Top 10 Smart Contract Platforms Competing With Ethereum in 2025: Scalability, Fees, and Future of Web3

Top 10 Smart Contract : Ethereum has long been the gold standard for smart contract platforms, paving the way for decentralized applications, DeFi protocols, and NFT ecosystems. Yet, as we step into 2025, the landscape is more competitive than ever. Rising adoption of DeFi, Web3 gaming, and enterprise blockchain solutions has created fertile ground for Ethereum competitors to thrive.

The global smart contracts industry continues to expand at a remarkable pace, with billions flowing into decentralized ecosystems. Ethereum remains dominant, but high gas fees, network congestion, and scalability challenges have opened the door for alternative blockchains that promise faster, cheaper, and more sustainable solutions.

What Are Smart Contract Platforms?

At their core, smart contract platforms are blockchain frameworks that allow developers to write, deploy, and execute self-executing agreements. These contracts verify transactions, enforce immutability, and ensure decentralized trust without intermediaries.

They power much of the blockchain world—DeFi lending protocols, NFT marketplaces, supply chain tracking, decentralized autonomous organizations (DAOs), and even cross-border payments. Ethereum set the benchmark by showing what was possible, but limitations such as expensive gas fees and congestion mean newer platforms are racing to offer better alternatives.

Key Factors Defining Ethereum Competitors

Before diving into the top 10 smart contract platforms in 2025, it’s worth noting the metrics that shape their competitiveness:

- Security: Preventing bugs, exploits, and vulnerabilities.

- Scalability: Handling thousands of transactions per second (TPS) without congestion.

- Transaction Costs: Keeping fees affordable for users and developers.

- Developer Ecosystem: Availability of tools, SDKs, and supportive communities.

- Consensus Mechanism: From Proof of Stake to unique models like Proof of History, shaping speed and security.

- Flexibility & Governance: Adaptability, on-chain governance, and upgradeability.

Ethereum remains the reference point, but each competitor brings unique trade-offs.

Top 10 Smart Contract Platforms Competing With Ethereum in 2025

1. Polkadot

Source: CCN

Polkadot distinguishes itself with a parachain model that enables true interoperability. Instead of being confined to a single blockchain, developers can build multi-chain applications where data and assets flow seamlessly. Powered by Nominated Proof of Stake (NPoS), Polkadot balances scalability with strong security.

Its main strength lies in cross-chain dApps and decentralized networks, though the challenge remains in growing a developer ecosystem as vast as Ethereum’s.

2. Hyperledger

Source: BlockChain Council

Hyperledger is a heavyweight in the enterprise blockchain space. Unlike permissionless networks, it offers permissioned frameworks designed for industries like finance, healthcare, and supply chains. Using BFT-based consensus models, Hyperledger emphasizes security, privacy, and customization.

While not a direct competitor to Ethereum in the public DeFi or NFT space, its modular architecture makes it indispensable for regulated industries seeking blockchain adoption.

