Top 10 Crypto Payment Gateways for Businesses in 2025: The Best Solutions to Accept Bitcoin, Ethereum, and Stablecoins Online

Top 10 Crypto Payment : The way businesses handle transactions is changing, and in 2025, crypto payment gateways are no longer a niche experiment. From online stores to SaaS platforms and even traditional retailers, companies are looking beyond credit cards and bank transfers to accept Bitcoin, Ethereum, stablecoins, and other digital assets. The appeal is simple: lower fees, faster settlements, and a chance to serve a global audience that increasingly values digital-first finance.

This article takes a closer look at the Top 10 Crypto Payment Gateways for Businesses in 2025, comparing their features, accessibility, and costs. Whether you’re running a small Shopify store, managing a global eCommerce platform, or exploring Web3 payments, the right gateway can shape your customer experience and bottom line.

What is a Crypto Payment Gateway?

At its core, a crypto payment gateway is a digital bridge. It allows merchants to accept crypto payments from customers and then either hold the digital assets or instantly convert them into fiat currencies.

Here’s how it typically works: a customer checks out on your website, selects a cryptocurrency like Bitcoin, sends the payment, and the gateway verifies the transaction on the blockchain. Some gateways instantly convert it into fiat (like USD or EUR), while others settle in crypto directly.

Compared to traditional payment processors such as Stripe or PayPal, crypto payment gateways offer global accessibility, reduced fees, and fewer middlemen. Many also come with features like multi-coin support, APIs for developers, Shopify or WooCommerce plugins, and compliance measures like KYC/AML for regulated markets.

Key Factors to Consider When Choosing a Crypto Payment Gateway

Not every crypto payment processor suits every business. Here are some of the most important considerations:

- Transaction fees: Even a small percentage makes a difference in high-volume sales. Hidden costs also matter.

- Crypto support: Some only support Bitcoin and Ethereum, while others offer 300+ coins including stablecoins.

- Fiat conversion: Businesses must decide if they want instant fiat settlement or crypto-only payouts.

- Integration options: Look for easy plugins for Shopify, WooCommerce, or point-of-sale systems.

- Global accessibility: Certain gateways restrict services in specific regions.

- Compliance & regulation: For enterprises, KYC and AML adherence are critical.

- Customer support & security: Businesses need reliable uptime and robust fraud prevention tools.

Top 10 Crypto Payment Gateways for Businesses in 2025

1. Cryptomus

Source: cryptomus

Launched in 2022, Cryptomus has quickly become a favorite among small and medium-sized businesses. Supporting over 100 cryptocurrencies, it offers one of the lowest fees in the market at just 0.4% per transaction. Its features include auto-conversion, recurring payments, mass payouts, and even White Label options for businesses wanting more control.

Best suited for SMEs seeking affordable and flexible integration without compromising on functionality.

2. CoinGate

Source: Bitcoinworld

Established in 2014, CoinGate is available in more than 170 countries. It supports around 70 cryptocurrencies and offers merchants the option to convert instantly to fiat. Its ecosystem extends to gift cards, e-commerce plugins, and point-of-sale tools.

With transaction fees starting at 1%, CoinGate remains popular for businesses that value global accessibility and a balance between crypto and fiat services.

3. BitPay

Source: The Block

As one of the oldest names in the industry, BitPay (founded in 2011) has become synonymous with Bitcoin payment processing. Its platform is designed with a strong focus on compliance, invoicing tools, and direct bank transfers. While fees begin at 1%, what sets BitPay apart is its established reputation and enterprise-grade security.

This makes it a natural choice for larger companies prioritizing regulation and reliability.

4. DePay

Source: BeycanPress

Founded in 2020, DePay is unique as a Web3-native decentralized solution. It supports multiple chains and integrates seamlessly with WalletConnect, Solana Pay, and Coinbase SDK. Unlike many others, DePay doesn’t require KYC, making it attractive for decentralized finance projects and Web3 startups.

With its utility token DAPY helping to lower transaction costs, DePay appeals most to businesses immersed in the DeFi ecosystem.

5. CoinPayments

Source: CoinPayments blog

CoinPayments, established in 2013, supports over 200 cryptocurrencies. Merchants benefit from auto-conversion, shopping cart plugins, and point-of-sale compatibility. The fee structure is transparent: 0.5% plus network commissions.

Known for its long-standing presence, CoinPayments is well-regarded among merchants wanting token diversity and proven reliability.

6. Stripe (Crypto-enabled)

Source: LI

Stripe, one of the biggest global payment processors since 2010, has integrated crypto support in recent years. It blends traditional fiat processing with support for major digital currencies. With 450+ integrations across CRM, CMS, and POS platforms, Stripe offers a hybrid experience for businesses that want both fiat and crypto without multiple providers.

Its transaction fees start at just 0.25%, making it competitive for scaling businesses already within the Stripe ecosystem.

7. Cryptix

Source: The Crypto Basic

Cryptix, founded in 2017, caters to businesses looking for fast settlements and AML protection. It supports BTC, ETH, SOL, as well as fiat currencies like USD and EUR. Transactions are settled in as little as 15 minutes, and it also supports refunds and exchange services.

With fees starting at 0.2%, Cryptix stands out as one of the fastest and most security-focused gateways available.

