Top 10 Crypto Exchanges by Trading Volume in 2025: Who’s Leading the Market Shift?

Top 10 Crypto Exchanges: The global crypto market in 2025 is navigating a fascinating transition. While the total market capitalization sits above $3.8 trillion and daily trading volumes hover around $144 billion, the role of centralized exchanges (CEXs) remains pivotal in shaping liquidity, retail access, and institutional adoption.

In this piece, we rank the Top 10 crypto exchanges by 24-hour trading volume, offering deep insights into their current standing, performance over Q1 2025, and what traders should know as the market repositions in the second half of the year.

Methodology: Top 10 Crypto Exchanges – How We Ranked the Top Crypto Exchanges

Our rankings are based on updated data from CoinGecko and CoinMarketCap, focusing on performance metrics as of April 2025 and trends observed throughout Q1 2025.

Key factors considered:

- 24-hour spot trading volume

- Market share percentage

- Month-on-month (MoM) growth or decline

- Liquidity score

- Weekly website traffic

- Number of listed coins and active markets

- Fiat currency on-ramp support

This approach highlights not just raw volume but the broader market impact, resilience, and growth velocity of each exchange.

A Shaky Quarter: Top 10 Crypto Exchanges – Global Trends in Crypto Exchange Volume

Source: The Block

In Q1 2025, global spot trading volume declined by -16.3%, reflecting broader market volatility and regulatory tensions in key jurisdictions. Despite this pullback, trading on centralized exchanges remains heavily concentrated.

Binance, although still dominant, saw its market share erode slightly, while Gate.io and HTX (Huobi) emerged as rare growth stories in an otherwise red quarter.

We’re also seeing a rising tide of mid-tier exchanges—like Bitget and MEXC—attracting younger retail audiences with broader altcoin offerings and innovative tools, though often lacking deep liquidity.

1. Binance: Top 10 Crypto Exchanges – Still the Titan, But Cracks Are Showing

Source: The Block

With a 24h trading volume of $17.6 billion, Binance still commands the largest slice of the market—38.0% as of April 2025. Despite this, it recorded a -15.7% decline in Q1 volume.

Its liquidity score of 935 remains unmatched, and its global footprint (supporting over 80 fiat currencies and 2,000+ markets) reinforces its leadership. However, growing regulatory fatigue and aggressive regional competition are slowly chipping at its once-untouchable dominance.

2. Gate.io: The Altcoin Powerhouse on the Rise

Source: Baxity

Gate.io had a standout quarter with a +14.4% MoM growth in Q1, reaching $3.69 billion in daily volume and securing 9.0% market share.

What sets Gate apart is its massive listing catalog—over 2,800 markets and 2,000+ coins—making it a magnet for altcoin hunters and niche project investors. It’s also expanding fiat support, now covering 60+ currencies globally.

3. Bitget: Fastest Riser with a Tech-Savvy Edge

Source: The Block

Bitget surged to a $3.49 billion daily volume, up from 4.6% to 7.2% market share since January. Its rise is powered by smart integrations like AI trading assistants and social trading features aimed at newer crypto users.

With increasing user traffic and a rapidly evolving platform, Bitget is carving out a serious presence among younger investors.

4. MEXC Global: The Listing Leader, Volume Plateau

MEXC commands a $3.31 billion volume and 7.1% market share, maintaining its strength as the exchange with the most listed coins (1900+).

While its Q1 saw a modest -1.8% dip, MEXC remains essential for users looking for exposure beyond mainstream tokens. However, lower liquidity across niche tokens remains a challenge.

5. OKX: Deep in Derivatives, Slower in Spot

Despite being renowned for its derivatives ecosystem, OKX still holds its ground in spot trading with $2.67 billion daily volume and 7.0% market share.

It suffered a -16.3% contraction in Q1, reflecting broader weakness in high-leverage retail segments. However, its liquidity and cross-product integration keep it relevant for multi-strategy traders.

6. Coinbase: Regulatory Compliant, Volume Conservative

The most compliant and institution-friendly exchange on the list, Coinbase saw $2.33 billion in spot trading volume with 6.9% market share.

Operating from the U.S., it remains the gateway exchange for over 60 countries, but its slower listing pace and cautious approach keep it trailing in volume compared to more aggressive peers.

7. Bybit: Derivatives First, Spot Still Maturing

Source: PR Newswire

Bybit is known for its derivatives platform, but its spot volume is rising—$3.38 billion daily, despite a -16.9% drop in Q1.

The exchange is making notable investments in user interface and education, trying to bridge casual users into more advanced trading formats.

8. Upbit: Korean Giant, Localized and Under Pressure

Source: Boxmining

Upbit, South Korea’s leading exchange, holds $1.84 billion in daily volume and 6.4% market share. Yet it posted the steepest Q1 drop at -34.0%, largely due to stricter local regulations and capital outflows.

Still, its hold on the Korean market gives it strategic importance in the regional ecosystem.

9. Crypto.com: Building an Ecosystem Around CRO

Source: Crypto Ninjas

With $2.27 billion in daily volume and 6.2% market share, Crypto.com is focusing on a brand-led ecosystem with its native CRO token at the center.

