Why Trading Psychology Determines the Success of Beginner Traders in Indonesia

Trading psychology Indonesia refers to how emotions, mindset, and behavior affect a trader’s decision-making. Many beginner traders in Indonesia enter the markets with strong technical or fundamental skills but still struggle to succeed. Why? Because unmanaged emotions—like fear, greed, and regret—often override logic. Mastering trading psychology helps traders stay disciplined, minimize impulsive mistakes, and build long-term consistency.

How Does Fear Affect Beginner Traders in the Market?

Fear often arises from uncertainty, high volatility, or information overload. Beginner traders may hesitate to enter good trades or exit too early from promising ones due to fear of loss. In trading psychology, this emotional reaction can lead to missed opportunities. The key to managing fear is redefining how we perceive risk. Set clear risk thresholds and pre-plan exits to keep fear from dominating your strategy.

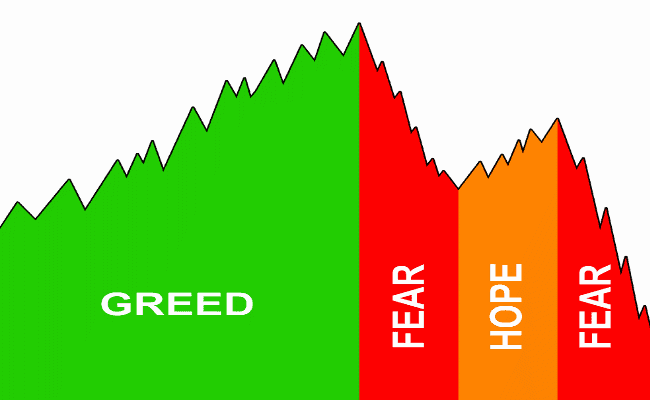

What Is the Role of Greed in Emotional Trading?

Source: DIVESH’S technical analysis

Greed pushes traders to overtrade or hold onto positions longer than they should. It’s the voice that says “just a little more” even when your targets are met. Many beginners ignore exit strategies or open too many trades at once in pursuit of fast profits. Self-awareness is critical here. Trading psychology Indonesia encourages setting profit targets ahead of time and following through, even if emotions tempt you to deviate.

Can Hope Be Dangerous in Trading Decisions?

Yes—especially when it becomes irrational. Hope causes traders to hold losing positions far too long, believing the market will eventually reverse in their favor. This can quickly lead to deeper losses. It’s important to replace hope with data-driven analysis. Trading is about probabilities, not wishful thinking. Objective decision-making is at the heart of sound trading psychology.

What Is Regret Trading and How Can Beginners Avoid It?

Source: Vox

Regret happens after missing an opportunity or making a bad call. This can trigger “revenge trading”—rushing into new trades just to make up for previous losses. It’s a dangerous spiral. Instead of reacting emotionally, take a pause. Review your trading journal, analyze what went wrong, and stick to your plan. Accept that losses are part of the process and don’t require emotional compensation.

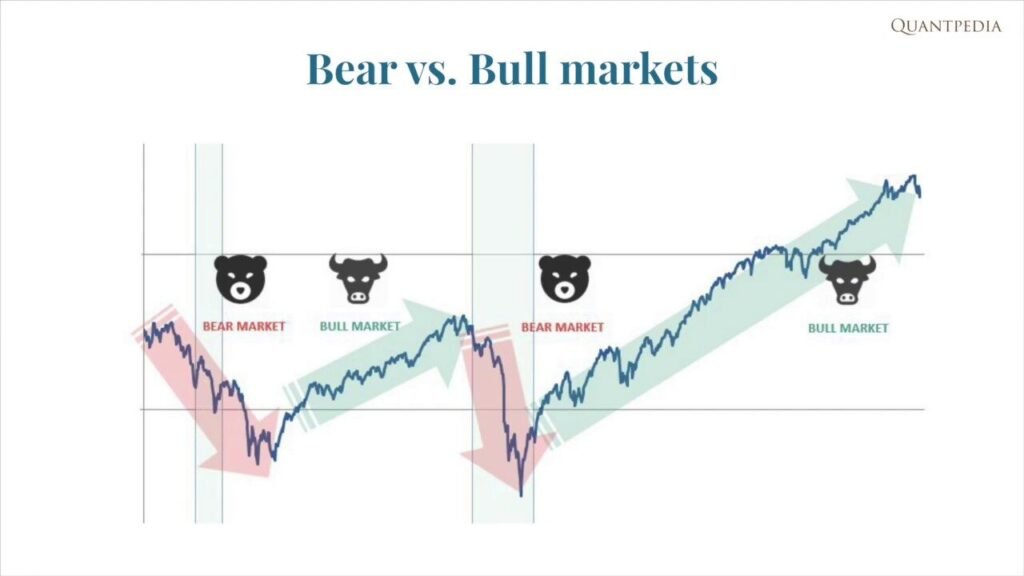

How Should Trader Mindset Adjust to Bear and Bull Markets?

Source: Quantpedia

In a bear market, caution and realism are essential. It’s a good time to focus on research and fundamentals rather than short-term profit. However, waiting too long may lead to missed opportunities.

In a bull market, the atmosphere is often hype-driven. FOMO (Fear of Missing Out) is high, and quick decisions are required. While momentum is key, discipline matters more. Know when to enter—and when to exit.

