TOP 10 Crypto Regulations That Could Shake 2025: Global Shifts and What They Mean

The TOP 10 crypto regulations to watch in 2025 highlight a turning point for the digital asset world. Over the past decade, cryptocurrency has evolved from a niche experiment to a recognized global financial asset class, attracting investors, institutions, and even central banks. But with growth comes increased scrutiny. Governments are moving beyond debates over whether to regulate — the focus now is on how.

From the United States’ shifting stance under new political leadership, to the European Union’s rollout of its landmark MiCA framework, to Asia’s blend of strict oversight and innovation-friendly policies, the regulatory landscape is anything but uniform. Add to this the growing pressure for Anti-Money Laundering (AML) and Know Your Customer (KYC) compliance, plus looming rules for stablecoins, DeFi, and even taxation, and 2025 is shaping up to be a year of dramatic change for crypto.

Before diving into the detailed TOP 10 list, here’s a snapshot of how key regions are positioning themselves in the year ahead.

Comparative Summary Table: Global Crypto Regulations 2025

| Region / Country | Legal Status | Main Regulator(s) | Licensing Requirements | Tax Treatment | Notable Restrictions |

|---|---|---|---|---|---|

| United States | Legal, regulated | SEC, CFTC, FinCEN, OFAC, IRS | Federal + state licenses (e.g., NY BitLicense) | Property for tax purposes | AML/KYC, Travel Rule, SEC oversight |

| European Union | Legal | ESMA + national regulators | MiCA unified license | Varies by member state | AMLD5/6 compliance, consumer protections |

| China | Banned | N/A | N/A | N/A | Complete ban on crypto trading & mining |

| Japan | Legal | FSA, JVCEA | FSA registration | Miscellaneous income | Remittance limits, strict AML rules |

| Singapore | Legal | MAS | MAS licensing | Income tax rules vary | Restrictions on retail marketing, stablecoin framework |

| South Korea | Legal, regulated | FSC | Licensing under 2023 Act | Income tax planned (delayed) | Privacy coin ban |

| UK | Legal | FCA | Registration under FCA | CGT applies | Ban on retail derivatives |

| Australia | Legal | AUSTRAC | AUSTRAC registration | CGT applies | Privacy coin ban |

| Canada | Legal | FINTRAC, provincial securities regulators | Platform registration | Commodity tax treatment | Custody & insurance requirements |

| India | Legal but heavily restricted | RBI, Ministry of Finance | No formal licensing | 30% tax on gains | High taxation, no loss offsets |

1. The Global Push for Stricter AML & KYC Rules

Source: Linkedin

Across 2024 and into 2025, one regulatory theme is consistent: governments worldwide are strengthening Anti-Money Laundering (AML) and Know Your Customer (KYC) requirements for the crypto sector. This isn’t just about ticking compliance boxes — regulators are expanding “Travel Rule” obligations to ensure transaction transparency, targeting anonymous transactions often linked to illicit activities. For exchanges, DeFi platforms, and even wallet providers, this means tighter onboarding processes and more thorough transaction monitoring. While some fear this could slow innovation, others see it as a necessary step to protect legitimate investors.

2. TOP 10 Crypto Regulations: Stablecoin Reserve Transparency and Licensing Requirements

Source: ELLIPTIC

Stablecoins are facing some of the most significant upcoming changes. In 2025, several jurisdictions — including Singapore, Japan, and the EU under its MiCA framework — will require issuers to maintain transparent reserve audits and secure licenses before operating. This is a direct response to past concerns about undercollateralized stablecoins and the systemic risk they might pose to the broader financial system. If these measures take hold globally, stablecoins may start resembling traditional bank products in regulation, even if they remain blockchain-native in function.

3. TOP 10 Crypto Regulations: DeFi Under the Microscope: Smart Contract & DAO Regulation

What was once the “Wild West” of finance is now firmly on the radar of regulators. Decentralized Finance (DeFi) protocols, DAOs (Decentralized Autonomous Organizations), and even non-custodial interfaces are increasingly being treated as financial intermediaries. In the U.S., the SEC is exploring whether front-end interfaces to DeFi fall under existing securities laws, while the EU is working on specific clauses in MiCA to address decentralized protocols. 2025 could see the first formal licensing regimes for DeFi — a move that may reshape how developers and communities operate globally.

4. TOP 10 Crypto Regulations: The United States’ Policy Pivot: From Strict Oversight to Deregulation?

Source: Sygna

The U.S. regulatory environment remains fragmented, with multiple agencies — SEC, CFTC, FinCEN, OFAC, IRS — each claiming authority over parts of the crypto space. However, 2025’s political landscape could shift the tone. The Trump administration has signaled a more industry-friendly approach, potentially rolling back certain restrictive measures and clarifying the SEC vs. CFTC jurisdiction battle. That said, enforcement actions against non-compliant projects are unlikely to vanish overnight, meaning U.S.-based firms will still need robust compliance frameworks.

