Top 10 Regulatory Trends in Crypto for 2025: What Investors Need to Know

Top 10 Regulatory Trends : The crypto industry has always lived in a delicate balance between innovation and oversight, but 2025 is proving to be a decisive year. With institutional adoption rising, governments and regulators worldwide are stepping up compliance requirements. The goal is clear: to protect investors, ensure market stability, and curb financial crime—without suffocating the technological progress that made digital assets attractive in the first place.

Amid this backdrop, the top 10 regulatory trends highlight how global frameworks are converging, where regional differences remain, and what it means for crypto adoption going forward.

1. Global Harmonization of Crypto Regulations

Source: Ledgerinsights

Regulatory fragmentation has long frustrated industry players, but 2025 is seeing a push toward international alignment. The Financial Stability Board (FSB) and IMF have issued fresh recommendations urging global standards for digital assets. The United States, European Union, United Kingdom, and Asia-Pacific regulators are coordinating more closely, though differences in implementation still persist.

Harmonization matters because crypto is inherently borderless. Without shared rules, cross-border transfers and compliance frameworks become inefficient. A global approach could streamline licensing, enhance investor protection, and reduce regulatory arbitrage.

2. U.S. Regulatory Clarity and Executive Oversight

Source: Medium

For years, the U.S. regulatory environment was defined by uncertainty. Now, in 2025, clarity is beginning to emerge. New executive orders and congressional bills—such as the much-debated Digital Asset Market Structure Act—are paving the way for a unified framework.

The jurisdictional tug-of-war between the SEC and CFTC over tokens and stablecoins remains ongoing, but industry insiders expect clearer definitions in the coming months. For institutional players, this could be the green light needed to fully embrace Bitcoin ETFs, tokenized assets, and stablecoins under a more transparent regime.

3. The EU’s MiCA Regulation Rollout

The Markets in Crypto-Assets Regulation (MiCA) has officially begun rolling out across EU member states. Its licensing requirements for crypto service providers, along with stricter consumer protection rules, are reshaping how exchanges and custodians operate in Europe.

Beyond regional impact, MiCA is setting a global benchmark. Countries outside the EU are watching closely, with many expected to model their frameworks after MiCA. This regulatory clarity could make Europe a prime destination for crypto businesses seeking long-term stability.

4. Stablecoin Regulation and the Rise of CBDCs

Source: Vegavid

Stablecoins are no longer a niche corner of crypto—they’re systemically important. Regulators in the U.S. and EU are enforcing stricter rules on reserves, audits, and issuance. The days of unregulated stablecoins may be numbered.

At the same time, Central Bank Digital Currencies (CBDCs) are entering real-world trials. From China’s digital yuan to discussions about a potential U.S. digital dollar, CBDCs will coexist—and sometimes compete—with private stablecoins. This raises questions about the future of cross-border payments and the role of private issuers in global finance.

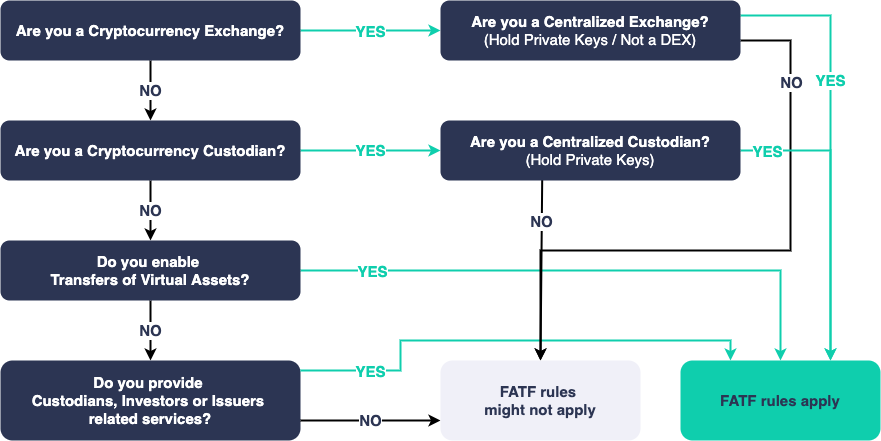

5. Top 10 Regulatory Trends : AML, KYC, and the Travel Rule

Source: KYC Chain

Anti-money laundering (AML) obligations are intensifying. The FATF Travel Rule, which requires exchanges to share sender and recipient details, is now being enforced across more jurisdictions.

For DeFi platforms and custodians, compliance brings significant challenges. Many smaller players may struggle with increased reporting requirements, while larger institutions have the resources to adapt. The result could be greater market consolidation as compliance becomes a barrier to entry.

6. Top 10 Regulatory Trends : DeFi and Decentralized Protocol Oversight

The decentralized nature of DeFi doesn’t exempt it from regulation. Authorities are exploring ways to impose KYC and AML rules on protocols that lack centralized operators. In some regions, smart contract audits are becoming mandatory.

