CBDCs Explained: What Is a CBDC and How It’s Shaping the Future of Money

In today’s fast-evolving financial world, what is a CBDC is a question being explored by central banks, policymakers, and curious consumers alike. A Central Bank Digital Currency (CBDC) is essentially a digital form of government-backed money. Unlike Bitcoin or other cryptocurrencies created and maintained by decentralized communities or companies, a CBDC is issued directly by a country’s central bank—the same institution responsible for printing your paper money.

The concept brings together the convenience of digital payments with the trust and stability of fiat currency. As physical cash declines and digital payments rise globally, CBDCs aim to provide a secure, efficient, and inclusive way to transact—while keeping the state in control of monetary systems.

What Does CBDC Really Mean?

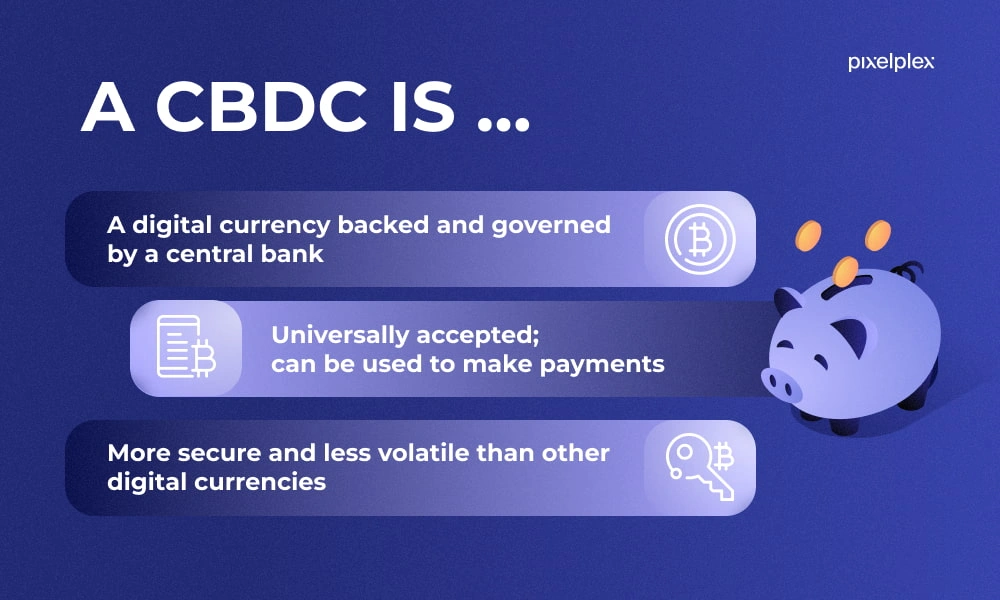

Credit from Pixelplex.io

A CBDC is a sovereign digital currency recognized as legal tender. It can be used for payments, savings, and official disbursements, just like traditional banknotes—but in digital form. Unlike money stored in commercial bank accounts, which represent claims on the bank, CBDCs are direct liabilities of the central bank. This means they carry the full backing of the state.

CBDCs exist entirely in electronic form and are typically accessed via digital wallets. They may be designed to support offline transactions and can either bear interest (like savings accounts) or not, depending on national policy choices.

