TOP 10 Risks and Threats to Crypto in 2025: What Investors Should Watch

The cryptocurrency market in 2025 is a paradox — thriving with innovation yet increasingly vulnerable to complex threats. While adoption rates soar globally, so too do the risks that could shake investor confidence. From shifting regulations to technology-driven vulnerabilities, the landscape is far from stable. Understanding these TOP 10 Risks and Threats is essential for investors, developers, and regulators who aim to navigate the year ahead with informed caution.

1. Regulatory Crackdowns and Legal Uncertainty

Source: CryptoBlogs

Regulation remains the most unpredictable force shaping the crypto market in 2025. Several countries have introduced tighter Anti-Money Laundering (AML) and Know Your Customer (KYC) requirements, and some have moved to limit anonymous transactions entirely.

Regions like the European Union have expanded their MiCA (Markets in Crypto-Assets) framework, while certain Asian nations have applied strict exchange licensing rules. The challenge for crypto projects lies in adapting quickly without losing operational flexibility. If these measures accelerate, smaller exchanges and DeFi platforms could find themselves locked out of key markets.

2. AML/KYC Non-Compliance Risks

Source: Flagright

Even as regulation intensifies, not all exchanges meet the required AML and KYC standards. In 2025, enforcement has escalated — authorities are imposing heavy fines, suspending licenses, and in extreme cases, shutting down platforms.

Research suggests a significant percentage of smaller or offshore exchanges still operate with minimal KYC checks, making them a target for money laundering investigations. For investors, the lesson is clear: using platforms without proper compliance measures is increasingly risky.

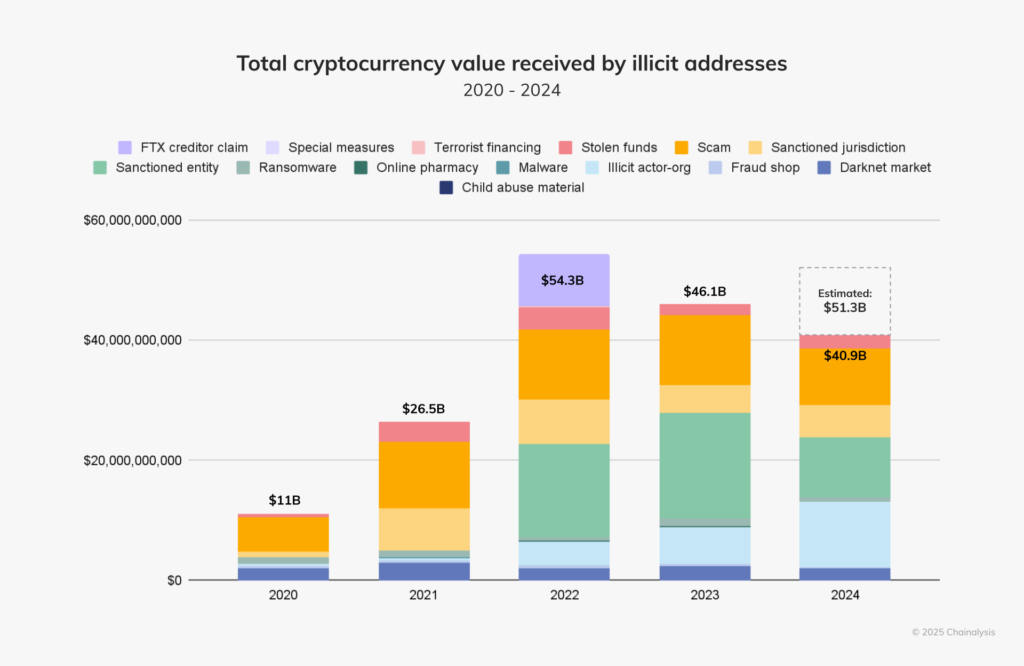

3. Cybersecurity Threats and Exchange Hacks

Source: Chainalysis

The sophistication of crypto-related cybercrime continues to grow. In 2025, attacks have shifted from basic phishing scams to complex smart contract exploits and AI-assisted hacking campaigns.

