Top 10 Cross-Border Remittance Crypto Solutions in 2025: How Blockchain, Stablecoins, and Digital Payments Are Changing Global Money Transfers

Top 10 Cross-Border Remittance : Cross-border remittance plays a vital role in today’s global economy, supporting millions of families who rely on money sent home by overseas workers. Traditional systems, however, are weighed down by high fees, slow settlement times, and limited transparency. This is where blockchain-powered crypto remittance enters the picture, offering faster, cheaper, and more reliable alternatives.

By 2025, the market is seeing a pivotal shift. Stablecoins, central bank digital currencies (CBDCs), and fintech partnerships are reshaping how money moves across borders. As regulatory clarity improves, crypto remittance is no longer just an experiment—it’s becoming a mainstream reality.

Top 10 Cross-Border Remittance – Key Factors Driving Crypto Remittance Adoption

The growth of crypto remittance is fueled by several trends. Blockchain networks cut settlement times from days to minutes, dramatically lowering costs. For the unbanked and underbanked, mobile-first crypto wallets offer financial inclusion previously out of reach. Stablecoins and CBDCs are addressing volatility concerns, making digital remittance more reliable.

Meanwhile, banks and fintechs are collaborating with blockchain networks to build hybrid systems. This blending of traditional finance with crypto rails is one reason adoption is accelerating so quickly in 2025.

Top 10 Cross-Border Remittance – Methodology for Selection

The solutions featured here are chosen based on criteria such as speed, scalability, and global reach. Cost-effectiveness remains a major factor, as does compliance with local and international regulations. Accessibility is equally important—platforms that integrate fiat on/off ramps and mobile-first experiences stand out. Finally, adoption by remittance providers and fintech platforms highlights real-world utility.

Top 10 Cross-Border Remittance Crypto Solutions in 2025

1. Ripple (XRP Ledger & RippleNet)

Source: Decrypt

Ripple remains a leader in institutional remittance, connecting banks and payment providers with its On-Demand Liquidity (ODL) service. By using XRP as a bridge currency, RippleNet reduces the need for pre-funded accounts, cutting costs and freeing up liquidity. Case studies in Asia and the Middle East show how large-scale financial institutions are moving real value across borders in seconds.

2. Stellar (XLM & MoneyGram Access)

Source: Stellar

Stellar continues to shine in retail remittance, particularly in regions where money transfer operators dominate. Its partnership with MoneyGram has opened corridors in Africa, Asia, and Latin America, giving users a simple bridge between cash and crypto. For many migrant workers, Stellar’s low-cost transactions are becoming the go-to alternative for sending money home.

3. Circle (USDC Transfers)

Circle’s USDC has emerged as one of the most trusted stablecoins in the world. With backing from major players like Visa and Stripe, USDC-powered remittances offer the stability of the U.S. dollar combined with the efficiency of blockchain. This makes it a preferred option for fintech platforms serving global remittance markets.

4. Tether (USDT in Emerging Markets)

Tether’s USDT continues to dominate remittance flows in emerging economies. Despite regulatory scrutiny, it remains widely used for sending money to regions such as Asia and Latin America, where people seek stability against local currency fluctuations. Its availability across exchanges and wallets ensures broad adoption for small and large remittances alike.

5. Lightning Network (Bitcoin Layer 2)

Source: C & B

Bitcoin remains a popular choice for cross-border payments, and the Lightning Network enhances its efficiency for micro-remittances. Instant, low-cost transfers over Bitcoin’s second layer are gaining traction among fintech startups. For users seeking to leverage the world’s largest cryptocurrency, Lightning-powered remittances offer a practical path.