The Two Faces of CBDC: Retail and Wholesale

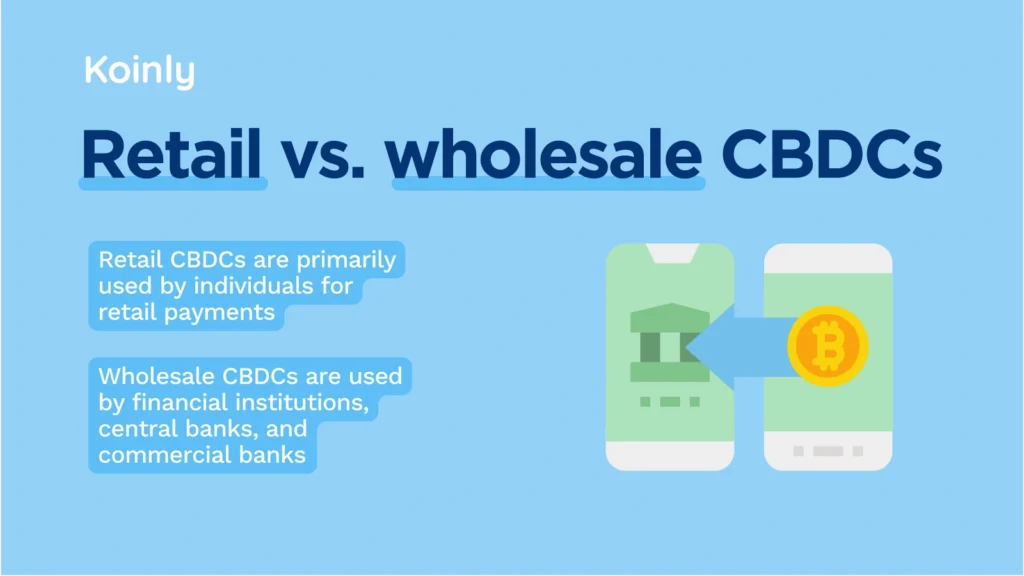

Credit from Koinly

Central banks around the world are designing two core models of CBDCs, each with a specific function in the economy.

Retail CBDCs are meant for everyday use by individuals and businesses. From paying for groceries to sending money to family, this version is designed to mimic cash and debit cards but in a fully digital format. These CBDCs can also facilitate direct payments from governments to citizens, particularly in emergencies or for welfare programs.

In contrast, Wholesale CBDCs are not for public use. Instead, they serve as a tool for interbank transactions, helping financial institutions settle large-scale payments efficiently. These can improve the stability of the banking system and enhance cross-border transaction processing.

The retail model promotes financial inclusion and public access to state-backed money, while the wholesale model focuses on streamlining institutional settlements.

Core Characteristics of a CBDC

CBDCs differ from traditional forms of money not just in form, but also in functionality. These currencies are digitally native and often programmable, allowing central banks to embed specific rules directly into transactions. This could include restrictions on usage or expiry dates for stimulus payments.

Each CBDC unit is uniquely identifiable, reducing the risk of counterfeiting and enhancing transaction traceability. While some CBDCs are built on blockchain or distributed ledger technology, not all rely on it. The technology choice depends on the priorities of the issuing country—some prioritize speed and scalability, while others lean toward transparency or decentralization.

They are also centrally issued and regulated, meaning users can trust their stability and legitimacy. Depending on the design, CBDCs may be interest-bearing, influencing saving and spending behaviors more directly than current cash.

Why Are CBDCs Gaining Global Momentum?

There’s no single reason why more than 130 countries are exploring CBDCs. Instead, a combination of economic, technological, and social factors is driving interest.

First, CBDCs offer a powerful tool for financial inclusion. In many countries, large segments of the population remain unbanked or underbanked. CBDCs could offer a secure, low-cost alternative for people with limited access to banking services—particularly in areas where smartphones are more common than bank branches.

They also promise efficiency. Digital currencies can streamline domestic payments and reduce the cost and time of cross-border transactions. By enabling faster settlements and cutting out intermediaries, CBDCs may reduce fees and improve access to global markets.

Central banks are also interested in the monetary policy potential. CBDCs can provide real-time data on spending patterns, improve policy targeting, and even allow direct delivery of stimulus or subsidies. In theory, they could help governments manage inflation, recessions, and financial shocks more precisely.

In countries facing declining use of physical cash, CBDCs offer a modern alternative that maintains public access to state-backed money—ensuring that payments don’t become dominated by private tech giants.