Decentralized exchanges (DEXs) remain prime targets, as their open-source nature often leaves exploitable code in plain sight. High-profile breaches in late 2024 and early 2025 have collectively cost billions, proving that even the largest exchanges aren’t immune. Cold storage, multi-sig wallets, and frequent audits are no longer optional — they’re survival tools.

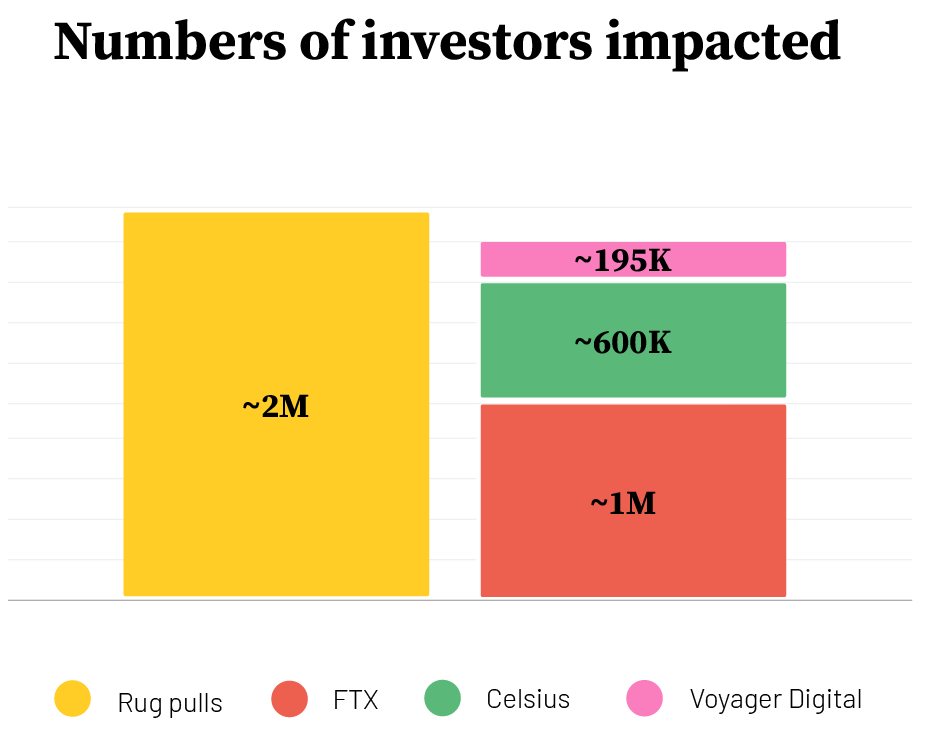

4. Fraud, Scams, and Rug Pulls

Source: SOLIDUS LABS

Fraudulent projects still thrive, especially in DeFi and NFT markets. The 2024 boom in meme coins and low-liquidity tokens has carried over into 2025, with many projects disappearing overnight — taking investor funds with them.

A lack of investor education and the lure of high returns contribute to the problem. While some regulators are targeting pump-and-dump schemes, enforcement lags behind the speed at which scams evolve.

5. Stablecoin Depegging and Liquidity Risks

Source: Cryptonews

Stablecoins, once seen as the “safe” corner of crypto, are facing their own credibility crisis. Even fiat-backed stablecoins like USDT and USDC have come under scrutiny for reserve transparency, while algorithmic stablecoins remain fragile to market shocks.

History has shown how quickly confidence can collapse — a single depegging event can trigger widespread panic in DeFi lending pools and trading markets. This risk makes diversification of stablecoin holdings a prudent strategy for 2025.

