Top 10 Crypto Derivatives & Futures Platforms in 2025: Comparing the Biggest Players in Trading

Top 10 Crypto Derivatives : The crypto derivatives market has entered a new stage in 2025, with platforms handling billions in daily volume across futures, perpetual swaps, and options. Traders use these platforms not only for speculation but also for hedging and risk management, while institutions increasingly recognize them as tools for efficient capital deployment.

The top 10 crypto derivatives platforms stand out because of a mix of liquidity, security, regulatory standing, and innovation. While some exchanges cater primarily to professional traders with advanced dashboards and compliance frameworks, others have leaned into retail adoption, social features, and gamified trading.

Top 10 Crypto Derivatives : What Makes a Derivatives Exchange Stand Out?

Before jumping into the rankings, it’s worth noting the criteria that shape how these platforms are evaluated. Trading volume and liquidity are central, since deep order books ensure fair pricing. Fees — both maker and taker — remain a deciding factor for many traders. Security, licenses, and insurance mechanisms weigh heavily in light of past exchange failures.

At the same time, innovation plays an increasingly large role. Copy trading, perpetual swaps, and even AI-driven bots are now part of the landscape. User experience also matters: mobile apps, beginner-friendly dashboards, and advanced charting tools can make or break adoption.

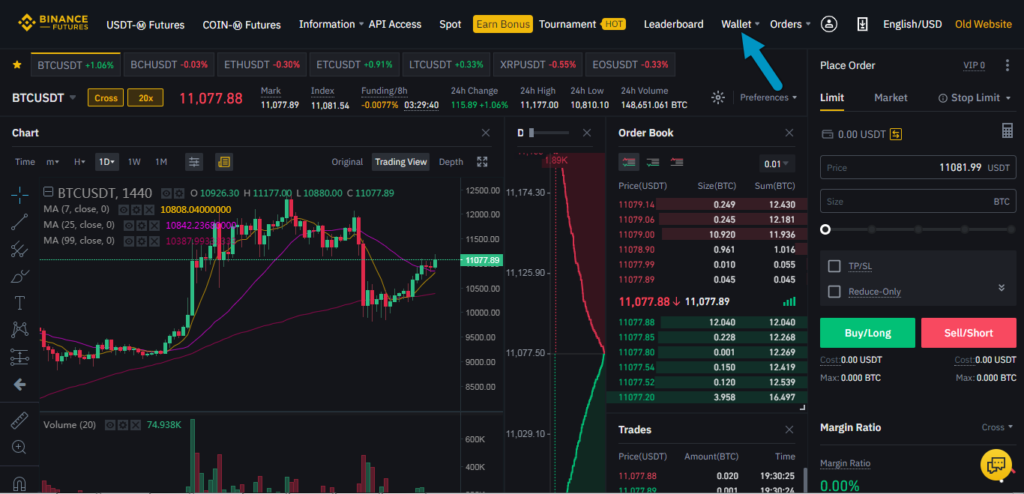

Binance Futures: Still the Global Leader

Source: Binance

Binance Futures continues to dominate global crypto derivatives trading, with unmatched daily volumes and liquidity. Traders are drawn to its wide range of contracts, including perpetual futures and cross-asset margining. Its SAFU fund provides a safety net in extreme market conditions, a factor that boosts user confidence.

Yet, regulatory headwinds remain a challenge. Some jurisdictions restrict access to Binance Futures, leaving certain traders in search of alternatives. Despite that, for many professionals, its scale and depth make it the benchmark.

Bybit: Building Its Own Identity

Source: IQwiki

Bybit has carved out its position as a leading derivatives exchange, often ranking just behind Binance in volume. Its focus on user-friendly design and strong risk management has made it especially popular with both retail traders and mid-sized funds.

Bybit’s USDC-settled contracts are a notable innovation, offering stability in collateral management. The platform has also doubled down on copy trading and community engagement, appealing to a younger, mobile-first demographic. Access restrictions in certain regions, however, still limit its global reach.

OKX: Blending CeFi and DeFi

OKX occupies a unique position as both a centralized exchange and a DeFi ecosystem hub. Its derivatives offering covers perpetual swaps and options, with advanced risk tools that attract professional traders.

What makes OKX interesting in 2025 is its integration of DeFi yields with centralized trading, creating a hybrid model. This dual approach has strengthened its user base, though the platform supports fewer markets compared to some rivals.

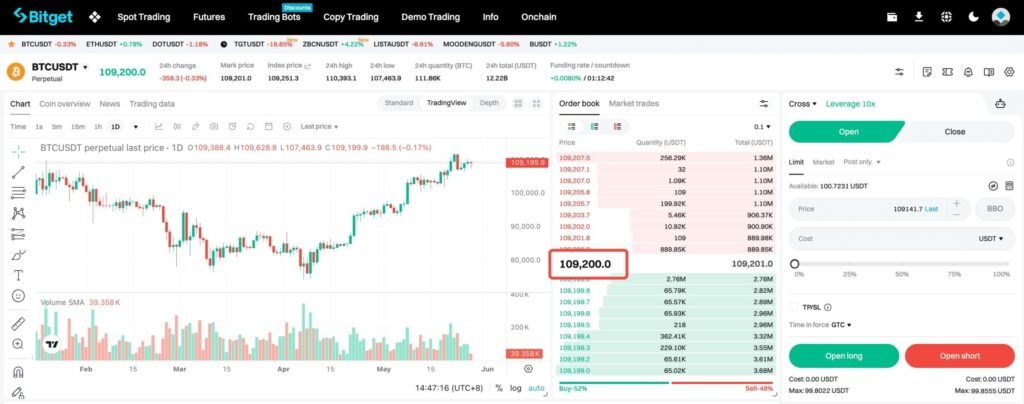

Bitget: The Copy Trading Specialist

Source: Bitget

Bitget has emerged as one of the fastest-growing derivatives platforms in 2025, leaning heavily into social and copy trading. This focus has made it especially appealing to beginners who want exposure without designing complex strategies.