5. TOP 10 Crypto Regulations : MiCA Implementation in the European Union

Source: beincrypto

The EU’s Markets in Crypto-Assets Regulation (MiCA) officially kicks into gear in 2025, introducing a unified licensing system for crypto companies across all member states. This creates both clarity and complexity — while firms can now operate across the EU with one license, they must adhere to strict capital, consumer protection, and AML requirements. The MiCA rollout is being closely watched by other regions, especially in Asia, as a potential model for harmonized crypto regulation.

6. Asia’s Divergent Paths: Japan, Singapore, and South Korea

Source: Insights

Asia presents a mixed regulatory picture for 2025. Japan continues its pro-crypto but heavily supervised approach, requiring exchanges to register with the Financial Services Agency (FSA) and comply with stringent AML rules. Singapore is refining its licensing under the Monetary Authority of Singapore (MAS), with added restrictions on retail marketing. South Korea is expanding oversight under its 2023 Act on Virtual Asset Users, including a ban on privacy coins. Collectively, these moves show Asia is moving toward a regulated but innovation-friendly environment — provided firms play by the rules.

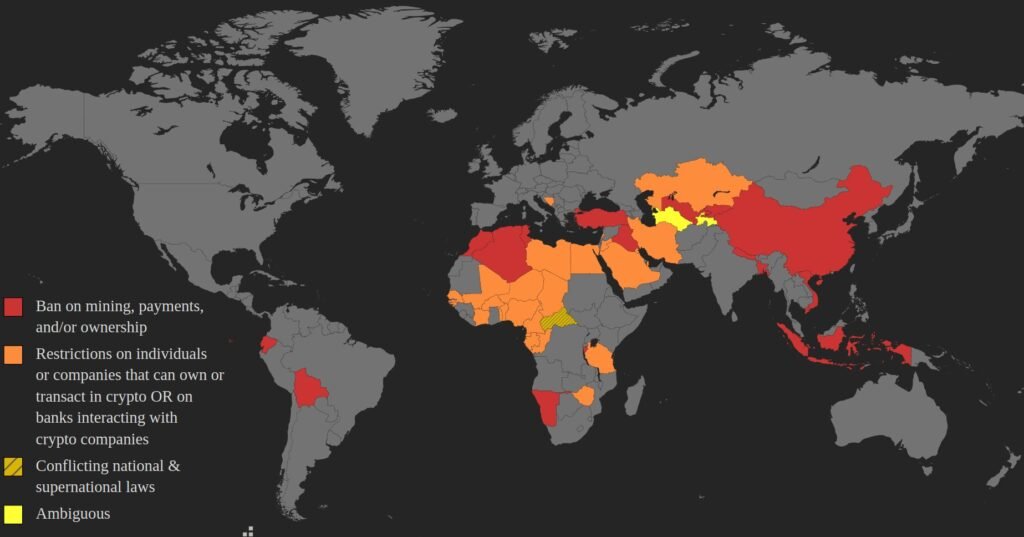

7. Countries with Complete or Partial Crypto Bans

Source: Axiom Alpha

Some jurisdictions remain resolutely anti-crypto. China maintains its blanket ban on trading and mining, effectively forcing activity underground or overseas. India hasn’t imposed a full ban but uses heavy taxation and regulatory uncertainty to discourage retail participation. While these policies isolate domestic markets from global trends, they also push talent and innovation toward more open jurisdictions, a shift that could reshape the global crypto map over the next decade.

8. Cross-Border Enforcement Cooperation

With crypto transactions often moving across multiple jurisdictions in seconds, regulators are stepping up cross-border collaboration. Agencies like the Financial Action Task Force (FATF) are pushing for greater alignment in AML, sanctions enforcement, and fraud investigations. In practice, this means a suspicious transaction flagged in one country could quickly lead to asset freezes or enforcement actions in another. For global exchanges and wallet providers, this interconnected enforcement network raises the stakes for compliance slip-ups.

9. The Rise of CBDC Regulations and Their Impact on Crypto

Source: Indodax

Central Bank Digital Currencies (CBDCs) are moving from pilot programs to real-world deployments in 2025, with countries like China, the EU, and several emerging economies leading the way. While CBDCs are not direct crypto bans, their rollout often coincides with tighter restrictions on private digital currencies, especially in payment use cases. This regulatory balancing act — encouraging CBDC adoption while not stifling crypto innovation — will be a defining challenge for policymakers worldwide.

10. Preparing for New Crypto Tax Rules in 2025

Taxation is becoming a core part of crypto regulation. The IRS in the U.S., the Australian Taxation Office (ATO), and the Canada Revenue Agency (CRA) are all refining how they classify and tax digital assets. In 2025, expect broader reporting obligations for both individuals and institutions, potentially including wallet-to-wallet transfers. Countries may also introduce real-time tax reporting systems, mirroring existing frameworks for securities. For investors, staying ahead of these changes will be as critical as picking the right coins.

Conclusion

From AML crackdowns to the formal licensing of stablecoins and DeFi protocols, the TOP 10 crypto regulations shaping 2025 reflect a maturing industry moving toward mainstream integration. While some regions embrace clear and supportive rules, others tighten restrictions or maintain outright bans. For global investors and businesses, understanding — and adapting to — these shifts will be key to staying compliant without missing new opportunities.