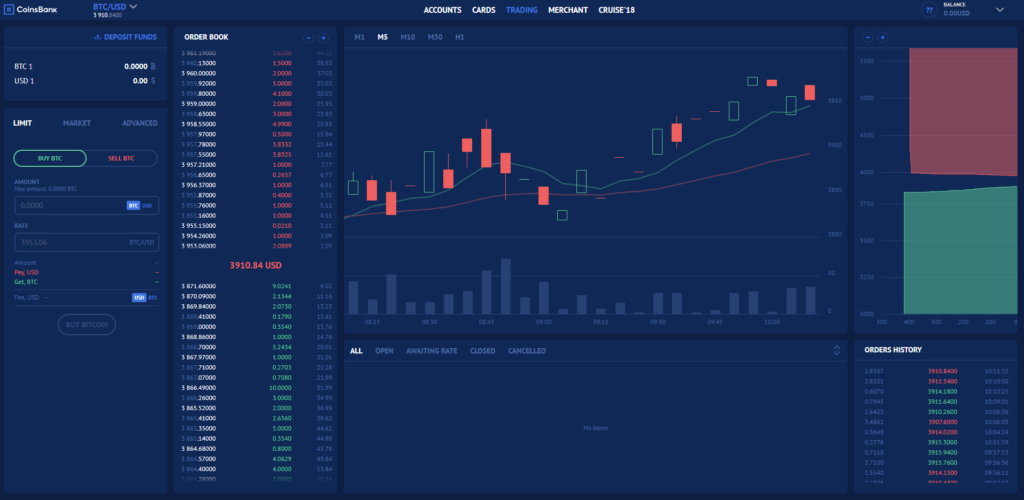

8. Coinsbank

Source: Cryptowisser

Unlike some competitors that focus on token variety, Coinsbank emphasizes financial services. Founded in 2016, it supports only four cryptos—BTC, ETH, LTC, and XRP—but provides robust wallet services and prepaid cards. Businesses can access fiat gateways and comprehensive wallet management.

It’s especially suited for fintechs or companies that prefer simple crypto options paired with strong fiat solutions.

9. NOWPayments

Source: NowPayments

A relatively newer player since 2019, NOWPayments has gained traction, particularly in Asia, including Malaysia. It supports over 300 cryptocurrencies and offers some of the lowest fees at 0.5% per transaction. Features include auto-conversion, recurring billing, donation widgets, and mass payouts.

With its wide token support and affordable pricing, it’s a strong option for global merchants who want scale without high costs.

10. Coinbase Commerce

Source: Medium

Launched in 2018, Coinbase Commerce benefits from the trust and recognition of the larger Coinbase brand. Supporting 100+ cryptocurrencies, it offers businesses tools such as volatility-free payments, fiat settlement, and a user-friendly merchant dashboard.

At a flat 1% fee, it is especially appealing to businesses seeking brand trust and compliance with direct integration into the Coinbase ecosystem.

Comparison Table: Top Crypto Payment Gateways 2025

| Payment Gateway | Founded | Cryptos Supported | Fees | Key Features | Best For |

|---|---|---|---|---|---|

| Cryptomus | 2022 | 100+ | 0.4% | Auto-conversion, Recurring, White Label | SMEs, low fees |

| CoinGate | 2014 | 70+ | 1% | Fiat conversion, Gift cards, Plugins | Global reach |

| BitPay | 2011 | 16+ | 1% | Invoicing, Compliance, Bank transfer | Enterprises |

| DePay | 2020 | 1000+ wallets | 1% | Web3-native, No KYC, Multi-chain | DeFi & Web3 projects |

| CoinPayments | 2013 | 200+ | 0.5% | Multi-coin, POS, Auto-conversion | Token diversity |

| Stripe (Crypto) | 2010 | Major tokens | 0.25%+ | Compliance, 450+ integrations | Hybrid fiat + crypto businesses |

| Cryptix | 2017 | BTC, ETH, SOL | 0.2% | AML checks, Refunds, Fast settlement | Fast & secure payments |

| Coinsbank | 2016 | 4 cryptos | 0.5% | Wallets, Fiat, Prepaid cards | Fintech & wallet-focused businesses |

| NOWPayments | 2019 | 300+ | 0.5% | Auto-conversion, Recurring, Donations | Global merchants |

| Coinbase Commerce | 2018 | 100+ | 1% | Dashboard, Fiat settlement, Compliance | Coinbase ecosystem users |

Why Crypto Payment Gateways Matter for Businesses in 2025

The rise of digital payments is no longer just a trend—it’s a business necessity. In 2025, crypto adoption continues to expand globally, particularly in eCommerce and cross-border trade. Customers increasingly expect businesses to offer multiple payment methods, including digital currencies, as a sign of trust and flexibility.

For merchants, crypto gateways also bring cost savings, transparency, and faster access to funds compared to traditional banking systems. Businesses that move early often gain a competitive advantage by being seen as more adaptable and customer-friendly.

Top 10 Crypto Payment – The Future of Crypto Payments for Businesses

Looking ahead, several shifts are shaping the space:

- DeFi and Web3 integration will make decentralized payments a seamless part of online transactions.

- Stablecoins are expected to become the preferred currency for merchants seeking price stability.

- Stronger regulations will provide more clarity and safety for enterprises and customers alike.

- Multi-chain solutions will allow businesses to accept payments across ecosystems without complexity.

- Industries like gaming, travel, and SaaS are projected to be leading adopters of crypto-first payment systems.

Conclusion – Top 10 Crypto Payment

Crypto payment gateways are reshaping how businesses approach transactions in 2025. From low-fee solutions like Cryptomus and NOWPayments to enterprise-ready platforms such as BitPay and Coinbase Commerce, the landscape offers something for every business model.

The key takeaway is that there’s no single best option—choosing among the Top 10 Crypto Payment Gateways depends on business size, region, and priorities. By weighing factors like fees, compliance, crypto variety, and integration, businesses can find the right balance and stay ahead in an increasingly digital economy.