Top 10 DeFi Projects to Watch in 2025: Innovation, Utility, and Market Impact

Decentralized finance, or DeFi, has shifted from being a niche blockchain experiment to a core component of the global crypto economy. The top 10 DeFi projects in 2025 aren’t just about hype — they’re about building systems that replace or complement traditional banking functions with transparent, open-source protocols. From lending and staking to yield optimization, each project brings unique value to the evolving ecosystem.

While thousands of DeFi tokens and platforms exist, the projects listed here stand out for their adoption, innovation, and staying power. They also highlight the diverse directions DeFi is taking — some focusing on security and compliance, others pushing the limits of interoperability and user experience.

Top 10 DeFi Projects : Uniswap (UNI)

Source: Binance academy

Uniswap remains a cornerstone of decentralized exchanges (DEXs), offering token swaps without intermediaries. Launched in 2018, it pioneered the automated market maker (AMM) model, allowing liquidity providers to earn fees by adding tokens to pools. With Uniswap v4 on the horizon, features like customizable liquidity hooks and reduced gas fees are expected to attract both developers and traders.

Its cross-chain ambitions and consistently high trading volume make it one of the most recognized DeFi platforms globally. Still, competition from newer DEXs and regulatory pressures could challenge its dominance.

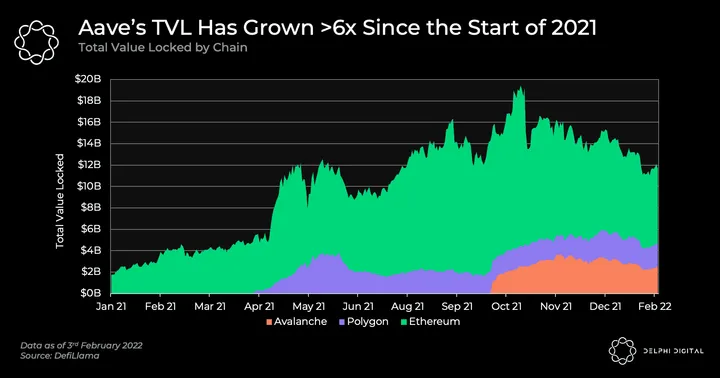

Top 10 DeFi Projects : Aave (AAVE)

Source: delphidigital

As one of the leading decentralized lending platforms, Aave enables users to deposit crypto assets and earn interest or borrow against them without traditional credit checks. Known for its flash loans — uncollateralized loans executed within one transaction block — it has expanded its offerings to include multiple chains and collateral types.

With billions in total value locked (TVL), Aave’s security track record and governance-driven upgrades have kept it at the forefront of DeFi lending. The challenge ahead lies in maintaining growth while balancing risk in a more regulated crypto environment.

Top 10 DeFi Projects : MakerDAO (DAI)

MakerDAO stands out for its stablecoin DAI, which maintains a soft peg to the US dollar without relying on a central authority. This stability is achieved through overcollateralized loans and an on-chain governance system run by MKR token holders.

It has played a critical role in DeFi’s stability layer, integrating with lending, yield farming, and payment applications. However, as regulators intensify scrutiny on stablecoins, MakerDAO faces a balancing act between decentralization and compliance.

Top 10 DeFi Projects : Curve Finance (CRV)

Curve Finance specializes in low-slippage swaps for stablecoins and pegged assets. Its focus on efficient trading for assets with similar prices has made it essential for stablecoin liquidity. Liquidity providers benefit from incentives in both CRV and partner protocol tokens.

Its integration with other DeFi protocols has amplified its influence, but the competitive landscape of AMMs means Curve must continue innovating to maintain market share.

Top 10 DeFi Projects : Lido Finance (LDO)

Source: Medium

Lido has become the dominant player in liquid staking, allowing users to stake Ethereum and other proof-of-stake (PoS) assets without locking them up. Users receive stETH or other derivative tokens, which can then be used in other DeFi activities.

This flexibility has made Lido integral to the staking ecosystem, especially post-Ethereum’s shift to PoS. Still, its size raises concerns about centralization in staking, a debate likely to intensify in 2025.