A successful trading mindset adapts to market conditions. It avoids panic in downtrends and overexcitement in uptrends. This adaptability defines mature trading psychology.

What Is the 3M Framework in Trading Psychology?

The 3M Framework is a balanced approach to trading success:

- Mind: Emotional discipline and psychological readiness

- Method: A tested trading system or strategy

- Money: Sound capital and risk management

Even the best strategy fails if your mindset is weak. For beginners in Indonesia, combining these three pillars is the best foundation for long-term trading consistency.

How Can Beginner Traders Avoid Overtrading?

Source: Daily Price Action

Overtrading happens when you enter too many trades without proper analysis, often due to boredom or excitement. Many beginners fall into this trap hoping for more profit, but it usually leads to more risk.

To prevent this, trade only when your strategy conditions are met. Use a checklist, respect your risk parameters, and avoid chasing the market. Less is often more in trading.

Is Intuition Useful in Trading or Should It Be Avoided?

Intuition, when shaped by experience, can be valuable. But for beginners, it’s often just impulsive guesswork. Trust your strategy—not your gut—until you’ve built enough experience to recognize patterns reliably. Over time, your intuition will sharpen and become a useful complement, not a replacement, for structure.

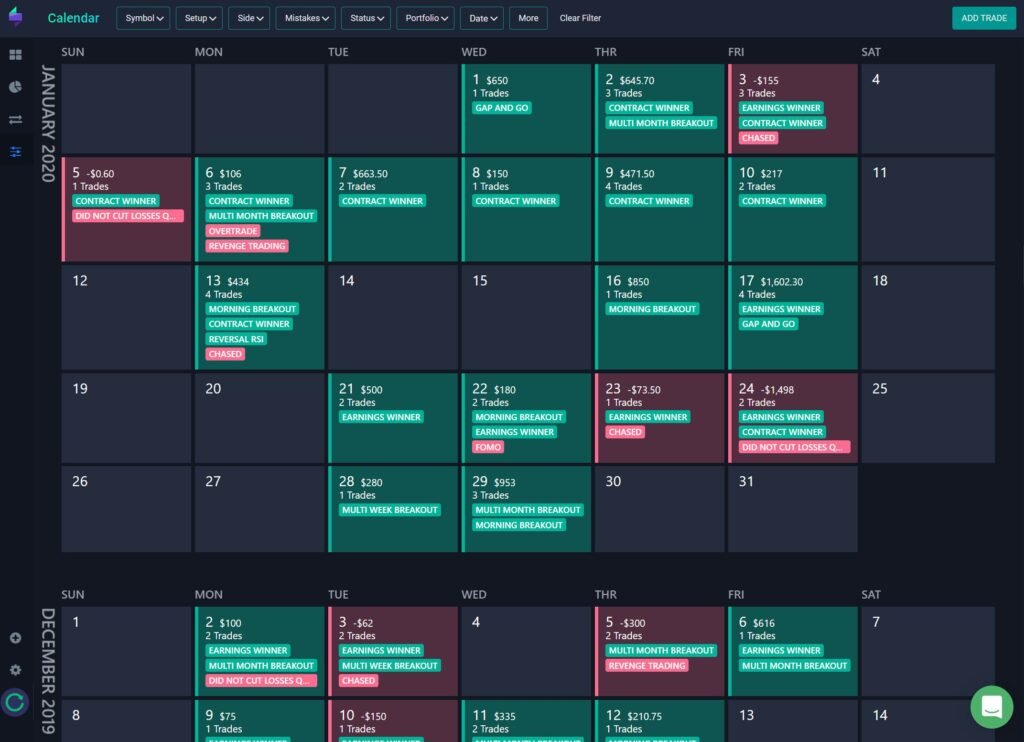

Trading Psychology Indonesia: What Are Practical Techniques to Control Emotions While Trading?

Source: Tradersync

1. Set Clear Risk Limits

Decide how much you’re willing to lose before you enter a trade. This helps keep emotions out of the exit process.

2. Use Automation Tools

Set stop-loss and take-profit levels. This removes the need for emotional decision-making during price swings.

3. Keep a Trading Journal

Write down your trades, your reasoning, and how you felt. Over time, you’ll notice patterns that can be adjusted for better control.

4. Practice With Demo Accounts

Simulate real trades without financial risk. This builds confidence and mental resilience before going live.

Trading Psychology Indonesia: What Are the Common Psychological Mistakes Beginner Traders Make?

Source: Whitebit

Some of the most frequent psychological pitfalls include:

- Trading based on emotion instead of analysis

- Letting FOMO override planned strategy

- Overtrading to chase profits

- Revenge trading after a loss

The solution is discipline, patience, and structured reflection. Remember: trading psychology Indonesia is not something you master overnight. It’s a process of learning, failing, adjusting, and evolving.

Conclusion: Trading Psychology Indonesia- Why Psychology Matters More Than Strategy

While tools, charts, and strategies are vital, they’re only effective when your mind is clear. Trading psychology Indonesia teaches us that mindset determines how well you follow your plan, manage your risks, and adapt to changing markets.

Each market condition demands a different mental approach. And every emotion—whether fear, greed, or regret—must be observed and managed. The most successful traders aren’t just good at analysis. They’re good at knowing themselves.

Mastering your psychology isn’t a shortcut to success—but it is the only path to sustaining it.