Top 10 Staking & Yield Platforms in 2025: Where Crypto Investors Earn Smarter

Crypto has matured in 2025, and so has the way investors earn from their digital assets. The top 10 staking & yield platforms play a central role in this evolution. Whether through traditional staking on proof-of-stake blockchains like Ethereum and Solana, or by participating in liquidity pools and yield farming, these platforms are where investors turn to secure passive income.

Staking not only strengthens blockchain security but also provides steady rewards. Yield farming, meanwhile, has shifted from a risky, experimental practice into a more stable income stream thanks to cross-chain liquidity and audited DeFi protocols. Investors are increasingly moving from centralized exchanges toward decentralized, non-custodial platforms—seeking more control, transparency, and flexibility in their crypto portfolios.

Understanding Staking & Yield Platforms

Staking is straightforward: lock tokens into a proof-of-stake blockchain and earn rewards in return. Ethereum, Solana, and Cardano are prime examples. Rewards depend on network demand, validator performance, and staking terms.

Yield farming is more dynamic. Instead of locking tokens directly into consensus, it involves providing liquidity, lending stablecoins, or deploying assets into strategies across DeFi. It’s where liquidity pools, cross-chain protocols, and stable yield strategies come into play.

The benefits are clear: passive income, diversified portfolios, and even governance rights in some ecosystems. But investors also face risks—from market volatility and slashing penalties, to smart contract vulnerabilities and liquidity lock-ups. Understanding these trade-offs is the first step to choosing the right platform.

Criteria for Evaluating Staking & Yield Platforms

Not all platforms are created equal. What makes one better than another often comes down to a mix of yield, security, and accessibility. APY rates matter, but so does the range of supported assets—whether you’re staking ETH, SOL, DOT, or stablecoins.

Security is critical, with top platforms undergoing regular audits and offering slashing protection. Ease of use is also key, especially for new investors who may prefer a simple UI or custodial options. Flexibility is another factor—does the platform lock funds for months, or offer liquid staking tokens for instant access? And finally, extra features like cross-chain support or governance participation can tip the scales.

Top 10 Staking & Yield Platforms in 2025

1. Binance Staking

Binance remains one of the most accessible entry points for staking. With a broad menu of coins—ETH, SOL, BNB, ADA, and DOT among them—users can choose between flexible and locked options. Yields typically range from 1% to 12%, depending on the asset and duration. The convenience is unmatched, but users must weigh that against custodial risks.

2. Coinbase Staking

Source: Coinbase

Coinbase has positioned itself as the beginner-friendly option, particularly for regulated markets like the U.S. It supports assets such as ETH, ADA, ATOM, and SOL. Yields are moderate, usually between 2% and 6%, with fees slightly higher than competitors. The appeal lies in compliance and simplicity rather than high returns.

3. Kraken Earn

Source: Kraken

Kraken continues to offer a strong balance between security and staking rewards. Assets like ETH, DOT, KSM, and ADA are supported, with yields ranging from 2% to 12%. Its reputation for transparency and protection makes it a favorite among security-conscious investors, though its selection is smaller than Binance’s.

4. Lido Finance (Decentralized Liquid Staking)

Source: Altcoinbuzz

Lido dominates the liquid staking space, especially for Ethereum. By issuing tokens like stETH and stSOL, it allows users to keep liquidity while earning yield (typically 4%–8%). Yet, debates around centralization and reliance on smart contracts remind investors that convenience comes with trade-offs.

5. Rocket Pool

Source: The Coin Republic

For ETH stakers who want a decentralized alternative, Rocket Pool remains a strong choice. With entry requirements as low as 0.01 ETH, it’s accessible to smaller investors while also supporting node operators. Rewards are competitive (3%–6%), and its decentralized ethos appeals to those avoiding centralized platforms.

6. Figment

Source: The Block

Figment stands out as an institutional-grade validator, offering a transparent, secure service for multiple chains including ETH, SOL, ATOM, NEAR, and DOT. Yields often fall between 4% and 12%. While aimed at institutions, its reliability and track record attract serious individual stakers as well.

7. Stakefish

Source: Stake Fish

Stakefish provides global validator services, covering ETH, SOL, ATOM, ADA, and more. Known for its strong validator presence and fair fee structures, it appeals to advanced stakers who prioritize decentralization and security over convenience.

8. P2P.org

Source: Egamers

Another institutional-grade option, P2P.org emphasizes slashing protection and transparency. Supporting ETH, SOL, DOT, and Cosmos, it’s a platform tailored for institutions but accessible to high-volume retail stakers as well. Features like analytics dashboards add a professional edge.

9. Marinade Finance (Solana Focused)

For those immersed in Solana’s ecosystem, Marinade is the go-to liquid staking protocol. By issuing mSOL, it enables liquidity while earning staking rewards (6%–8%). Integration across Solana DeFi adds extra utility, but exposure is limited to SOL only.