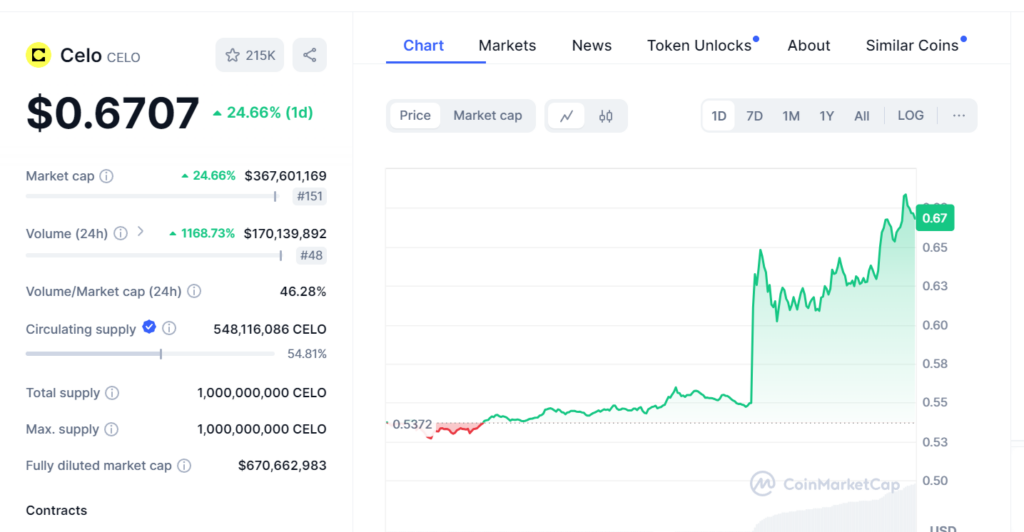

6. Celo (Mobile-First Remittance Network)

Source: The Coin Republic

Celo has carved out a niche in financial inclusion with its mobile-first approach. By focusing on regions with high mobile money adoption, Celo enables peer-to-peer transfers that integrate seamlessly with local payment systems. Its mission-driven network continues to empower communities traditionally left behind by banking infrastructure.

7. Airwallex (Blockchain-Enabled Business Remittance)

Source: Airwallex

While consumer remittance often dominates the conversation, Airwallex brings blockchain efficiencies to small and medium enterprises. Its multi-currency wallet and integration with blockchain rails help businesses settle cross-border payments faster. For global e-commerce merchants, this represents a crucial step forward.

8. Worldcoin / Newmoney AI

Source: Pintu

Combining blockchain with artificial intelligence, Worldcoin and newer AI-driven solutions are experimenting with optimized remittance flows. By analyzing transaction routes and settlement layers, these platforms promise faster, more cost-efficient transfers. While still early-stage, they highlight how emerging technologies will shape the next decade of digital remittance.

9. Zenus Bank

Source: Zenus

Zenus Bank positions itself as a bridge between traditional banking and blockchain. Offering U.S. bank accounts to customers worldwide, it integrates crypto remittance solutions into its platform. For expatriates and businesses needing stable U.S. banking access, Zenus is pioneering a hybrid approach.

10. BOSS Money (Africa-Focused Remittance)

Source: Boss Money

In Africa, remittances remain lifelines for millions of families. BOSS Money is expanding its network through blockchain partnerships, allowing faster and cheaper transfers to underserved regions. By collaborating with local fintech startups, it ensures last-mile connectivity, making remittance services more inclusive.

Comparative Analysis – Top 10 Cross-Border Remittance

Each of these solutions offers unique strengths. Ripple and Stellar dominate in speed and institutional adoption, while USDC and USDT lead on stability and cost. The Lightning Network excels in micro-transfers, and Celo stands out for financial inclusion. Airwallex and Zenus bridge business needs with blockchain innovation, while Worldcoin and BOSS Money explore experimental and regional approaches.

From a regulatory standpoint, Circle and Ripple have strong positioning, while stablecoin adoption continues to spark debate among policymakers. Regional strengths vary: Stellar and BOSS Money shine in Africa, Ripple and Airwallex in Asia-Pacific, and Circle/USDC in global fintech ecosystems.

Challenges & Risks Ahead – Top 10 Cross-Border Remittance

Despite rapid growth, crypto remittances face hurdles. Regulations vary widely, creating uncertainty for providers and users. Stablecoins remain under scrutiny, with potential restrictions in some markets. Security risks, including fraud and phishing, continue to pose threats. Lastly, accessibility is still a challenge in areas with limited mobile or internet connectivity.

Future Outlook (2025–2030)

Looking forward, integration of CBDCs with crypto remittance networks is expected to be a game-changer. Multi-chain interoperability will allow smoother transfers across different networks. AI-driven optimization could make remittances smarter, adapting fees and routes in real time. As traditional banks deepen partnerships with blockchain firms, the line between old and new systems may blur entirely.

Conclusion – Top 10 Cross-Border Remittance

The top 10 cross-border remittance crypto solutions in 2025 highlight how blockchain is transforming global money transfers. By reducing costs, speeding up settlement, and expanding access, these platforms are challenging traditional money transfer services. With stablecoins, CBDCs, and fintech partnerships entering the mix, 2025 could mark the true mainstream breakthrough for crypto remittances.