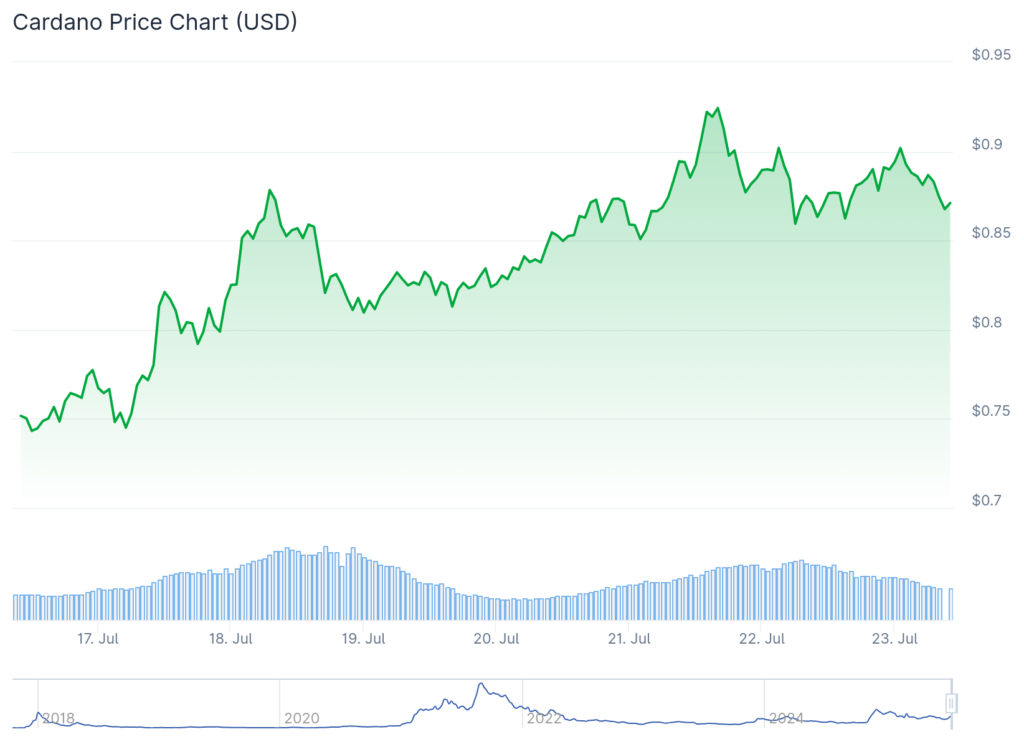

3. Cardano

Source: CoinCentral

Cardano takes a research-first approach, using peer-reviewed protocols and formal verification methods to ensure security. Its Ouroboros PoS consensus is energy-efficient and built on academic rigor.

Though adoption has been slower compared to faster-moving rivals, Cardano has carved a niche in government, healthcare, and education projects. Its ecosystem is growing steadily, with an emphasis on sustainability and trustworthiness.

4. Solana

Source: Cryptopotato

Solana is best known for speed—boasting over 65,000 TPS powered by its hybrid Proof of History and PoS consensus. Its thriving DeFi and NFT ecosystems have made it one of Ethereum’s most visible challengers.

However, Solana’s reliability issues, with occasional outages, continue to spark debate about long-term stability. Still, its ultra-fast transactions and low fees make it attractive for gaming, DeFi, and Web3 applications requiring instant settlement.

5. Binance Smart Chain (BSC)

Source: FMCPay

BSC positions itself as a low-cost Ethereum alternative with fast block times and broad adoption. Operating with a Delegated PoS model, it appeals to developers looking for affordability and ease of deployment.

Its centralization has been criticized, but BSC remains one of the most active ecosystems, particularly for DeFi projects, token swaps, and retail-friendly dApps.

6. Tezos

Tezos brings something unique: a self-amending blockchain. Its Liquid PoS consensus enables smooth governance upgrades without requiring hard forks, reducing friction for developers.

The platform has been particularly strong in digital art, tokenized assets, and sustainable projects, thanks to its energy-efficient design. While its adoption curve has been slower, its governance model remains a blueprint for future blockchain networks.

7. Stellar

Stellar is optimized for cross-border payments and remittances, leveraging its Federated Byzantine Agreement consensus. Transactions are near-instant and cost fractions of a cent, making it highly efficient for fintech and global transfers.

That said, its limited smart contract capabilities mean it’s less suitable for complex dApps. Instead, its role in global payments and micropayments gives it a unique position among Ethereum competitors.

8. Top 10 Smart Contract – Polygon

Source: The Block

Often described as Ethereum’s right hand, Polygon serves as a Layer-2 scaling solution rather than a full L1 alternative. Its PoS sidechains dramatically reduce transaction costs and increase throughput, while maintaining close ties to Ethereum’s developer community.

For dApps, DeFi, and NFT platforms that want scalability without leaving the Ethereum ecosystem, Polygon remains the go-to choice. Its strength lies in being complementary rather than fully competitive.

9. Top 10 Smart Contract – Algorand

Source: Flipster

Algorand’s Pure Proof of Stake (PPoS) makes it one of the most eco-friendly platforms available. With near-instant finality and a growing focus on sustainability, it appeals to enterprises and developers seeking green blockchain solutions.

While its ecosystem is smaller compared to Solana or BSC, Algorand is making steady progress in finance, government-backed blockchain initiatives, and sustainable applications.

10. Top 10 Smart Contract- Avalanche

Avalanche uses a unique consensus protocol with subnets—allowing developers to create customizable blockchains tailored to specific needs. Its near-instant finality, low fees, and eco-friendly operations have fueled adoption across DeFi and enterprise projects.

The challenge lies in managing the complexity of subnets, but its versatility positions Avalanche as a strong Ethereum competitor for Web3 infrastructure.

Top 10 Smart Contract : Which Smart Contract Platform Should You Choose?

There is no universal “best” platform—it depends on project needs.

- For DeFi and NFTs, Solana, Polygon, and BSC are popular picks.

- For cross-chain applications, Polkadot and Avalanche stand out.

- For enterprises and regulated industries, Hyperledger and Cardano offer strong foundations.

- For payments and remittances, Stellar remains unmatched.

- For sustainability-focused projects, Algorand and Tezos are excellent options.

Ethereum continues to be the benchmark, but 2025 is undeniably a multi-chain era.

Conclusion – Top 10 Smart Contract

The rise of Ethereum competitors highlights how far smart contract platforms have come. No longer a one-chain world, blockchain in 2025 is defined by diversity, specialization, and interoperability. While Ethereum still leads, Solana, Polkadot, Cardano, and others have proven that speed, affordability, and sustainability matter.

The future of decentralized applications will not be dominated by a single chain. Instead, the top 10 smart contract platforms will each thrive in their niches, shaping a multi-chain ecosystem where choice and flexibility define the next stage of Web3.