, and the system translates that into automated strategies using specialized agents for lending, trading, and analytics.

As a Solana AI Hackathon winner, Hive AI has gained traction quickly. Its BUZZ token underpins governance, transaction fees, and incentive structures, reflecting a growing focus on community-driven financial automation.

Fetch.ai (FET) — Multi-Agent AI Economy Meets DeFi

Source: Pintu

Fetch.ai has long worked on decentralized AI agent networks, and its natural expansion into DeFi is now taking shape. The platform enables agents that trade autonomously, share data, and integrate with DeFi protocols. This ecosystem is one of the more established crossovers between AI and crypto.

The FET token fuels agent operations and marketplace services. With ongoing partnerships across industries, Fetch.ai demonstrates how DeFi is becoming part of a larger multi-agent economy.

SingularityDAO (SDAO) — AI-Driven DeFi Asset Management

Source: Dune

Born from the SingularityNET ecosystem, SingularityDAO focuses on AI-powered asset management. Its flagship product, DynaSets, automates portfolio rebalancing with the goal of achieving risk-adjusted returns. This blends machine learning with professional-grade trading strategies, opening hedge-fund-like tools to everyday users.

The SDAO token drives governance and participation, while integration with broader AI initiatives adds depth to its vision. For users seeking structured DeFi investment strategies, SingularityDAO is a standout.

Numerai (NMR) — AI-Powered Hedge Fund Meets DeFi

Source: CoinBureau

Numerai has been blending data science and finance since its inception. Using a global network of data scientists, it builds models that fuel its hedge fund strategies. With its Erasure protocol, it decentralizes prediction markets and financial insights.

The NMR token incentivizes accurate models, penalizing errors while rewarding contributions. Numerai’s entry into DeFi integrations shows how long-standing AI-finance projects are finding a place in this new decentralized landscape.

Comparative Analysis of the Top 10 AI x DeFi Protocols

Looking across these ten projects, distinct categories emerge:

- Infrastructure Providers: ChainGPT, Solidus Ai Tech

- Automation Layer-1s: Supra, Newton Protocol

- User Interfaces: Hey Anon, GRIFFAIN, Hive AI

- Asset Management: SingularityDAO, Numerai

- Multi-Agent Economies: Fetch.ai bridging AI and DeFi

Metrics such as token performance, community size, and partnerships vary, but all share a common thread: experimenting with how AI can create new forms of efficiency and accessibility in finance.

Risks and Challenges in 2025 – Top 10 AI x DeFi

The path forward isn’t without risks. Smart contract exploits remain a pressing issue, and AI agents themselves can misbehave if models are poorly trained or manipulated. Market volatility of new tokens adds further uncertainty, while regulators are only beginning to grapple with what AI-driven finance means for consumer protection.

Scalability also looms large. Networks running thousands or millions of autonomous agents will need robust infrastructure to avoid congestion and high fees.

Future Outlook: Top 10 AI x DeFi – Beyond 2025

Looking ahead, AI x DeFi is poised to move from experimentation to broader adoption. AI-driven DAOs may begin governing protocols. Personalized robo-advisors could give retail users more tailored financial tools. Institutional adoption is likely to grow, particularly for risk management and automated compliance.

The merging of AI data marketplaces with DeFi liquidity pools hints at a trillion-dollar opportunity if adoption scales globally. While many challenges remain, the direction is clear: decentralized finance is becoming more intelligent.

Conclusion – Top 10 AI x DeFi

The top 10 AI x DeFi protocols in 2025 represent some of the most ambitious and creative projects in the crypto space. From infrastructure builders like ChainGPT and Solidus to user-facing platforms like Hey Anon and Hive AI, these initiatives are reshaping how finance is automated, personalized, and secured.

As this sector evolves, it carries both immense promise and significant risks. But one thing is certain: the convergence of AI and decentralized finance is more than just a passing trend — it is laying the groundwork for a new era of intelligent, user-friendly, and transparent financial systems.