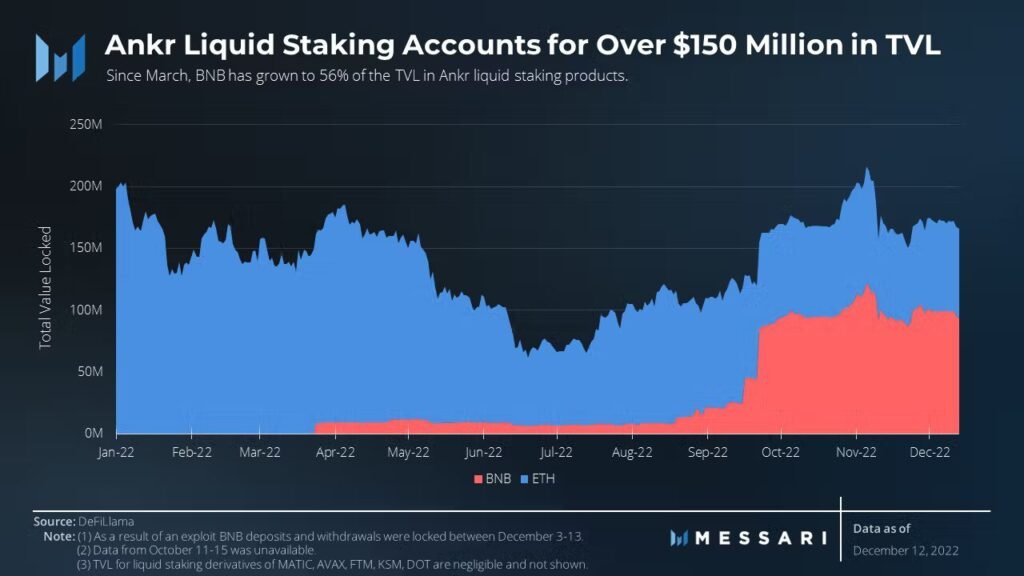

10. Ankr Staking

Source: Messari

Ankr offers one of the broadest multi-chain liquid staking solutions, supporting ETH, BNB, POL, FTM, and AVAX. Yields typically range from 3%–9%, with flexibility provided through its liquid staking tokens. Ankr also integrates with developer tools, bridging staking with Web3 infrastructure.

Comparative Table: Top Staking & Yield Platforms in 2025

| Platform | Type (CEX/DeFi) | Key Assets | APY Range | Liquidity Options | Best For |

|---|---|---|---|---|---|

| Binance | CEX | ETH, SOL, BNB, ADA | 1–12% | Flexible & Locked | Beginners & traders |

| Coinbase | CEX | ETH, ADA, SOL | 2–6% | Locked | Regulated users |

| Kraken | CEX | ETH, DOT, ADA | 2–12% | Locked | Security-focused |

| Lido | DeFi (Liquid) | ETH, SOL, MATIC | 4–8% | stTokens | DeFi users |

| RocketPool | DeFi | ETH only | 3–6% | rETH | ETH stakers |

| Figment | Validator | ETH, SOL, ATOM | 4–12% | Locked | Institutions |

| Stakefish | Validator | ETH, SOL, ADA | 4–10% | Locked | Advanced stakers |

| P2P.org | Validator | ETH, SOL, DOT | 4–12% | Locked | Institutions |

| Marinade | DeFi (Liquid) | SOL only | 6–8% | mSOL | Solana ecosystem |

| Ankr | DeFi (Liquid) | ETH, BNB, AVAX | 3–9% | aTokens | Multi-chain users |

How to Start Staking & Yield Farming in 2025 – Top 10 Staking & Yield

Starting is easier than ever. Investors first need to pick a platform—whether that’s a centralized exchange for simplicity, a validator service for reliability, or a DeFi protocol for flexibility. Next, choose assets based on yield, risk tolerance, and ecosystem alignment.

Consider lock-up periods: some platforms require months, while liquid staking offers immediate flexibility. Risk management is essential—diversify across assets and platforms, and stay updated on changing APYs. For those wanting balance, liquid staking tokens provide both yield and liquidity.

Top 10 Staking & Yield : Risks and Considerations

While staking and yield farming promise passive income, risks remain. Market volatility can erode gains, and slashing penalties may impact validators. Smart contracts, even audited ones, are not immune to exploits. Regulatory uncertainty, particularly in the U.S. and EU, continues to shape the space. Finally, centralization risks with major pools and CEX platforms must be weighed.

Future of Staking & Yield in 2025 and Beyond – Top 10 Staking & Yield

Looking ahead, liquid staking derivatives (LSDs) are expected to expand, providing new liquidity layers across DeFi. Multi-chain staking platforms will rise, connecting ecosystems that were once siloed. Institutions are treating staking as a mainstream financial product, offering clients a new income stream. Meanwhile, DeFi staking will likely merge with NFT utilities and Web3 apps, creating hybrid use cases that go beyond simple yields.

Conclusion – Top 10 Staking & Yield

The top 10 staking & yield platforms in 2025 highlight the diversity of choices available to crypto investors today. From the security of Kraken and Coinbase, to the flexibility of Lido and Rocket Pool, to the innovation of Marinade and Ankr—each caters to different needs. Success lies in matching goals with the right platform, balancing yield potential with security and liquidity. For both beginners and institutions, staking and yield remain central to crypto’s evolving economy.