It saw a -26.1% drop in Q1, signaling the challenges of ecosystem dependence during bearish cycles. However, its strong app and fiat gateway continue to attract everyday users.

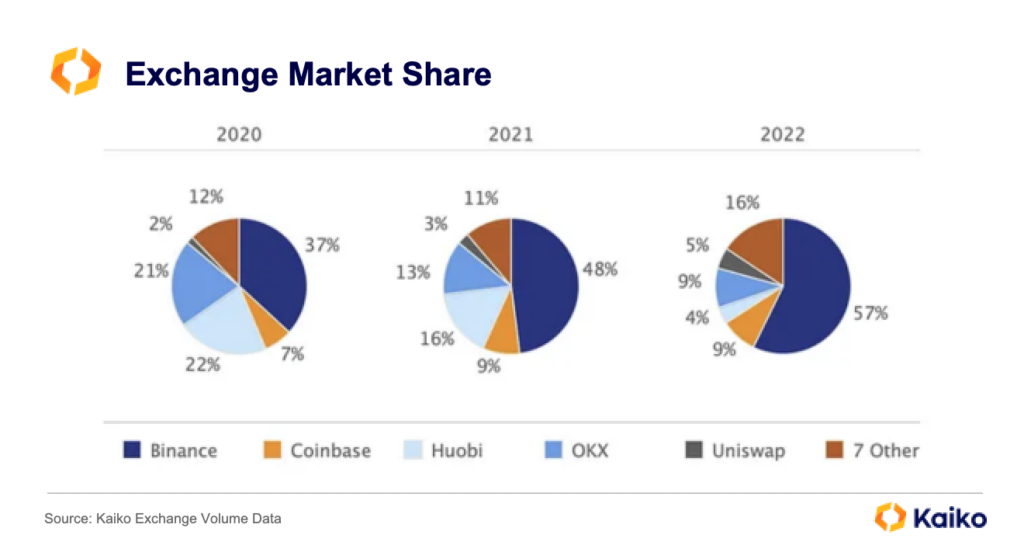

10. HTX (Huobi): The Surprise Comeback

Source: Kaiko

HTX (formerly Huobi) is the only exchange in the top 10 to post positive growth in Q1, with an +11.4% surge bringing it to $2.18 billion daily volume and 5.4% market share.

Its strong user growth in Asia-Pacific, especially Southeast Asia, marks it as a comeback player worth watching in 2025.

At a Glance: Comparative Table of the Top 10 Exchanges

| Rank | Exchange | Volume (24h) | Market Share | MoM Growth (Q1 2025) | Liquidity Score | Weekly Visits | Coins Listed | Markets | Fiat Supported |

|---|---|---|---|---|---|---|---|---|---|

| 1 | Binance | $17.6B | 38.0% | -15.7% | 935 | 11.3M | 538 | 2,040 | Yes (80+ fiat) |

| 2 | Gate.io | $3.69B | 9.0% | +14.4% | 642 | 4.7M | 2,048 | 2,827 | Yes (60+ fiat) |

| 3 | Bitget | $3.49B | 7.2% | +56.5% (started year at 4.6%) | 603 | 3.8M | 670+ | 980+ | Yes |

| 4 | MEXC Global | $3.31B | 7.1% | -1.8% | 589 | 2.9M | 1,900+ | 2,100+ | Yes (40+ fiat) |

| 5 | OKX | $2.67B | 7.0% | -16.3% | 713 | 5.4M | 390+ | 750+ | Yes (50+ fiat) |

| 6 | Coinbase | $2.33B | 6.9% | -10.2% | 702 | 3.6M | 250+ | 500+ | Yes (60+ fiat) |

| 7 | Bybit | $3.38B | 6.7% | -16.9% | 675 | 5.2M | 430+ | 820+ | Yes (20+ fiat) |

| 8 | Upbit | $1.84B | 6.4% | -34.0% | 620 | 1.8M | 190+ | 300+ | Yes (KRW only) |

| 9 | Crypto.com | $2.27B | 6.2% | -26.1% | 596 | 3.1M | 340+ | 500+ | Yes (50+ fiat) |

| 10 | HTX (Huobi) | $2.18B | 5.4% | +11.4% | 611 | 2.7M | 420+ | 880+ | Yes (30+ fiat) |

Key Trends: What’s Changing in the CEX Landscape?

- Binance’s dominance is declining slightly but still strong

- Gate.io and HTX outperformed in a volatile quarter

- Altcoin-focused platforms like MEXC and Bitget are drawing high traffic

- User preferences are shifting toward broader access and trading flexibility

- Non-U.S. exchanges are increasingly competitive across Asia and EMEA

Conclusion: What the 2025 Rankings Reveal About Crypto Exchanges

The top 10 crypto exchanges of 2025 show that while trading volume is still heavily centralized, growth stories are happening on the edges—especially in platforms focused on altcoins, regional expansion, and tech-forward features.

For traders and investors, this ranking underscores the need to monitor both liquidity and listing diversity, not just brand familiarity. As Q3–Q4 unfolds, the real question is whether market dominance will remain concentrated—or begin to meaningfully redistribute across more agile players.