CBDC vs Cryptocurrency: Not the Same Thing

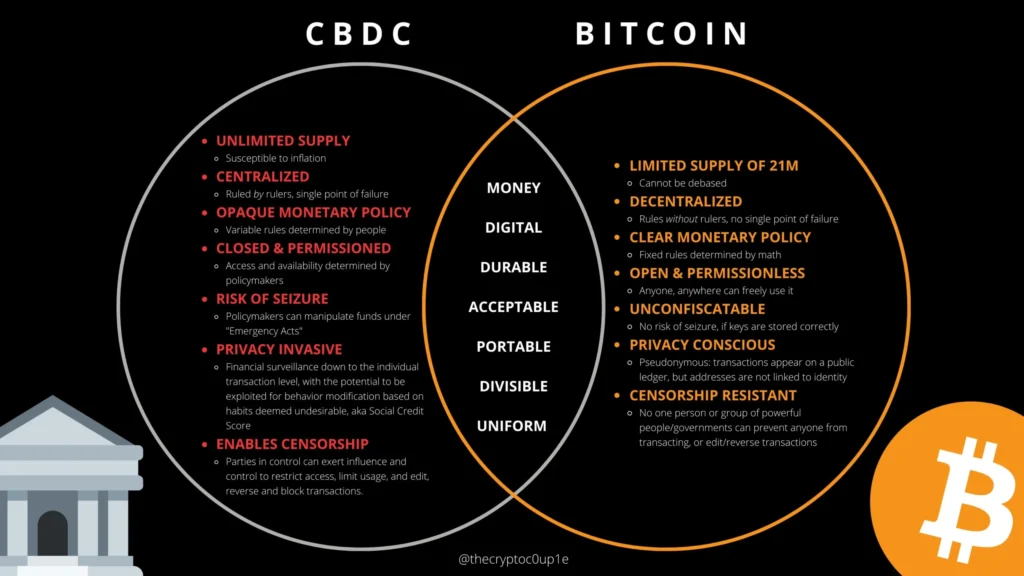

Credit from Reddit

Despite similarities in form, CBDCs are not cryptocurrencies. Cryptocurrencies like Bitcoin operate on decentralized networks, often without any central authority. Their value is determined by supply and demand, making them highly volatile and speculative.

CBDCs, in contrast, are stable by design. They are tied to a country’s official currency and regulated by that nation’s central bank. While some CBDCs may use blockchain-like infrastructure, their governance, purpose, and trust model differ significantly.

In short, cryptocurrencies aim to replace banks. CBDCs aim to modernize them.

Who’s Leading the Charge?

The global race toward CBDC adoption is well underway. Some countries have already launched national digital currencies, while others are still testing or researching.

The Bahamas became the world’s first to issue a live CBDC in 2020 with its “Sand Dollar.” Nigeria followed with its eNaira in 2021, and Jamaica launched JAM-DEX in 2022. These early adopters cite reasons like enhancing access, boosting digital payments, and modernizing currency infrastructure.

Larger economies like China are piloting their digital yuan in major cities, while India, the European Union, and Brazil are exploring prototypes or limited rollouts. Meanwhile, the United States and United Kingdom are still in the research and debate phase, focusing on regulatory and privacy frameworks.

Here’s a quick summary of the global status:

| Country/Region | Status | Notable Point |

|---|---|---|

| Bahamas | Launched | First live CBDC – Sand Dollar |

| Nigeria | Launched | Broad mobile integration – eNaira |

| China | Advanced Pilot | Public trials across multiple cities |

| European Union | Design Phase | Focus on privacy and legal framework |

| United States | Research Phase | Exploring balance between innovation and regulation |

Risks and Concerns to Watch

With innovation comes uncertainty. CBDCs raise serious questions about privacy, financial stability, and technological readiness.

One major concern is privacy. If every transaction is recorded by the central bank, what safeguards are in place to protect individual freedoms? Some citizens and civil liberties groups worry that CBDCs could become a tool for surveillance or control.

Another issue is the impact on commercial banks. If people move funds from private banks to central bank wallets, it could reduce the liquidity available for lending, altering how credit is created and distributed in the economy.

There are also cybersecurity risks. A national digital currency platform would be a prime target for hackers. Ensuring its security, uptime, and resistance to fraud will be crucial.

Finally, governments must decide whether CBDCs should replace or complement cash. In countries where physical currency is still vital, removing it too quickly could alienate older populations or those without digital access.

The Bigger Picture: Future of Digital Money

CBDCs aren’t just about payment systems—they are about reimagining the role of public money in the digital age. By giving everyone direct access to central bank funds, governments can ensure that digital finance isn’t dominated by corporations or fragmented across unstable platforms.

In emerging economies, CBDCs could leapfrog banking infrastructure altogether, offering secure financial access via smartphones. In wealthier nations, they may function as a public option for money, existing alongside private payment apps and credit systems.

At the heart of the matter lies the trust in national institutions. If designed well, CBDCs could strengthen that trust—offering transparency, accountability, and inclusiveness in an increasingly digital world.

Conclusion: What Is a CBDC and Why It Matters Today

Central Bank Digital Currencies are more than just a new form of payment—they represent a shift in how nations govern money, protect economic sovereignty, and support digital inclusion. As questions about privacy, control, and financial design unfold, one thing is clear: understanding what a CBDC is will be essential for anyone hoping to navigate the future of finance.

Whether used to pay for coffee, receive welfare, or settle interbank debts, CBDCs are no longer a theory—they are a reality, and they are coming faster than most people realize.