Uphold Exchange Review 2025: A Closer Look at the Multi-Asset Platform

When people search for a Uphold exchange review, the same words always pop up—multi-asset, easy to use, global reach. All true, but the reality feels a bit more nuanced once you spend time with the platform. Uphold isn’t just trying to be another crypto exchange. It positions itself as a hub where you can hold Bitcoin, Ethereum, precious metals, and even traditional stocks, almost like your own all-in-one investment wallet. That vision is ambitious, but how well does it hold up in practice?

Uphold Exchange Review: Features That Stand Out

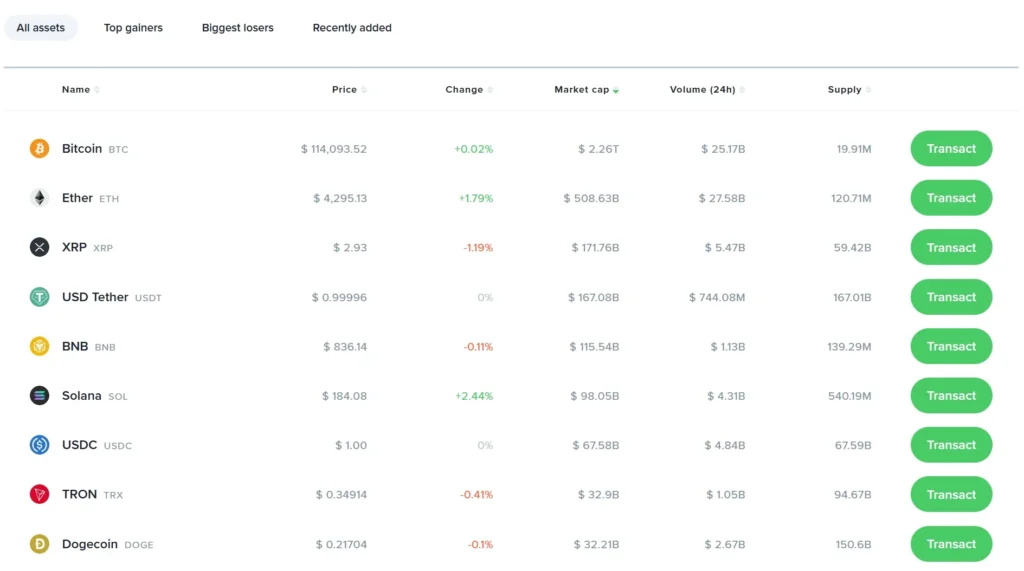

The first thing you notice is that Uphold isn’t limited to crypto. Alongside Bitcoin and Ethereum, you can trade gold, silver, and even U.S. equities. For some, that flexibility is refreshing. Instead of juggling different apps—one for crypto, another for stocks—you can keep everything in one account.

The platform also uses a “Anything-to-Anything” conversion system. What that means in real terms: you can swap XRP directly into Tesla shares or convert Litecoin into silver without first cashing out into fiat. It saves steps, and honestly, it feels smoother than most competitors.

Fees and Transparency

No Uphold exchange review is complete without touching on fees. Here’s where opinions split. Uphold markets itself as having zero commission trading, but spreads apply. On popular pairs like BTC/USD, spreads hover around 0.8–1.2%. For altcoins and metals, they can go higher, sometimes up to 3%.

| Asset Type | Average Spread | Notes |

|---|---|---|

| Major Cryptos (BTC, ETH) | 0.8% – 1.2% | Competitive compared to Coinbase |

| Altcoins | 1.5% – 3% | Higher cost for niche tokens |

| Precious Metals | 2% – 3% | Above industry average |

| U.S. Stocks | 1% spread | No extra commission |

Some users won’t mind paying for convenience, while others prefer low-fee alternatives like Kraken or Binance. To be fair, it comes down to whether you value the multi-asset flexibility enough to justify slightly higher costs.

Uphold Exchange Review: Security and Regulation

If there’s one area Uphold likes to highlight, it’s compliance. The company is U.S.-based and registered with FinCEN as a Money Services Business. In Europe, it complies with FCA standards. That doesn’t make it risk-free—no exchange is—but it’s a notch above unregulated offshore platforms.

Uphold also practices a “transparency-first” model. They publish a real-time reserve ledger, showing exactly how customer assets are backed. For a crypto exchange, that’s refreshing. Most competitors only provide proof-of-reserves sporadically, if at all.

User Experience: Smooth or Frustrating?

Here’s the part many Uphold exchange review readers want to know—does it feel good to actually use? The app design is clean, intuitive, and works across mobile and desktop. Signing up is fast, though the KYC process sometimes gets flagged as slow. Once inside, funding with cards or bank transfers is straightforward, but fees on credit card deposits can sting.

A small drawback: professional traders might find the platform too simple. There are no advanced charting tools like on Binance or Bybit. It’s clearly aimed at everyday users who want exposure to multiple assets, not hardcore day traders.

Uphold Exchange Review: Pros and Cons

To make things clearer, let’s break it down:

Pros

- Multi-asset support (crypto, metals, stocks in one place)

- Anything-to-Anything swaps save time

- Transparent reserve system, better trust level

- User-friendly app design

Cons

- Spreads can be higher than pure crypto exchanges

- Limited advanced trading tools

- KYC can feel slow for some users

Final Thoughts: Is Uphold Worth It in 2025?

Wrapping up this Uphold exchange review, the platform feels like a crossover between a crypto exchange and a digital bank. If you’re someone who just wants to buy Bitcoin and hold it, cheaper options exist. But if you like the idea of managing crypto, gold, and even stocks in one dashboard, Uphold’s proposition is compelling.

It’s not perfect, and spreads aren’t the lowest, but the transparency and multi-asset structure give it a unique place in the market. For casual investors, it works. For professional traders, it might feel limited. Either way, Uphold in 2025 remains one of the few exchanges still pushing the idea of a “universal investment wallet”—and that alone makes it worth a try.