Beyond futures contracts, Bitget introduced trader protection funds that cover losses in certain conditions. However, the platform’s rapid growth has also drawn more regulatory scrutiny, and its global expansion may hinge on how it navigates compliance challenges.

Gate.io: Wide Market Coverage

Source: Cryptoslate

Gate.io’s strength lies in breadth. With more than 600 derivatives markets, it remains one of the most diverse trading venues for altcoin futures. Its long-standing presence has cemented its role in Asia, where it continues to attract high-volume retail activity.

On the downside, the exchange can feel overwhelming to newcomers. The abundance of trading pairs and tools creates a steep learning curve, though seasoned traders often see this as an advantage.

KuCoin Futures: Altcoin-Friendly Options

Source: Kucoin

Known as the “People’s Exchange,” KuCoin has leaned into its reputation as the go-to venue for altcoin futures. Its Futures Brawl feature — a gamified trading mode — reflects its willingness to experiment with retail-friendly formats.

KuCoin Token (KCS) holders benefit from fee discounts, making the platform attractive for long-term users. However, questions about regulatory certainty continue to shadow KuCoin, particularly in the U.S. and Europe.

Kraken Futures: Trust and Security

Kraken has always stood apart as one of the most security-conscious exchanges. Its derivatives arm reflects this ethos, focusing on institutional-grade compliance and limited but reliable futures contracts on major cryptocurrencies like Bitcoin and Ethereum.

While it cannot compete with Asian exchanges in terms of market breadth, Kraken’s regulated structure and focus on trust make it appealing to funds and conservative traders.

BingX: Emerging Challenger

Source: BingX

BingX has quickly gained traction in Southeast Asia and beyond, thanks to its emphasis on demo trading and copy trading features. These make it accessible to newcomers while still providing professional tools for advanced users.

The exchange balances retail-friendly design with robust liquidity, making it a middle-ground choice for traders who want both simplicity and depth.

Deribit: The Options Specialist – Top 10 Crypto Derivatives

Source: Dinsights

Unlike most exchanges on this list, Deribit has focused almost exclusively on options and volatility products. It dominates the BTC and ETH options market, making it the preferred choice for institutions engaging in hedging strategies.

Its biggest limitation remains the narrow focus. Traders looking for a wide set of perpetuals or altcoin futures must look elsewhere. Still, for those who want sophisticated options trading, Deribit is unmatched.

MEXC Futures: Low Fees, High Ambition – Top 10 Crypto Derivatives

MEXC Futures has climbed rapidly in the rankings by offering ultra-low or even zero trading fees. Combined with its huge roster of markets — over 700 listed pairs — it has become a magnet for high-frequency retail traders.

Though still building its global reputation, MEXC’s aggressive fee strategy has positioned it as a direct competitor to Bitget and Bybit in 2025. Its success will likely depend on sustaining this model without compromising stability.

Comparative Snapshot: Fees and Liquidity – Top 10 Crypto Derivatives

| Exchange | 24h Volume | Maker Fee | Taker Fee | Open Interest | No. of Markets | Strengths | Weaknesses |

|---|---|---|---|---|---|---|---|

| Binance | $52.2B | 0.02% | 0.04% | $40.1B | 576 | Liquidity, security | Regulatory restrictions |

| Bybit | $17.6B | 0.02% | 0.055% | $25.2B | 609 | Copy trading, UI | Limited in some regions |

| OKX | $18.6B | 0.02% | 0.05% | $11.6B | 279 | Risk mgmt tools | Smaller market count |

| Bitget | $16.7B | 0.02% | 0.06% | $26.2B | 538 | Social trading | Regulatory hurdles |

| Gate.io | $14.4B | 0.015% | 0.05% | $19.1B | 633 | Wide coverage | Complex for beginners |

| KuCoin | $5.6B | 0.02% | 0.06% | $2.8B | 468 | Altcoin focus | Compliance risks |

| Kraken | $516M | 0.02% | 0.05% | $757M | 338 | Security, trust | Limited pairs |

| BingX | $7.1B | 0.02% | 0.05% | $3.8B | 511 | Copy trading | Still scaling |

| Deribit | $414M | 0% | 0.05% | $3.4B | 33 | Options leader | Limited pairs |

| MEXC | $16.1B | 0% | 0.02% | $8.3B | 779 | Low fees, many markets | Relatively new in futures |

Trends Defining 2025

Several themes cut across the best crypto derivatives platforms 2025:

- Institutions are more present than ever, pushing for stronger compliance and security.

- Asian exchanges continue to outpace Western rivals in retail adoption and product breadth.

- Zero-fee models are gaining traction, forcing competitors to rethink pricing.

- Copy trading and social features are shaping how retail users engage with complex markets.

Conclusion: Picking the Right Platform – Top 10 Crypto Derivatives

The top 10 crypto derivatives platforms in 2025 show how diverse this market has become. From Binance’s liquidity dominance to Deribit’s options niche, and from Bitget’s copy trading appeal to Kraken’s institutional trust, each serves a distinct audience.

No single exchange is “best” for everyone. The right choice depends on whether you value deep liquidity, low fees, compliance, or innovative tools. As always, traders should practice solid risk management and conduct their own research before diving into leveraged trading.