Crypto vs Traditional Credit Card: Which One Actually Wins in 2025?

Let’s get this out of the way—crypto vs traditional credit card isn’t just a techie debate anymore. It’s real life. You can walk into a coffee shop and pay with Bitcoin (sort of), or tap your Visa and be on your way in seconds. Both work. But which one actually works better in today’s world?

Spoiler: it depends… but here’s the honest breakdown.

The Basics: What Are We Even Comparing?

Okay, so on one hand you’ve got the traditional credit card—Visa, Mastercard, Amex—you know the drill. You buy now, pay later (with interest if you’re not careful), and maybe earn some airline miles that you’ll never redeem. It’s old-school, but it works.

On the other hand, crypto payments are kind of the wild west. You might use a Web3 credit card that pulls from your wallet, or scan a QR code and pay in ETH or USDT. No banks. No middlemen. Just blockchain doing its thing.

Sounds futuristic, right? But let’s be real, it’s not all rainbows and decentralization.

Fees & Friction: Crypto vs Traditional Credit Card

This is where things get interesting.

Traditional credit cards? They’re packed with fees—annual fees, foreign transaction fees, sometimes even “inactivity” fees. And don’t even get me started on interest rates.

Crypto payments? Technically, they can be cheaper. You skip the banks, skip the intermediaries, and just… send value. But (yeah, there’s a but) gas fees on Ethereum can spike like crazy, and some services add sneaky conversion charges. So while it’s often cheaper, it’s not always predictable.

And let’s be honest, nobody wants to pay $12 to send $20.

Speed & Accessibility: Who’s Faster, Really?

Tap a credit card, done. It’s fast, familiar, and accepted pretty much everywhere—from your local ramen shop to Amazon. There’s comfort in that.

Crypto? Well, it’s a mixed bag. Lightning-fast on some chains like Solana or Polygon, but slower (and more expensive) on others like Ethereum during peak hours. Plus, not every store takes crypto. Actually, most don’t. Yet.

Still, things are changing. Some major brands and online shops now accept it, and Web3 credit cards are making crypto feel more “normal” by the day.

Security & Control: Who’s Really in Charge?

Now here’s where crypto shines. You own your keys, you own your money. Nobody can freeze your funds or reject your payment—unless you mess up the address (which, yeah… happens).

Credit cards, on the other hand, offer fraud protection. Someone nabs your number? The bank usually covers it. With crypto? Not so much. If you send it to the wrong wallet—say goodbye forever. So it’s a tradeoff: more control vs more safety nets.

Some people love that freedom. Others? Not so much.

Rewards & Perks: Points or Tokens?

Traditional credit cards live and die by rewards. Cashback, points, lounge access—it’s their bread and butter.

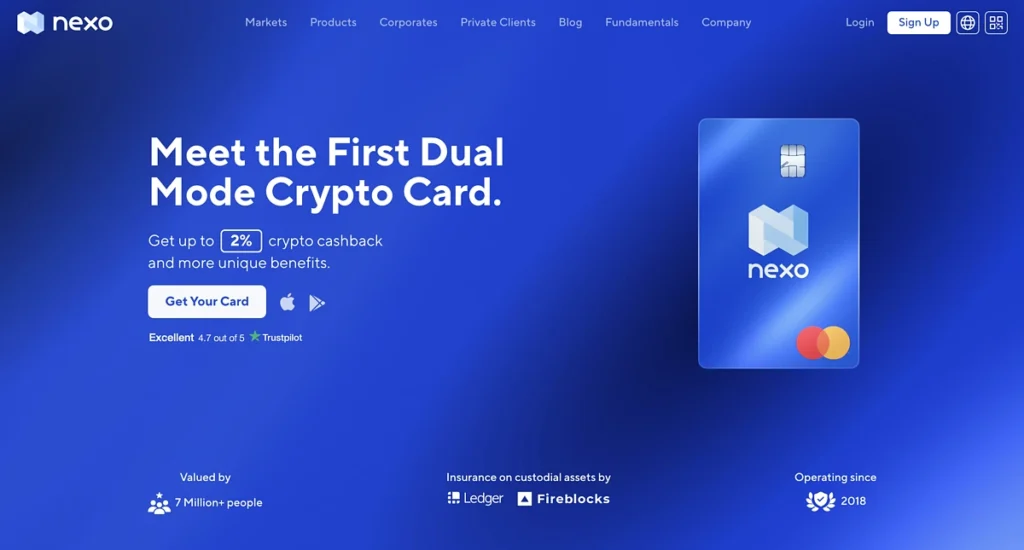

Crypto’s catching up. Some Web3 cards offer token-based rewards: earn BTC or ETH on everyday purchases. Pretty cool, right? But those rewards can be… volatile. That 2% in crypto might be worth more tomorrow—or half as much.

So yeah, crypto rewards are riskier, but potentially more exciting.

Final Thoughts: Crypto vs Traditional Credit Card in 2025

So—who wins the crypto vs traditional credit card battle?

Honestly? There’s no clear champ (yet).

Traditional cards are reliable, widely accepted, and secure. Crypto options offer freedom, fewer gatekeepers, and a peek at the future of money. If you’re adventurous, tech-savvy, and don’t mind a little volatility, crypto might be worth a shot. If you just want to pay and move on with life? Stick with the plastic—at least for now.

That said, we’re watching a shift. Slowly, but surely, crypto is creeping into the mainstream. Whether it replaces the credit card—or just lives alongside it—we’ll see. But one thing’s certain: the way we pay is evolving.

And honestly? That’s kinda exciting.

Relevant News : Here