Synthetix (SNX)

Source: Gate

Synthetix enables the creation of synthetic assets — on-chain tokens that track the value of real-world assets like currencies, commodities, and indices. This allows traders to gain exposure without holding the underlying asset.

The platform’s integration with perpetual futures markets and DeFi trading protocols has expanded its reach, making it a hub for derivatives in DeFi. However, liquidity depth and competition from newer synthetic asset platforms remain ongoing challenges.

Balancer (BAL)

Balancer offers multi-token liquidity pools with customizable parameters, enabling innovative portfolio management strategies. Its flexibility allows for weighted pools, fee adjustments, and composability with other DeFi protocols.

This adaptability has made Balancer attractive for both institutional players and experimental DeFi builders. Market volatility and user acquisition remain critical factors for its long-term success.

Compound (COMP)

Source: Capital.com

Compound is a pioneer in algorithmic money markets, allowing users to supply assets to earn interest or borrow against them. Its interest rates adjust automatically based on supply and demand.

The COMP governance token distributes control among users, setting a precedent for decentralized governance in DeFi lending. While its model is widely copied, Compound’s brand recognition and developer trust keep it competitive.

Yearn Finance (YFI)

Source: Atomic Wallet

Yearn Finance automates yield farming through its Vaults, optimizing returns for users with minimal manual management. It aggregates strategies across multiple protocols, making it a one-stop platform for passive DeFi investing.

Its community-driven governance and rapid product development have kept it relevant, though yield compression in the market could limit future growth potential.

PancakeSwap (CAKE)

Source: Stormgain

Operating on Binance Smart Chain (BSC), PancakeSwap offers low-fee token swaps, liquidity farming, and even lottery and NFT features. Its lower transaction costs make it appealing to retail traders priced out of Ethereum gas fees.

While some critics see it as an Ethereum DEX clone, PancakeSwap’s strong community and constant feature updates have secured its position as BSC’s flagship DEX.

Comparative Snapshot of the Top 10 DeFi Projects

| Project | Launch Year | Primary Function | TVL (Latest) | Governance Token | Chain Compatibility | Unique Strength |

|---|---|---|---|---|---|---|

| Uniswap | 2018 | AMM DEX | High | UNI | Multi-chain | Liquidity depth |

| Aave | 2020 | Lending/Borrowing | High | AAVE | Multi-chain | Flash loans |

| MakerDAO | 2017 | Stablecoin issuance | High | MKR | Ethereum-based | Decentralized stablecoin |

| Curve Finance | 2020 | Stable asset swaps | High | CRV | Multi-chain | Low slippage |

| Lido Finance | 2020 | Liquid staking | High | LDO | Multi-chain | stETH liquidity |

| Synthetix | 2018 | Synthetic assets | Medium | SNX | Ethereum & L2 | Derivatives hub |

| Balancer | 2020 | Multi-token AMM | Medium | BAL | Multi-chain | Customizable pools |

| Compound | 2018 | Lending/Borrowing | Medium | COMP | Ethereum-based | Algorithmic rates |

| Yearn Finance | 2020 | Yield aggregation | Medium | YFI | Multi-chain | Automated strategies |

| PancakeSwap | 2020 | DEX + farming | High | CAKE | BSC | Low fees |

Key Trends in DeFi for 2025

The DeFi sector in 2025 is shaped by three major forces: interoperability, tokenized real-world assets, and liquid staking dominance. Cross-chain protocols are enabling seamless movement of assets, while tokenization is bringing traditional assets like bonds and commodities on-chain.

At the same time, staking protocols — particularly those offering liquidity — are becoming central to DeFi’s yield landscape. Regulatory developments, especially around stablecoins and lending, will influence how projects adapt. Security is also moving beyond audits, with real-time threat detection and insurance integration becoming standard.

Conclusion

The top 10 DeFi projects for 2025 demonstrate the sector’s resilience and adaptability. From pioneering lending platforms to innovative staking solutions, each project reflects a different vision of decentralized finance.

For investors, developers, and users, the takeaway is clear: while the potential rewards are significant, careful research and risk assessment remain essential. As DeFi continues to evolve, its role in the broader financial landscape will only deepen, making 2025 another pivotal year for the sector.