Why Trading Journal Indonesia Is the New Edge for Smart Traders

Trading Journal Indonesia: In recent years, trading journals have gained significant traction among traders in Indonesia, especially within the growing communities involved in forex, crypto, and equity markets. This trend isn’t merely a passing phase; it’s a response to a deeper shift in how modern traders approach the market. As more people enter the trading scene—many through mobile apps and social trading platforms—the need for structure, discipline, and self-evaluation becomes more evident. A trading journal serves as a personal tool for tracking trades, analyzing decisions, and learning from both wins and losses. Indonesian traders are increasingly realizing that maintaining a journal is not just for beginners but is a long-term asset used by professional traders to stay accountable and improve over time.

What’s Fueling the Trend?

There are several key reasons why trading journals are trending in Indonesia. First, the growing availability of online resources—ranging from YouTube tutorials to free Excel templates—makes it easier than ever to start journaling, even for beginners. Second, the digital transformation of trading platforms allows for easy access to trade data and statistics, which traders can quickly log into their journals. Many Indonesian brokers now offer downloadable trade histories, which can be imported into spreadsheets or analysis tools. Third, the influence of trading education channels and mentors on social media is reinforcing the habit. Leading voices in the Indonesian trading scene increasingly advocate for journaling as a vital part of professional growth, not just a formality. These factors combined are encouraging more traders to treat journaling as a must-have tool for success.

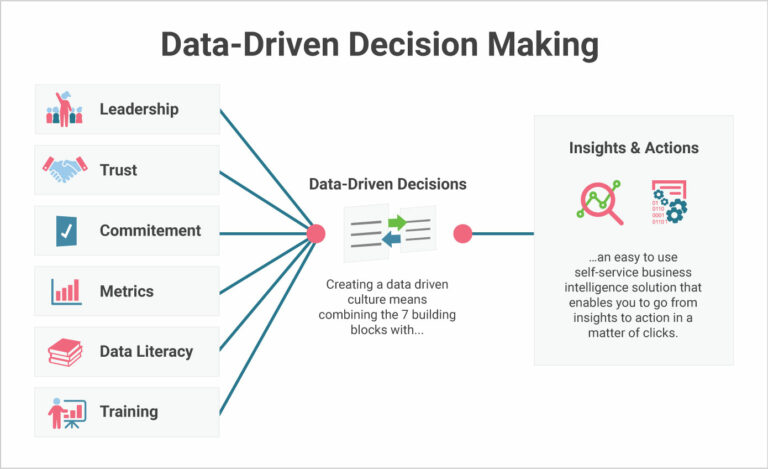

A Shift Toward Data-Driven Trading

Source: Reveal

One of the biggest changes that comes with using a trading journal is the shift from emotional to data-driven decision-making. When traders log and review each trade in detail—recording things like entry/exit price, reasons for the trade, psychological state, and the outcome—they create a database of personal trading behavior. Over time, patterns begin to emerge, such as which strategies yield the highest returns or what mistakes tend to happen under stress. This self-awareness is essential in a market that moves rapidly and unpredictably. In Indonesia, where traders often navigate high-volatility assets and time-sensitive trades, having a personal database to reflect on becomes a competitive edge. Journaling helps remove the guesswork, replacing it with informed insights backed by real trading data.

Trading Journal Indonesia: Benefits Gained by Indonesian Traders Using Journals

Source: Quantified Stratergies

The practical benefits of maintaining a trading journal are widely reported by traders across Indonesia. One major advantage is improved risk management. By recording each trade’s risk-reward ratio and actual outcome, traders can identify whether they are following their risk plan or deviating due to emotional decisions. Another benefit is better execution of strategy. By reviewing journal entries, traders can measure the effectiveness of their chosen setups and refine them over time. Emotional control is another frequently cited benefit. Many traders jot down their feelings before and after a trade—whether they felt anxious, greedy, or hesitant—which helps in identifying psychological patterns. Lastly, journaling accelerates the learning curve. Instead of making the same mistakes repeatedly, traders who review their journals can spot flaws early and adjust quickly. These benefits are particularly valuable for Indonesian traders navigating markets where timing and discipline are critical for success.

How to Start Your Own Trading Journal

Starting a trading journal does not require expensive software or complex tools. Many successful traders begin with something as simple as a Google Sheet or Excel spreadsheet. What matters is consistency and structure. At a minimum, your journal should include the instrument traded, entry and exit points, strategy used, position size, risk/reward ratio, and your reflections about the trade. You can also use platforms like Notion or Evernote to make your journal more visual by including chart screenshots or strategy notes. For those seeking automation, dedicated journaling software like Edgewonk or Trademetria can pull trade data directly from your broker and generate performance analytics. For Indonesian traders specifically, it’s also helpful to include additional context such as the trading platform used, internet speed at the time of trade, or regional news events that may have influenced your decisions. This added context makes the journal more insightful and locally relevant.

Final Thoughts: The Trading Journal as a Long-Term Asset

Source: Malaymail

As trading becomes more accessible and competitive in Indonesia, traders who rely on discipline, analysis, and continuous improvement are more likely to succeed in the long run. The trading journal is no longer just a basic record-keeping tool—it has evolved into a strategic asset. It provides clarity, builds confidence, and acts as a personal mentor, guiding you through both good and bad trades. With Indonesian traders gaining access to global markets, a well-maintained journal helps bridge the gap between impulsive trading and professional execution. Whether you’re trading forex during the London session, scalping crypto on local exchanges, or investing in IDX-listed stocks, a trading journal tailored to your strategy can be the difference between short-term luck and sustainable growth. This growing trend is here to stay, and embracing it now can put you ahead of the curve.