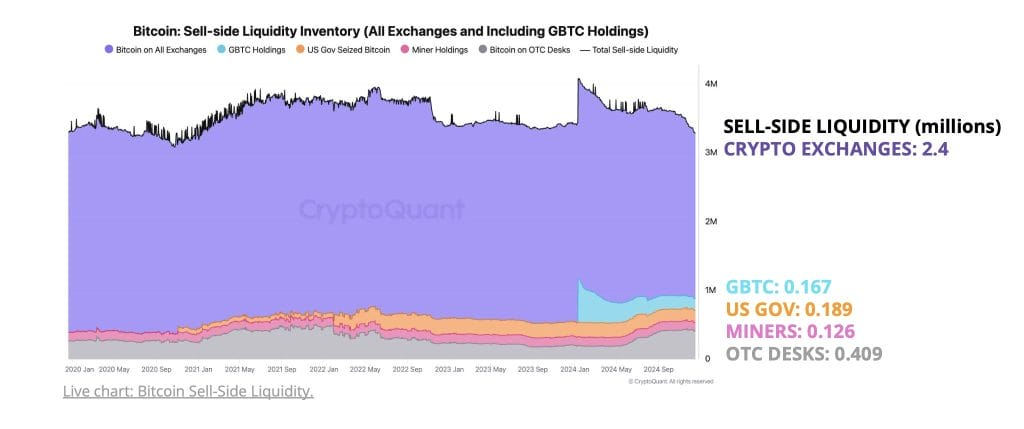

6. Market Volatility and Liquidity Shocks

Source: Cryptonews

Macroeconomic uncertainty, central bank policies, and whale-driven trades all contribute to unpredictable price swings. The rise of leveraged trading compounds the risk — one large sell-off can trigger cascading liquidations across exchanges.

Smaller tokens face an even greater challenge: thin liquidity means that even moderate trades can move prices sharply, leading to instability that scares off long-term investors.

7. Smart Contract Vulnerabilities

Source: Solulab

While smart contracts power most of DeFi, they also carry inherent risks. Coding flaws, rushed deployments, and insufficient audits have resulted in millions lost to exploits.

In 2025, the trade-off between innovation speed and security remains a contentious issue. Some projects still prioritize rapid launches over thorough code review, leaving them exposed to attacks that could have been prevented with better development discipline.

8. TOP 10 Risks and Threats : Cross-Border Compliance Challenges

Source: cellbunq

Crypto businesses operating internationally face a complex puzzle: varying laws, conflicting requirements, and sometimes outright bans. A platform legal in one jurisdiction may be considered illegal in another.

As more nations implement their own crypto frameworks, navigating these rules becomes increasingly resource-intensive — especially for smaller players without dedicated legal teams.

9. TOP 10 Risks and Threats : Environmental and ESG Pressures

Source: Lingarogroup

Crypto’s environmental footprint is under greater scrutiny than ever. Proof-of-Work mining, in particular, faces mounting criticism for its energy consumption. In some regions, new sustainability laws may directly restrict mining operations.

Institutional investors are also factoring Environmental, Social, and Governance (ESG) criteria into their crypto exposure. Projects unable to meet these standards risk being excluded from major investment portfolios.

10. TOP 10 Risks and Threats : Reputational Risks and Public Trust Erosion

Public trust is fragile in the crypto world. Each exchange collapse, scam, or high-profile arrest erodes confidence, making it harder for legitimate projects to attract users.

In 2025, the reputational stakes are higher than ever. Without consistent transparency, sound governance, and honest communication, the industry risks alienating both retail and institutional participants — potentially slowing adoption for years.

Conclusion – TOP 10 Risks and Threats

The TOP 10 Risks and Threats outlined here show that the challenges facing crypto in 2025 are deeply interconnected. Regulatory uncertainty feeds into market volatility, cybersecurity failures erode public trust, and environmental concerns shape investor sentiment.

While the sector continues to offer immense growth potential, proactive risk management is no longer optional. Building a resilient crypto ecosystem will require collaboration between regulators, businesses, developers, and investors — balancing innovation with responsibility to ensure the industry’s long-term survival.