This raises a fundamental question: how do you regulate an ecosystem built on code and distributed governance? Some jurisdictions are experimenting with frameworks for “responsible DeFi,” balancing innovation with accountability. Whether these efforts succeed will determine if DeFi remains an experimental niche or matures into mainstream finance.

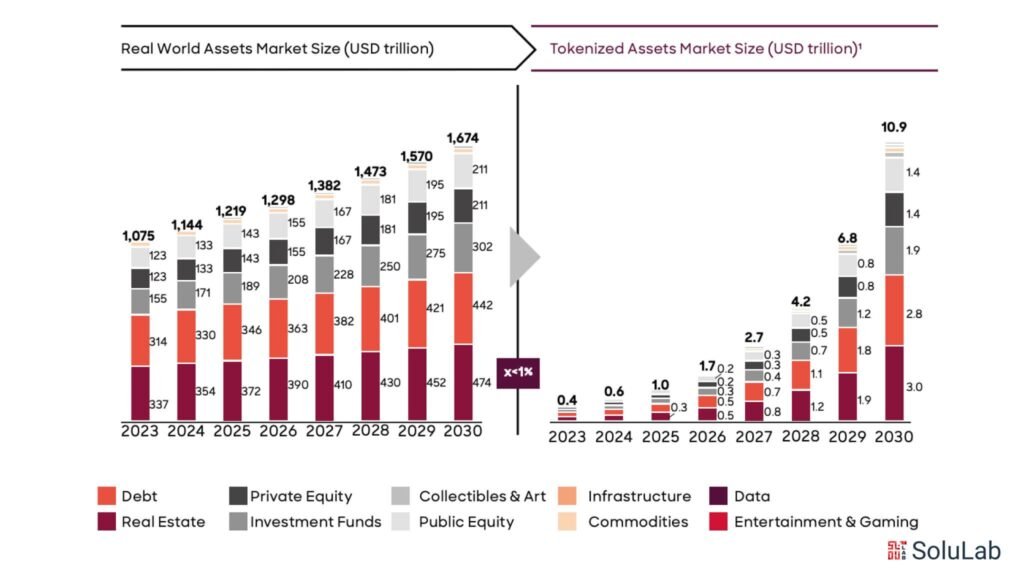

7. Top 10 Regulatory Trends : NFT and Tokenized Assets Regulation

Source: Solulab

NFTs and tokenized assets are facing closer scrutiny in 2025. Regulators are clarifying whether certain NFTs qualify as securities or commodities, particularly when linked to financial returns.

Meanwhile, the rise of real-world asset (RWA) tokenization—from real estate to government bonds—is prompting regulators to adapt existing laws to digital formats. Taxation and copyright remain thorny issues, with creators and investors needing clearer guidance.

8. Top 10 Regulatory Trends : Crypto Tax Compliance and Reporting

Source: Chainalysis

Tax reporting is becoming unavoidable. The IRS, HMRC, and EU tax authorities have rolled out stricter reporting standards, covering both individuals and institutions. Exchanges are being required to integrate automated tax reporting tools, easing the process for users but tightening enforcement.

Cross-border cooperation is also expanding, meaning tax evasion through crypto is increasingly difficult. For many investors, this signals the end of the “gray zone” era of crypto taxes.

9. Cybersecurity, Fraud Prevention, and Consumer Protection

With billions in losses from hacks and scams, regulators are prioritizing cybersecurity. Custody providers now face stricter requirements for insurance, audits, and compensation obligations if customer funds are stolen.

At the same time, fraud prevention laws are intensifying. Exchanges must implement stronger user protections, while regulatory sandboxes allow startups to innovate within a safer environment. The balance here is crucial: protecting consumers without discouraging new entrants.

10. ESG and Green Crypto Regulations

Source: The Conversation

Sustainability has become a regulatory priority. The EU is leading efforts to impose carbon disclosure requirements on mining operations. Incentives for renewable-powered crypto mining are being introduced in multiple regions.

Investors are also demanding transparency, pushing projects to adopt greener consensus mechanisms. Bitcoin’s energy debate continues, but broader industry initiatives show that “green crypto” is no longer optional—it’s becoming regulatory expectation.

Conclusion

The top 10 regulatory trends in crypto for 2025 illustrate a global market in transition. From MiCA rollout and stablecoin laws to DeFi oversight and environmental reporting, the year represents a turning point for digital assets.

The long-term outlook is a cautious optimism: greater compliance may reduce short-term flexibility, but it also builds trust, fosters institutional adoption, and sets the foundation for sustainable market growth. For investors and builders alike, adapting to this new era of regulation will be as important as keeping up with the technology itself.